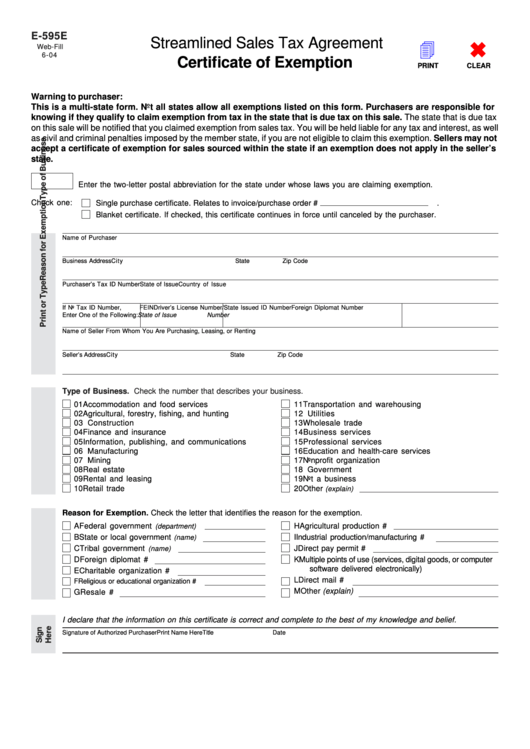

E-595E

Streamlined Sales Tax Agreement

4

Web-Fill

6-04

Certificate of Exemption

PRINT

CLEAR

Warning to purchaser:

This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for

knowing if they qualify to claim exemption from tax in the state that is due tax on this sale. The state that is due tax

on this sale will be notified that you claimed exemption from sales tax. You will be held liable for any tax and interest, as well

as civil and criminal penalties imposed by the member state, if you are not eligible to claim this exemption. Sellers may not

accept a certificate of exemption for sales sourced within the state if an exemption does not apply in the seller’s

state.

Enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

Check one:

Single purchase certificate. Relates to invoice/purchase order #

.

Blanket certificate. If checked, this certificate continues in force until canceled by the purchaser.

Name of Purchaser

Business Address

City

State

Zip Code

Purchaser’s Tax ID Number

State of Issue

Country of Issue

If No Tax ID Number,

FEIN

Driver’s License Number/State Issued ID Number

Foreign Diplomat Number

Enter One of the Following:

State of Issue

Number

Name of Seller From Whom You Are Purchasing, Leasing, or Renting

Seller’s Address

City

State

Zip Code

Type of Business. Check the number that describes your business.

01 Accommodation and food services

11 Transportation and warehousing

02 Agricultural, forestry, fishing, and hunting

12 Utilities

03 Construction

13 Wholesale trade

04 Finance and insurance

14 Business services

05 Information, publishing, and communications

15 Professional services

06 Manufacturing

16 Education and health-care services

07 Mining

17 Nonprofit organization

08 Real estate

18 Government

09 Rental and leasing

19 Not a business

10 Retail trade

20 Other

(explain)

Reason for Exemption. Check the letter that identifies the reason for the exemption.

A

Federal government

H

Agricultural production #

(department)

B

State or local government

I

Industrial production/manufacturing #

(name)

C Tribal government

J

Direct pay permit #

(name)

D Foreign diplomat #

K

Multiple points of use (services, digital goods, or computer

software delivered electronically)

E

Charitable organization #

L

Direct mail #

F

Religious or educational organization #

M

Other (explain)

G Resale #

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

Signature of Authorized Purchaser

Print Name Here

Title

Date

1

1 2

2