Omb No. 1845-0061 Form - Federal Perkins Loan Promissory Note

ADVERTISEMENT

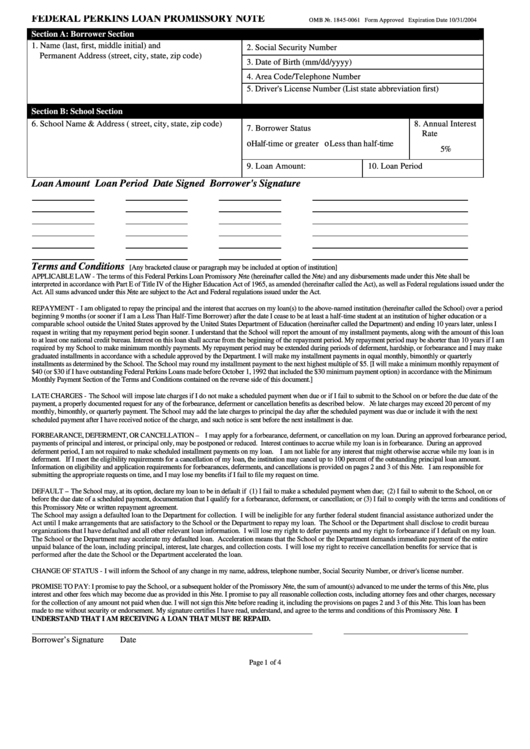

FEDERAL PERKINS LOAN PROMISSORY NOTE

OMB No. 1845-0061 Form Approved Expiration Date 10/31/2004

Section A: Borrower Section

1. Name (last, first, middle initial) and

2. Social Security Number

Permanent Address (street, city, state, zip code)

3. Date of Birth (mm/dd/yyyy)

4. Area Code/Telephone Number

5. Driver's License Number (List state abbreviation first)

Section B: School Section

6. School Name & Address ( street, city, state, zip code)

8. Annual Interest

7. Borrower Status

Rate

οHalf-time or greater οLess than half-time

5%

9. Loan Amount:

10. Loan Period

Loan Amount

Loan Period

Date Signed

Borrower's Signature

Terms and Conditions

[Any bracketed clause or paragraph may be included at option of institution]

APPLICABLE LAW - The terms of this Federal Perkins Loan Promissory Note (hereinafter called the Note) and any disbursements made under this Note shall be

interpreted in accordance with Part E of Title IV of the Higher Education Act of 1965, as amended (hereinafter called the Act), as well as Federal regulations issued under the

Act. All sums advanced under this Note are subject to the Act and Federal regulations issued under the Act.

REPAYMENT - I am obligated to repay the principal and the interest that accrues on my loan(s) to the ab ove-named institution (hereinafter called the School) over a period

beginning 9 months (or sooner if I am a Less Than Half-Time Borrower) after the date I cease to be at least a half-time student at an institution of higher education or a

comparable school outside the United States approved by the United States Department of Education (hereinafter called the Department) and ending 10 years later, unless I

request in writing that my repayment period begin sooner. I understand that the School will report the amount of my installment payments, along with the amount of this loan

to at least one national credit bureau. Interest on this loan shall accrue from the beginning of the repayment period. My repayment period may be shorter than 10 years if I am

required by my School to make minimum monthly payments. My repayment period may be extended during periods of deferment, hardship, or forbearance and I may make

graduated installments in accordance with a schedule approved by the Department. I will make my installment payments in equal monthly, bimonthly or quarterly

installments as determined by the School. The School may round my installment payment to the next highest multiple of $5. [I will make a minimum monthly repayment of

$40 (or $30 if I have outstanding Federal Perkins Loans made before October 1, 1992 that included the $30 minimum payment option) in accordance with the Minimum

Monthly Payment Section of the Terms and Conditions contained on the reverse side of this document.]

LATE CHARGES - The School will impose late charges if I do not make a scheduled payment when due or if I fail to submit to the School on or before the due date of the

payment, a properly documented request for any of the forbearance, deferment or cancellation benefits as described below. No late charges may exceed 20 percent of my

monthly, bimonthly, or quarterly payment. The School may add the late charges to principal the day after the scheduled payment was due or include it with the next

scheduled payment after I have received noti c e of the charge, and such notice is sent before the next installment is due.

FORBEARANCE, DEFERMENT, OR CANCELLATION – I may apply for a forbearance, deferment, or cancellation on my loan. During an approved forbearance period,

payments of principal and interest, or principal only, may be postponed or reduced. Interest continues to accrue while my loan is in forbearance. During an approved

deferment period, I am not required to make scheduled installment payments on my loan. I am not liable for any interest that might otherwise accrue while my loan is in

deferment. If I meet the eligibility requirements for a cancellation of my loan, the institution may cancel up to 100 percent of the outstanding principal loan amount.

Information on eligibility and application requirements for forbearances, deferments, and cancellations is provided on pages 2 and 3 of this Note. I am responsible for

submitting the appropriate requests on time, and I may lose my benefits if I fail to file my request on time.

DEFAULT – The School may, at its option, declare my loan to be in default if (1) I fail to make a scheduled payment when due; (2) I fail to submit to the School, on or

before the due date of a scheduled payment, documentation that I qualify for a forbearance, deferment, or cancellation; or (3) I fail to comply with the terms and conditions of

this Promissory Note or written repayment agreement.

The School may assign a defaulted loan to the Department for collection. I will be ineligible for any further federal student financial assistance authorized under the

Act until I make arrangements that are satisfactory to the School or the Department to repay my loan. The School or the Department shall disclose to credit bureau

organizations that I have defaulted and all other relevant loan information. I will lose my right to defer payments and my right to forbearance if I default on my loan.

The School or the Department may accelerate my defaulted loan. Acceleration means that the School or the Department demands immediate payment of the entire

unpaid balance of the loan, including principal, interest, late charges, and collection costs. I will lose my right to receive cancellation benefits for service that is

performed after the date the School or the Department accelerated the loan.

CHANGE OF STATUS - I will inform the School of any change in my name, address, telephone number, Social Security Number, or driver's license number.

PROMISE TO PAY: I promise to pay the School, or a subsequent holder of the Promissory Note, the sum of amount(s) advanced to me under the terms of this Note, plus

interest and other fees which may become due as provided in this Note. I promise to pay all reasonable collection costs, including attorney fees and other charges, necessary

for the collection of any amount not paid when due. I will not sign this Note before reading it, including the provisions on pages 2 and 3 of this Note. This loan has been

made to me without security or endorsement. My signature certifies I have read, understand, and agree to the terms and conditions of this Promissory Note. I

UNDERSTAND THAT I AM RECEIVING A LOAN THAT MUST BE REPAID.

Borrower’s Signature

Date

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4