Sba Section 504 Assistance Agreement

ADVERTISEMENT

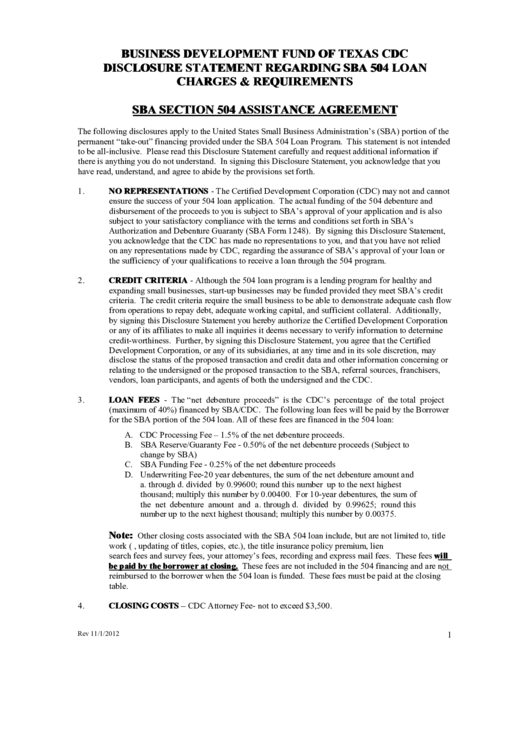

BUSINESS DEVELOPMENT FUND OF TEXAS CDC

DISCLOSURE STATEMENT REGARDING SBA 504 LOAN

CHARGES & REQUIREMENTS

SBA SECTION 504 ASSISTANCE AGREEMENT

The following disclosures apply to the United States Small Business Administration’s (SBA) portion of the

permanent “take-out” financing provided under the SBA 504 Loan Program. This statement is not intended

to be all-inclusive. Please read this Disclosure Statement carefully and request additional information if

there is anything you do not understand. In signing this Disclosure Statement, you acknowledge that you

have read, understand, and agree to abide by the provisions set forth.

1.

NO REPRESENTATIONS - The Certified Development Corporation (CDC) may not and cannot

ensure the success of your 504 loan application. The actual funding of the 504 debenture and

disbursement of the proceeds to you is subject to SBA’s approval of your application and is also

subject to your satisfactory compliance with the terms and conditions set forth in SBA’s

Authorization and Debenture Guaranty (SBA Form 1248). By signing this Disclosure Statement,

you acknowledge that the CDC has made no representations to you, and that you have not relied

on any representations made by CDC, regarding the assurance of SBA’s approval of your loan or

the sufficiency of your qualifications to receive a loan through the 504 program.

2.

CREDIT CRITERIA - Although the 504 loan program is a lending program for healthy and

expanding small businesses, start-up businesses may be funded provided they meet SBA’s credit

criteria. The credit criteria require the small business to be able to demonstrate adequate cash flow

from operations to repay debt, adequate working capital, and sufficient collateral. Additionally,

by signing this Disclosure Statement you hereby authorize the Certified Development Corporation

or any of its affiliates to make all inquiries it deems necessary to verify information to determine

credit-worthiness. Further, by signing this Disclosure Statement, you agree that the Certified

Development Corporation, or any of its subsidiaries, at any time and in its sole discretion, may

disclose the status of the proposed transaction and credit data and other information concerning or

relating to the undersigned or the proposed transaction to the SBA, referral sources, franchisers,

vendors, loan participants, and agents of both the undersigned and the CDC.

LOAN FEES - The “net debenture proceeds” is the CDC’s percentage of the total project

3.

(maximum of 40%) financed by SBA/CDC. The following loan fees will be paid by the Borrower

for the SBA portion of the 504 loan. All of these fees are financed in the 504 loan:

A. CDC Processing Fee – 1.5% of the net debenture proceeds.

B. SBA Reserve/Guaranty Fee - 0.50% of the net debenture proceeds (Subject to

change by SBA)

C. SBA Funding Fee - 0.25% of the net debenture proceeds

D. Underwriting Fee-20 year debentures, the sum of the net debenture amount and

a. through d. divided by 0.99600; round this number up to the next highest

thousand; multiply this number by 0.00400. For 10-year debentures, the sum of

the net debenture amount and a. through d. divided by 0.99625; round this

number up to the next highest thousand; multiply this number by 0.00375.

Note:

Other closing costs associated with the SBA 504 loan include, but are not limited to, title

work (i.e. abstracting, updating of titles, copies, etc.), the title insurance policy premium, lien

search fees and survey fees, your attorney’s fees, recording and express mail fees. These fees will

be paid by the borrower at closing. These fees are not included in the 504 financing and are not

reimbursed to the borrower when the 504 loan is funded. These fees must be paid at the closing

table.

CLOSING COSTS – CDC Attorney Fee- not to exceed $3,500.

4.

Rev 11/1/2012

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5