Reset Form

Print Form

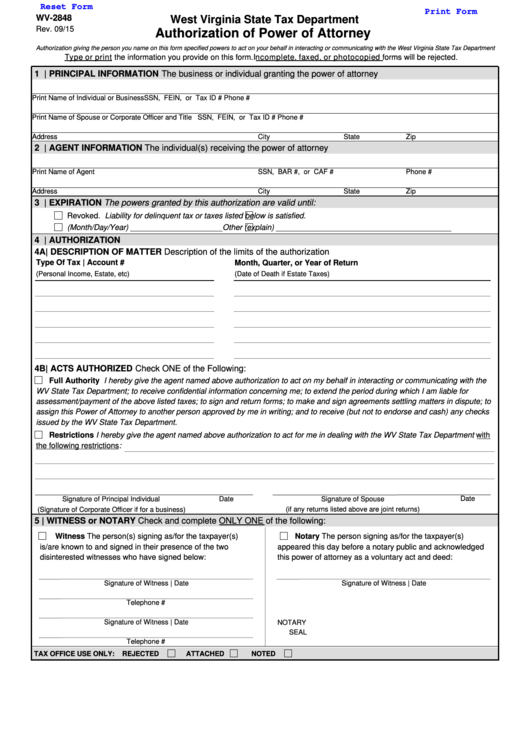

WV-2848

West Virginia State Tax Department

Rev. 09/15

Authorization of Power of Attorney

Authorization giving the person you name on this form specified powers to act on your behalf in interacting or communicating with the West Virginia State Tax Department

Type or print the information you provide on this form. Incomplete, faxed, or photocopied forms will be rejected.

1 | PRINCIPAL INFORMATION The business or individual granting the power of attorney

Print Name of Individual or Business

SSN, FEIN, or Tax ID #

Phone #

Print Name of Spouse or Corporate Officer and Title

SSN, FEIN, or Tax ID #

Phone #

Address

City

State

Zip

2 | AGENT INFORMATION The individual(s) receiving the power of attorney

Print Name of Agent

SSN, BAR #, or CAF #

Phone #

Address

City

State

Zip

3 | EXPIRATION The powers granted by this authorization are valid until:

Revoked.

Liability for delinquent tax or taxes listed below is satisfied.

(Month/Day/Year) _____________________

Other (explain) ________________________________________

4 | AUTHORIZATION

4A| DESCRIPTION OF MATTER Description of the limits of the authorization

Type Of Tax | Account #

Month, Quarter, or Year of Return

(Personal Income, Estate, etc)

(Date of Death if Estate Taxes)

4B| ACTS AUTHORIZED Check ONE of the Following:

Full Authority I hereby give the agent named above authorization to act on my behalf in interacting or communicating with the

WV State Tax Department; to receive confidential information concerning me; to extend the period during which I am liable for

assessment/payment of the above listed taxes; to sign and return forms; to make and sign agreements settling matters in dispute; to

assign this Power of Attorney to another person approved by me in writing; and to receive (but not to endorse and cash) any checks

issued by the WV State Tax Department.

Restrictions I hereby give the agent named above authorization to act for me in dealing with the WV State Tax Department with

the following restrictions:

Date

Date

Signature of Principal Individual

Signature of Spouse

(Signature of Corporate Officer if for a business)

(if any returns listed above are joint returns)

5 | WITNESS or NOTARY Check and complete ONLY ONE of the following:

Witness The person(s) signing as/for the taxpayer(s)

Notary The person signing as/for the taxpayer(s)

is/are known to and signed in their presence of the two

appeared this day before a notary public and acknowledged

disinterested witnesses who have signed below:

this power of attorney as a voluntary act and deed:

Signature of Witness | Date

Signature of Witness | Date

Telephone #

Signature of Witness | Date

NOTARY

SEAL

Telephone #

TAX OFFICE USE ONLY:

REJECTED

ATTACHED

NOTED

1

1