Combined Inter Vivos And Land Trust Agreement Template

ADVERTISEMENT

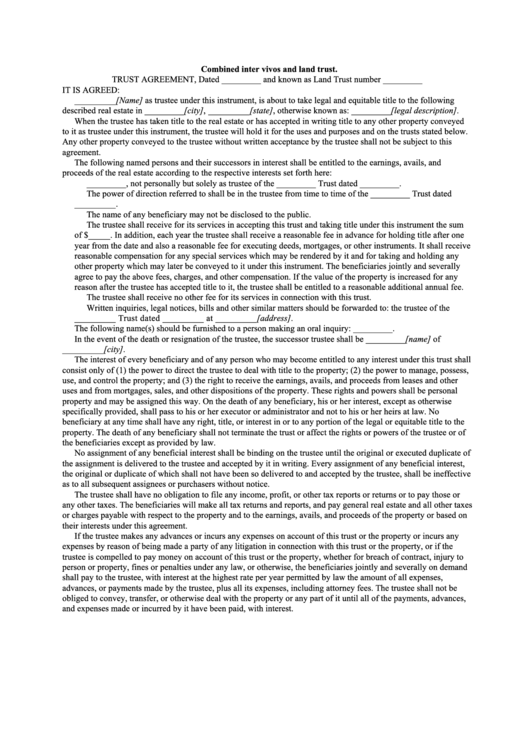

Combined inter vivos and land trust.

TRUST AGREEMENT, Dated _________ and known as Land Trust number _________

IT IS AGREED:

_________[Name] as trustee under this instrument, is about to take legal and equitable title to the following

described real estate in _________[city], _________[state], otherwise known as: _________[legal description].

When the trustee has taken title to the real estate or has accepted in writing title to any other property conveyed

to it as trustee under this instrument, the trustee will hold it for the uses and purposes and on the trusts stated below.

Any other property conveyed to the trustee without written acceptance by the trustee shall not be subject to this

agreement.

The following named persons and their successors in interest shall be entitled to the earnings, avails, and

proceeds of the real estate according to the respective interests set forth here:

_________, not personally but solely as trustee of the _________ Trust dated _________.

The power of direction referred to shall be in the trustee from time to time of the _________ Trust dated

_________.

The name of any beneficiary may not be disclosed to the public.

The trustee shall receive for its services in accepting this trust and taking title under this instrument the sum

of $_____. In addition, each year the trustee shall receive a reasonable fee in advance for holding title after one

year from the date and also a reasonable fee for executing deeds, mortgages, or other instruments. It shall receive

reasonable compensation for any special services which may be rendered by it and for taking and holding any

other property which may later be conveyed to it under this instrument. The beneficiaries jointly and severally

agree to pay the above fees, charges, and other compensation. If the value of the property is increased for any

reason after the trustee has accepted title to it, the trustee shall be entitled to a reasonable additional annual fee.

The trustee shall receive no other fee for its services in connection with this trust.

Written inquiries, legal notices, bills and other similar matters should be forwarded to: the trustee of the

_________ Trust dated _________ at _________[address].

The following name(s) should be furnished to a person making an oral inquiry: _________.

In the event of the death or resignation of the trustee, the successor trustee shall be _________[name] of

_________[city].

The interest of every beneficiary and of any person who may become entitled to any interest under this trust shall

consist only of (1) the power to direct the trustee to deal with title to the property; (2) the power to manage, possess,

use, and control the property; and (3) the right to receive the earnings, avails, and proceeds from leases and other

uses and from mortgages, sales, and other dispositions of the property. These rights and powers shall be personal

property and may be assigned this way. On the death of any beneficiary, his or her interest, except as otherwise

specifically provided, shall pass to his or her executor or administrator and not to his or her heirs at law. No

beneficiary at any time shall have any right, title, or interest in or to any portion of the legal or equitable title to the

property. The death of any beneficiary shall not terminate the trust or affect the rights or powers of the trustee or of

the beneficiaries except as provided by law.

No assignment of any beneficial interest shall be binding on the trustee until the original or executed duplicate of

the assignment is delivered to the trustee and accepted by it in writing. Every assignment of any beneficial interest,

the original or duplicate of which shall not have been so delivered to and accepted by the trustee, shall be ineffective

as to all subsequent assignees or purchasers without notice.

The trustee shall have no obligation to file any income, profit, or other tax reports or returns or to pay those or

any other taxes. The beneficiaries will make all tax returns and reports, and pay general real estate and all other taxes

or charges payable with respect to the property and to the earnings, avails, and proceeds of the property or based on

their interests under this agreement.

If the trustee makes any advances or incurs any expenses on account of this trust or the property or incurs any

expenses by reason of being made a party of any litigation in connection with this trust or the property, or if the

trustee is compelled to pay money on account of this trust or the property, whether for breach of contract, injury to

person or property, fines or penalties under any law, or otherwise, the beneficiaries jointly and severally on demand

shall pay to the trustee, with interest at the highest rate per year permitted by law the amount of all expenses,

advances, or payments made by the trustee, plus all its expenses, including attorney fees. The trustee shall not be

obliged to convey, transfer, or otherwise deal with the property or any part of it until all of the payments, advances,

and expenses made or incurred by it have been paid, with interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3