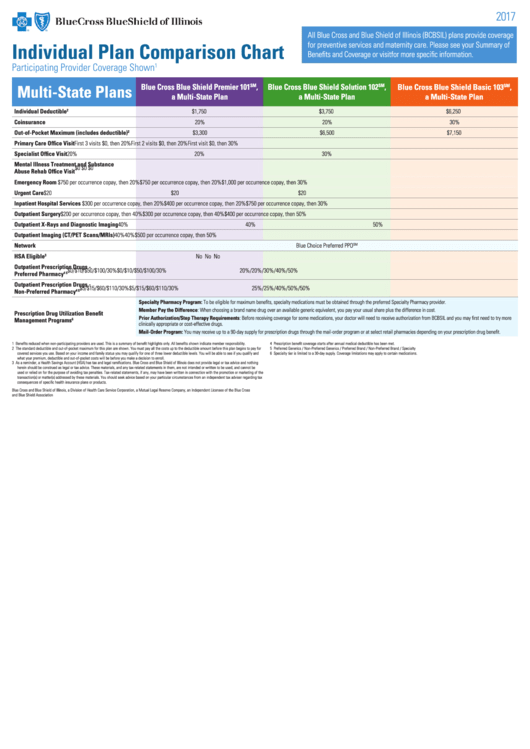

Multi-State Plans Individual Plan Comparison Chart - Bcbsil

ADVERTISEMENT

2017

All Blue Cross and Blue Shield of Illinois (BCBSIL) plans provide coverage

Individual Plan Comparison Chart

for preventive services and maternity care. Please see your Summary of

Benefits and Coverage or visit for more specific information.

Participating Provider Coverage Shown

1

Multi-State Plans

Blue Cross Blue Shield Premier 101

,

Blue Cross Blue Shield Solution 102

,

Blue Cross Blue Shield Basic 103

,

SM

SM

SM

a Multi-State Plan

a Multi-State Plan

a Multi-State Plan

Individual Deductible

$1,750

$3,750

$6,250

2

Coinsurance

20%

20%

30%

Out-of-Pocket Maximum (includes deductible)

$3,300

$6,500

$7,150

2

Primary Care Office Visit

First 3 visits $0, then 20%

First 2 visits $0, then 20%

First visit $0, then 30%

Specialist Office Visit

20%

20%

30%

Mental Illness Treatment and Substance

$0

$0

$0

Abuse Rehab Office Visit

Emergency Room

$750 per occurrence copay, then 20%

$750 per occurrence copay, then 20%

$1,000 per occurrence copay, then 30%

Urgent Care

$20

$20

$20

Inpatient Hospital Services

$300 per occurrence copay, then 20%

$400 per occurrence copay, then 20%

$750 per occurrence copay, then 30%

Outpatient Surgery

$200 per occurrence copay, then 40%

$300 per occurrence copay, then 40%

$400 per occurrence copay, then 50%

Outpatient X-Rays and Diagnostic Imaging

40%

40%

50%

Outpatient Imaging (CT/PET Scans/MRIs)

40%

40%

$500 per occurrence copay, then 50%

Network

Blue Choice Preferred PPO

SM

HSA Eligible

No

No

No

3

Outpatient Prescription Drugs -

$0/$10/$50/$100/30%

$0/$10/$50/$100/30%

20%/20%/30%/40%/50%

Preferred Pharmacy

4 5

Outpatient Prescription Drugs -

$5/$15/$60/$110/30%

$5/$15/$60/$110/30%

25%/25%/40%/50%/50%

Non-Preferred Pharmacy

4 5

Specialty Pharmacy Program: To be eligible for maximum benefits, specialty medications must be obtained through the preferred Specialty Pharmacy provider.

Member Pay the Difference: When choosing a brand name drug over an available generic equivalent, you pay your usual share plus the difference in cost.

Prescription Drug Utilization Benefit

Prior Authorization/Step Therapy Requirements: Before receiving coverage for some medications, your doctor will need to receive authorization from BCBSIL and you may first need to try more

Management Programs

6

clinically appropriate or cost-effective drugs.

Mail-Order Program: You may receive up to a 90-day supply for prescription drugs through the mail-order program or at select retail pharmacies depending on your prescription drug benefit.

1

Benefits reduced when non-participating providers are used. This is a summary of benefit highlights only. All benefits shown indicate member responsibility.

4

Prescription benefit coverage starts after annual medical deductible has been met.

2

The standard deductible and out-of-pocket maximum for this plan are shown. You must pay all the costs up to the deductible amount before this plan begins to pay for

5

Preferred Generics / Non-Preferred Generics / Preferred Brand / Non-Preferred Brand / Specialty

covered services you use. Based on your income and family status you may qualify for one of three lower deductible levels. You will be able to see if you qualify and

6

Specialty tier is limited to a 30-day supply. Coverage limitations may apply to certain medications.

what your premium, deductible and out-of-pocket costs will be before you make a decision to enroll.

3

As a reminder, a Health Savings Account (HSA) has tax and legal ramifications. Blue Cross and Blue Shield of Illinois does not provide legal or tax advice and nothing

herein should be construed as legal or tax advice. These materials, and any tax-related statements in them, are not intended or written to be used, and cannot be

used or relied on for the purpose of avoiding tax penalties. Tax-related statements, if any, may have been written in connection with the promotion or marketing of the

transaction(s) or matter(s) addressed by these materials. You should seek advice based on your particular circumstances from an independent tax adviser regarding tax

consequences of specific health insurance plans or products.

Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross

and Blue Shield Association

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1