Print

Reset

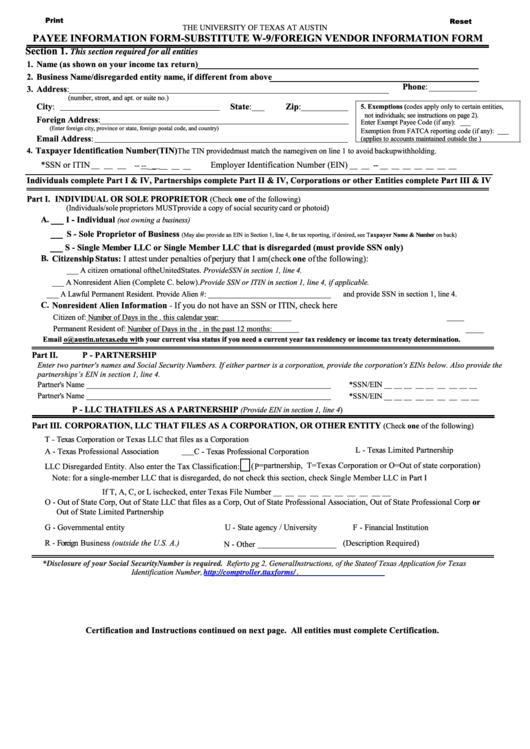

THE UNIVERSITY OF TEXAS AT AUSTIN

PAYEE INFORMATION FORM-SUBSTITUTE W-9/FOREIGN VENDOR INFORMATION FORM

Section 1.

This section required for all entities

1. Name (as shown on your income tax return)

2. Business Name/disregarded entity name, if different from above

Phone:

3. Address:

(number, street, and apt. or suite no.)

City:

State:

Zip:

5. Exemptions (codes apply only to certain entities,

not individuals; see instructions on page 2).

Foreign Address:

Enter Exempt Payee Code (if any):

(Enter foreign city, province or state, foreign postal code, and country)

Exemption from FATCA reporting code (if any):

Email Address:

(applies to accounts maintained outside the U.S.)

Taxpayer Identification Number (TIN)

4.

The TIN provided must match the name given on line 1 to avoid backup withholding.

*SSN or ITIN

Employer Identification Number (EIN)

--

-- __ __ __ __

__ __ -- __ __ __ __ __ __ __

Individuals complete Part I & IV, Partnerships complete Part II & IV, Corporations or other Entities complete Part III & IV

Part I. INDIVIDUAL OR SOLE PROPRIETOR

(Check one of the following)

(Individuals/sole proprietors MUST provide a copy of social security card or photo id)

A.

I - Individual

(not owning a business)

S - Sole Proprietor of Business

(May also provide an EIN in Section 1, line 4, for tax reporting, if desired, see Taxpayer Name & Number on back)

S - Single Member LLC or Single Member LLC that is disregarded (must provide SSN only)

B. Citizenship Status: I attest under penalties of perjury that I am (check one of the following):

___ A citizen or national of the United States. Provide SSN in section 1, line 4.

___ A Nonresident Alien (Complete C. below). Provide SSN or ITIN in section 1, line 4, if applicable.

___ A Lawful Permanent Resident. Provide Alien #: ________________________________ and provide SSN in section 1, line 4.

C. Nonresident Alien Information - If you do not have an SSN or ITIN, check here

Citizen of:

Number of Days in the U.S.A. this calendar year:

Permanent Resident of:

Number of Days in the U.S.A. in the past 12 months:

Email oa.ic@austin.utexas.edu with your current visa status if you need a current year tax residency or income tax treaty determination.

Part II.

P - PARTNERSHIP

Enter two partner's names and Social Security Numbers. If either partner is a corporation, provide the corporation's EINs below. Also provide the

partnerships’s EIN in section 1, line 4.

Partner's Name ______________________________________________________________

*SSN/EIN __ __ __ __ __ __ __ __ __

Partner's Name ______________________________________________________________

*SSN/EIN __ __ __ __ __ __ __ __ __

P - LLC THAT FILES AS A PARTNERSHIP

(Provide EIN in section 1, line 4)

Part III. CORPORATION, LLC THAT FILES AS A CORPORATION, OR OTHER ENTITY

(Check one of the following)

T - Texas Corporation or Texas LLC that files as a Corporation

L - Texas Limited Partnership

A - Texas Professional Association

C - Texas Professional Corporation

P =partnership, T=Texas Corporation or O=Out of state corporation)

(

LLC Disregarded Entity. Also enter the Tax Classification:

Note: for a single-member LLC that is disregarded, do not check this section, check Single Member LLC in Part I

If T, A, C, or L is checked, enter Texas File Number __ __ __ __ __ __ __ __ __ __

O - Out of State Corp, Out of State LLC that files as a Corp, Out of State Professional Association, Out of State Professional Corp or

Out of State Limited Partnership

G - Governmental entity

U - State agency / University

F - Financial Institution

R - Foreign Business (outside the U. S. A.)

(Description Required)

N - Other

Refer to pg 2, General Instructions, of the State of Texas Application for Texas

*Disclosure of your Social Security Number is required.

Identification Number,

Certification and Instructions continued on next page. All entities must complete Certification.

1

1 2

2