Determination Of Residency Status (Leaving Canada) - Canada Revenue Agency

ADVERTISEMENT

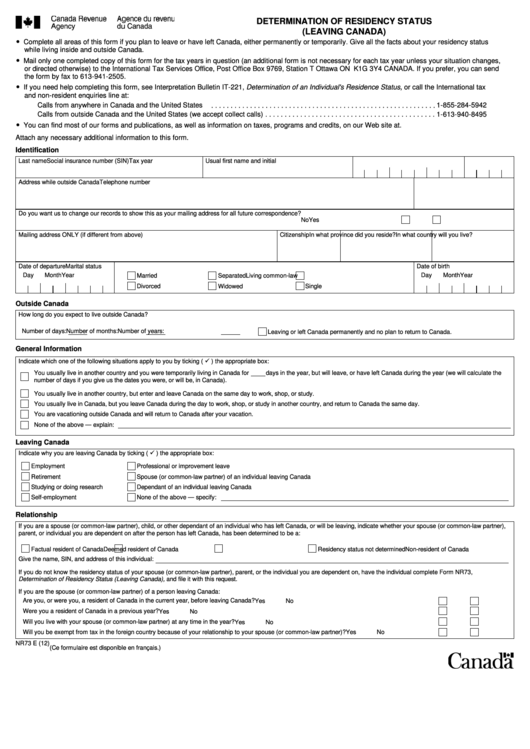

DETERMINATION OF RESIDENCY STATUS

(LEAVING CANADA)

Complete all areas of this form if you plan to leave or have left Canada, either permanently or temporarily. Give all the facts about your residency status

while living inside and outside Canada.

Mail only one completed copy of this form for the tax years in question (an additional form is not necessary for each tax year unless your situation changes,

or directed otherwise) to the International Tax Services Office, Post Office Box 9769, Station T Ottawa ON K1G 3Y4 CANADA. If you prefer, you can send

the form by fax to 613-941-2505.

If you need help completing this form, see Interpretation Bulletin IT-221, Determination of an Individual's Residence Status, or call the International tax

and non-resident enquiries line at:

Calls from anywhere in Canada and the United States

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1-855-284-5942

Calls from outside Canada and the United States (we accept collect calls)

1-613-940-8495

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

You can find most of our forms and publications, as well as information on taxes, programs and credits, on our Web site at

Attach any necessary additional information to this form.

Identification

Last name

Usual first name and initial

Social insurance number (SIN)

Tax year

Address while outside Canada

Telephone number

Do you want us to change our records to show this as your mailing address for all future correspondence?

Yes

No

Mailing address ONLY (if different from above)

Citizenship

In what province did you reside? In what country will you live?

Date of departure

Marital status

Date of birth

Day

Month

Year

Day

Month

Year

Married

Separated

Living common-law

Divorced

Widowed

Single

Outside Canada

How long do you expect to live outside Canada?

Number of days:

Number of months:

Number of years:

Leaving or left Canada permanently and no plan to return to Canada.

General Information

Indicate which one of the following situations apply to you by ticking (

) the appropriate box:

You usually live in another country and you were temporarily living in Canada for

days in the year, but will leave, or have left Canada during the year (we will calculate the

number of days if you give us the dates you were, or will be, in Canada).

You usually live in another country, but enter and leave Canada on the same day to work, shop, or study.

You usually live in Canada, but you leave Canada during the day to work, shop, or study in another country, and return to Canada the same day.

You are vacationing outside Canada and will return to Canada after your vacation.

None of the above — explain:

Leaving Canada

Indicate why you are leaving Canada by ticking (

) the appropriate box:

Employment

Professional or improvement leave

Retirement

Spouse (or common-law partner) of an individual leaving Canada

Studying or doing research

Dependant of an individual leaving Canada

Self-employment

None of the above — specify:

Relationship

If you are a spouse (or common-law partner), child, or other dependant of an individual who has left Canada, or will be leaving, indicate whether your spouse (or common-law partner),

parent, or individual you are dependent on after the person has left Canada, has been determined to be a:

Factual resident of Canada

Deemed resident of Canada

Non-resident of Canada

Residency status not determined

Give the name, SIN, and address of this individual:

If you do not know the residency status of your spouse (or common-law partner), parent, or the individual you are dependent on, have the individual complete Form NR73,

Determination of Residency Status (Leaving Canada), and file it with this request.

If you are the spouse (or common-law partner) of a person leaving Canada:

Are you, or were you, a resident of Canada in the current year, before leaving Canada?

Yes

No

Were you a resident of Canada in a previous year?

Yes

No

Will you live with your spouse (or common-law partner) at any time in the year?

Yes

No

Will you be exempt from tax in the foreign country because of your relationship to your spouse (or common-law partner)?

Yes

No

NR73 E (12)

(Ce formulaire est disponible en français.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4