RYLAND DEPARTMENT OF AGRICULTURE

Office of Resource Conservation

MARYLAND DEPARTMENT OF AGRICULTURE

MARYLAND DEPARTMENT OF AGRICULTURE

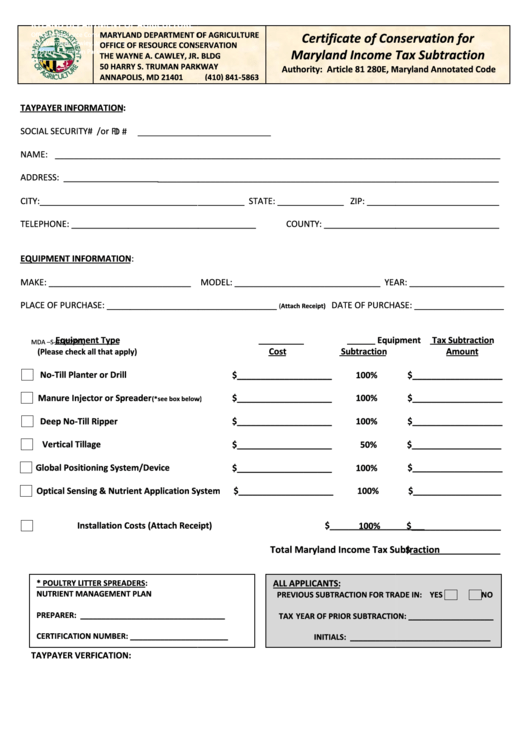

Certificate of Conservation for

Certificate of Conservation for

The Wayne A. Cawley, Jr. Building

OFFICE OF RESOURCE CONSERVATION

OFFICE OF RESOURCE CONSERVATION

50 Harry S. Truman Parkway

Maryland Income Tax Subtraction

Maryland Income Tax Subtraction

THE WAYNE A. CAWLEY, JR. BLDG

THE WAYNE A. CAWLEY, JR. BLDG

Ann

50 HARRY S. TRUMAN PARKWAY

50 HARRY S. TRUMAN PARKWAY

Authority: Article 81 280E, Maryland Annotated Code

Authority: Article 81 280E, Maryland Annotated Code

ANNAPOLIS, MD 21401

(410) 841-5863

TAYPAYER INFORMATION:

SOCIAL SECURITY# /or FID #

D #

____________________________

____________________________

NAME: ______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

ADDRESS: ____________________________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

CITY:___________________________________________ STATE: ______________ ZIP: ____________________________

CITY:___________________________________________ STATE: ______________ ZIP: ____________________________

CITY:___________________________________________ STATE: ______________ ZIP: ____________________________

TELEPHONE: _______________________________________

___________________________

COUNTY: _____________________________________

COUNTY: _____________________________________

EQUIPMENT INFORMATION:

MAKE: ______________________________ MODEL: _______________________________

MAKE: ______________________________ MODEL: _______________________________ YEAR: ____________________

YEAR: ____________________

PLACE OF PURCHASE: ____________________________________

_______________________________

DATE OF PURCHASE: ___________________

DATE OF PURCHASE: ___________________

(Attach Receipt)

Equipment Type

Equipment

Eligible

Tax Subtraction

MDA –S-07 (02/13)

Cost

Subtraction

Amount

(Please check all that apply)

No-Till Planter or Drill

$____________________

$____________________

100%

100%

$___________________

$___________________

Manure Injector or Spreader

$____________________

$____________________

100%

100%

$___________________

$___________________

(*see box below)

see box below)

Deep No-Till Ripper

$____________________

$____________________

100%

100%

$___________________

$___________________

Vertical Tillage

$____________________

$____________________

50%

50%

$___________________

$___________________

Global Positioning System/Device

$____________________

$____________________

100%

100%

$___________________

Optical Sensing & Nutrient Application System

Optical Sensing & Nutrient Application System

$____________________

$____________________

100%

100%

$___________________

$___________________

Installation Costs (Attach Receipt)

$____________________

100%

100%

$___________________

$___________________

Total Maryland Income Tax Subtraction

$___________________

* POULTRY LITTER SPREADERS:

ALL APPLICANTS:

NUTRIENT MANAGEMENT PLAN

PREVIOUS SUBTRACTION FOR TRADE IN: YES

FOR TRADE IN: YES

NO

PREPARER: __________________________________

PREPARER: __________________________________

TAX YEAR OF PRIOR SUBTRACTION: ____________________

YEAR OF PRIOR SUBTRACTION: ____________________

CERTIFICATION NUMBER: _______________________

CERTIFICATION NUMBER: _______________________

INITIALS: _________________________________

INITIALS: _________________________________

TAYPAYER VERFICATION:

1

1 2

2