Declaration Of Personal Property - Short Form - Sterling, Connecticut - 2016

ADVERTISEMENT

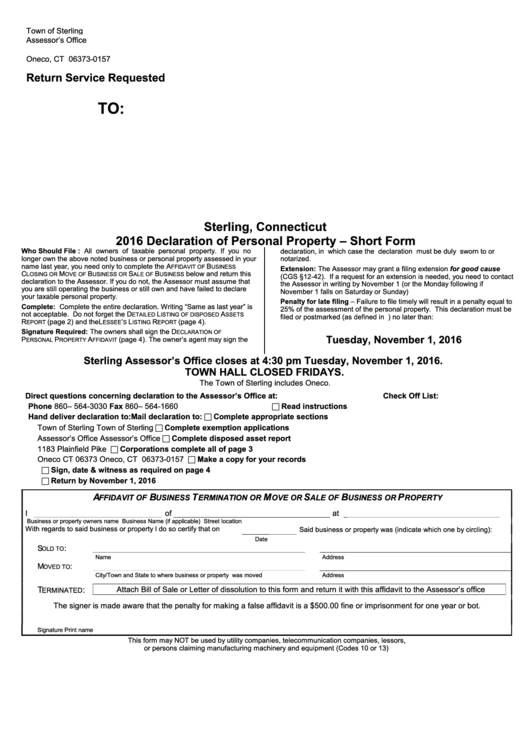

Town of Sterling

Assessor’s Office

P.O. Box 157

Oneco, CT 06373-0157

Return Service Requested

TO:

Sterling, Connecticut

2016 Declaration of Personal Property – Short Form

Who Should File : All owners of taxable personal property. If you no

declaration, in which case the declaration must be duly sworn to or

longer own the above noted business or personal property assessed in your

notarized.

name last year, you need only to complete the A

B

FFIDAVIT OF

USINESS

Extension: The Assessor may grant a filing extension for good cause

C

M

B

S

B

below and return this

LOSING OR

OVE OF

USINESS OR

ALE OF

USINESS

(CGS §12-42). If a request for an extension is needed, you need to contact

declaration to the Assessor. If you do not, the Assessor must assume that

the Assessor in writing by November 1 (or the Monday following if

you are still operating the business or still own and have failed to declare

November 1 falls on Saturday or Sunday)

your taxable personal property.

Penalty for late filing – Failure to file timely will result in a penalty equal to

Complete: Complete the entire declaration. Writing “Same as last year” is

25% of the assessment of the personal property. This declaration must be

not acceptable. Do not forget the D

L

A

ETAILED

ISTING OF DISPOSED

SSETS

filed or postmarked (as defined in C.G.S. Sec. 1-2a) no later than:

R

(page 2) and the L

’

L

R

(page 4).

EPORT

ESSEE

S

ISTING

EPORT

Signature Required: The owners shall sign the D

ECLARATION OF

Tuesday, November 1, 2016

P

P

A

(page 4). The owner’s agent may sign the

ERSONAL

ROPERTY

FFIDAVIT

Sterling Assessor’s Office closes at 4:30 pm Tuesday, November 1, 2016.

TOWN HALL CLOSED FRIDAYS.

The Town of Sterling includes Oneco.

Direct questions concerning declaration to the Assessor’s Office at:

Check Off List:

Phone 860– 564-3030

Fax 860– 564-1660

Read instructions

Hand deliver declaration to:

Mail declaration to:

Complete appropriate sections

Town of Sterling

Town of Sterling

Complete exemption applications

Assessor’s Office

Assessor’s Office

Complete disposed asset report

Corporations complete all of page 3

1183 Plainfield Pike

P.O. Box 157

Make a copy for your records

Oneco CT 06373

Oneco, CT 06373-0157

Sign, date & witness as required on page 4

Return by November 1, 2016

A

B

T

M

S

B

P

FFIDAVIT OF

USINESS

ERMINATION OR

OVE OR

ALE OF

USINESS OR

ROPERTY

I

of

at

Business or property owners name

Business Name (if applicable)

Street location

With regards to said business or property I do so certify that on

Said business or property was (indicate which one by circling):

Date

S

:

OLD TO

Name

Address

M

:

OVED TO

City/Town and State to where business or property was moved

Address

T

:

Attach Bill of Sale or Letter of dissolution to this form and return it with this affidavit to the Assessor’s office

ERMINATED

The signer is made aware that the penalty for making a false affidavit is a $500.00 fine or imprisonment for one year or both.

Signature

Print name

This form may NOT be used by utility companies, telecommunication companies, lessors,

or persons claiming manufacturing machinery and equipment (Codes 10 or 13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4