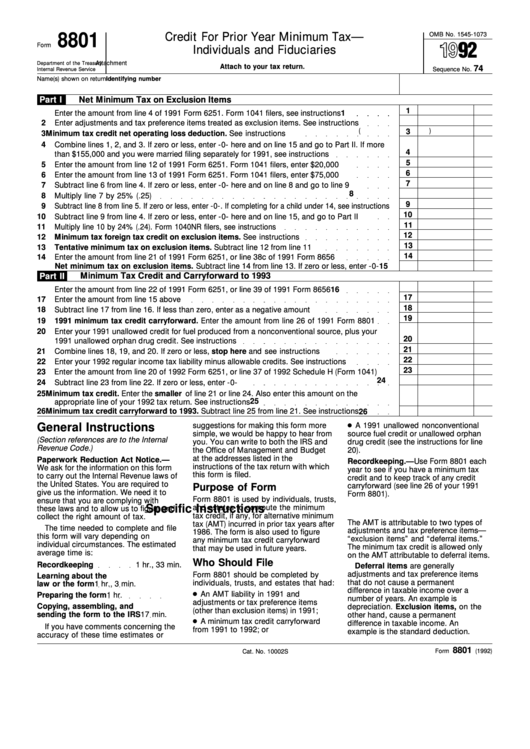

Form 8801 - Credit For Prior Year Minimum Tax - Individuals And Fiduciaries

ADVERTISEMENT

8801

OMB No. 1545-1073

Credit For Prior Year Minimum Tax—

Form

Individuals and Fiduciaries

Attachment

Department of the Treasury

Attach to your tax return.

74

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Net Minimum Tax on Exclusion Items

1

1

Enter the amount from line 4 of 1991 Form 6251. Form 1041 filers, see instructions

2

2

Enter adjustments and tax preference items treated as exclusion items. See instructions

(

)

3

3

Minimum tax credit net operating loss deduction. See instructions

4

Combine lines 1, 2, and 3. If zero or less, enter -0- here and on line 15 and go to Part II. If more

4

than $155,000 and you were married filing separately for 1991, see instructions

5

5

Enter the amount from line 12 of 1991 Form 6251. Form 1041 filers, enter $20,000

6

6

Enter the amount from line 13 of 1991 Form 6251. Form 1041 filers, enter $75,000

7

7

Subtract line 6 from line 4. If zero or less, enter -0- here and on line 8 and go to line 9

8

8

Multiply line 7 by 25% (.25)

9

9

Subtract line 8 from line 5. If zero or less, enter -0-. If completing for a child under 14, see instructions

10

10

Subtract line 9 from line 4. If zero or less, enter -0- here and on line 15, and go to Part II

11

11

Multiply line 10 by 24% (.24). Form 1040NR filers, see instructions

12

12

Minimum tax foreign tax credit on exclusion items. See instructions

13

13

Tentative minimum tax on exclusion items. Subtract line 12 from line 11

14

14

Enter the amount from line 21 of 1991 Form 6251, or line 38c of 1991 Form 8656

15

Net minimum tax on exclusion items. Subtract line 14 from line 13. If zero or less, enter -0-

15

Minimum Tax Credit and Carryforward to 1993

Part II

16

16

Enter the amount from line 22 of 1991 Form 6251, or line 39 of 1991 Form 8656

17

17

Enter the amount from line 15 above

18

18

Subtract line 17 from line 16. If less than zero, enter as a negative amount

19

19

1991 minimum tax credit carryforward. Enter the amount from line 26 of 1991 Form 8801

20

Enter your 1991 unallowed credit for fuel produced from a nonconventional source, plus your

20

1991 unallowed orphan drug credit. See instructions

21

21

Combine lines 18, 19, and 20. If zero or less, stop here and see instructions

22

22

Enter your 1992 regular income tax liability minus allowable credits. See instructions

23

23

Enter the amount from line 20 of 1992 Form 6251, or line 37 of 1992 Schedule H (Form 1041)

24

24

Subtract line 23 from line 22. If zero or less, enter -0-

25

Minimum tax credit. Enter the smaller of line 21 or line 24. Also enter this amount on the

25

appropriate line of your 1992 tax return. See instructions

26

Minimum tax credit carryforward to 1993. Subtract line 25 from line 21. See instructions

26

General Instructions

suggestions for making this form more

A 1991 unallowed nonconventional

simple, we would be happy to hear from

source fuel credit or unallowed orphan

(Section references are to the Internal

you. You can write to both the IRS and

drug credit (see the instructions for line

Revenue Code. )

the Office of Management and Budget

20).

at the addresses listed in the

Paperwork Reduction Act Notice.—

Recordkeeping.—Use Form 8801 each

instructions of the tax return with which

We ask for the information on this form

year to see if you have a minimum tax

this form is filed.

to carry out the Internal Revenue laws of

credit and to keep track of any credit

the United States. You are required to

carryforward (see line 26 of your 1991

Purpose of Form

give us the information. We need it to

Form 8801).

Form 8801 is used by individuals, trusts,

ensure that you are complying with

and estates to compute the minimum

Specific Instructions

these laws and to allow us to figure and

tax credit, if any, for alternative minimum

collect the right amount of tax.

The AMT is attributable to two types of

tax (AMT) incurred in prior tax years after

The time needed to complete and file

adjustments and tax preference items—

1986. The form is also used to figure

this form will vary depending on

“exclusion items” and “deferral items.”

any minimum tax credit carryforward

individual circumstances. The estimated

The minimum tax credit is allowed only

that may be used in future years.

average time is:

on the AMT attributable to deferral items.

Who Should File

Recordkeeping

1 hr., 33 min.

Deferral items are generally

adjustments and tax preference items

Form 8801 should be completed by

Learning about the

that do not cause a permanent

individuals, trusts, and estates that had:

law or the form

1 hr., 3 min.

difference in taxable income over a

An AMT liability in 1991 and

Preparing the form

1 hr.

number of years. An example is

adjustments or tax preference items

Copying, assembling, and

depreciation. Exclusion items, on the

(other than exclusion items) in 1991;

sending the form to the IRS

17 min.

other hand, cause a permanent

A minimum tax credit carryforward

difference in taxable income. An

If you have comments concerning the

from 1991 to 1992; or

example is the standard deduction.

accuracy of these time estimates or

8801

Form

(1992)

Cat. No. 10002S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2