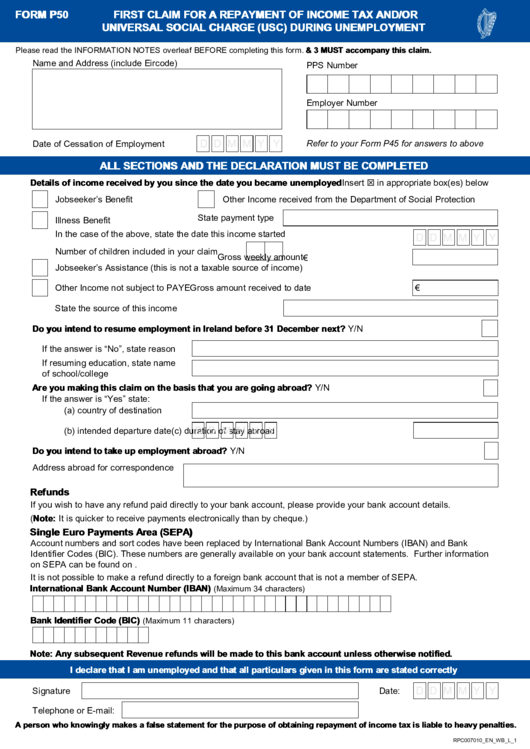

FORM P50

FIRST CLAIM FOR A REPAYMENT OF INCOME TAX AND/OR

UNIVERSAL SOCIAL CHARGE (USC) DURING UNEMPLOYMENT

Please read the INFORMATION NOTES overleaf BEFORE completing this form. N.B. Form P45 Parts 2 & 3 MUST accompany this claim.

Name and Address (include Eircode)

PPS Number

Employer Number

D D M M Y Y

Refer to your Form P45 for answers to above

Date of Cessation of Employment

ALL SECTIONS AND THE DECLARATION MUST BE COMPLETED

Details of income received by you since the date you became unemployed Insert T in appropriate box(es) below

Jobseeker’s Benefit

Other Income received from the Department of Social Protection

State payment type

Illness Benefit

In the case of the above, state the date this income started

D D M M Y Y

Number of children included in your claim

Gross weekly amount

€

Jobseeker’s Assistance (this is not a taxable source of income)

Other Income not subject to PAYE

Gross amount received to date

€

State the source of this income

Do you intend to resume employment in Ireland before 31 December next? Y/N

If the answer is “No”, state reason

If resuming education, state name

of school/college

Are you making this claim on the basis that you are going abroad? Y/N

If the answer is “Yes” state:

(a) country of destination

D D M M Y Y

(b) intended departure date

(c) duration of stay abroad

Do you intend to take up employment abroad? Y/N

Address abroad for correspondence

Refunds

If you wish to have any refund paid directly to your bank account, please provide your bank account details.

(Note: It is quicker to receive payments electronically than by cheque.)

Single Euro Payments Area (SEPA)

Account numbers and sort codes have been replaced by International Bank Account Numbers (IBAN) and Bank

Identifier Codes (BIC). These numbers are generally available on your bank account statements. Further information

on SEPA can be found on

It is not possible to make a refund directly to a foreign bank account that is not a member of SEPA.

International Bank Account Number (IBAN)

(Maximum 34 characters)

Bank Identifier Code (BIC)

(Maximum 11 characters)

Note: Any subsequent Revenue refunds will be made to this bank account unless otherwise notified.

I declare that I am unemployed and that all particulars given in this form are stated correctly

D D M M Y Y

Signature

Date:

Telephone or E-mail:

A person who knowingly makes a false statement for the purpose of obtaining repayment of income tax is liable to heavy penalties.

RPC007010_EN_WB_L_1

1

1 2

2