Second B Notice - Important Tax Notice - Action Is Required

ADVERTISEMENT

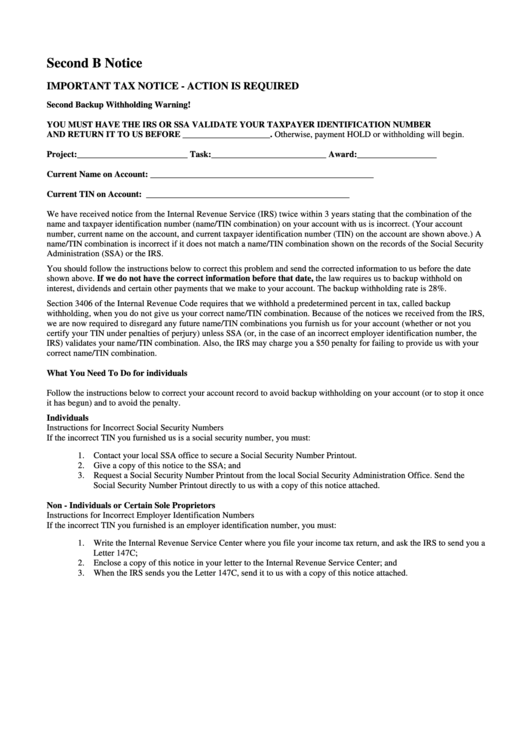

Second B Notice

IMPORTANT TAX NOTICE - ACTION IS REQUIRED

Second Backup Withholding Warning!

YOU MUST HAVE THE IRS OR SSA VALIDATE YOUR TAXPAYER IDENTIFICATION NUMBER

AND RETURN IT TO US BEFORE ____________________. Otherwise, payment HOLD or withholding will begin.

Project:_________________________

Task:__________________________

Award:__________________

Current Name on Account:

___________________________________________________

Current TIN on Account: ______________________________________________

We have received notice from the Internal Revenue Service (IRS) twice within 3 years stating that the combination of the

name and taxpayer identification number (name/TIN combination) on your account with us is incorrect. (Your account

number, current name on the account, and current taxpayer identification number (TIN) on the account are shown above.) A

name/TIN combination is incorrect if it does not match a name/TIN combination shown on the records of the Social Security

Administration (SSA) or the IRS.

You should follow the instructions below to correct this problem and send the corrected information to us before the date

shown above. If we do not have the correct information before that date, the law requires us to backup withhold on

interest, dividends and certain other payments that we make to your account. The backup withholding rate is 28%.

Section 3406 of the Internal Revenue Code requires that we withhold a predetermined percent in tax, called backup

withholding, when you do not give us your correct name/TIN combination. Because of the notices we received from the IRS,

we are now required to disregard any future name/TIN combinations you furnish us for your account (whether or not you

certify your TIN under penalties of perjury) unless SSA (or, in the case of an incorrect employer identification number, the

IRS) validates your name/TIN combination. Also, the IRS may charge you a $50 penalty for failing to provide us with your

correct name/TIN combination.

What You Need To Do for individuals

Follow the instructions below to correct your account record to avoid backup withholding on your account (or to stop it once

it has begun) and to avoid the penalty.

Individuals

Instructions for Incorrect Social Security Numbers

If the incorrect TIN you furnished us is a social security number, you must:

1.

Contact your local SSA office to secure a Social Security Number Printout.

2.

Give a copy of this notice to the SSA; and

3.

Request a Social Security Number Printout from the local Social Security Administration Office. Send the

Social Security Number Printout directly to us with a copy of this notice attached.

Non - Individuals or Certain Sole Proprietors

Instructions for Incorrect Employer Identification Numbers

If the incorrect TIN you furnished is an employer identification number, you must:

1.

Write the Internal Revenue Service Center where you file your income tax return, and ask the IRS to send you a

Letter 147C;

2.

Enclose a copy of this notice in your letter to the Internal Revenue Service Center; and

3.

When the IRS sends you the Letter 147C, send it to us with a copy of this notice attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1