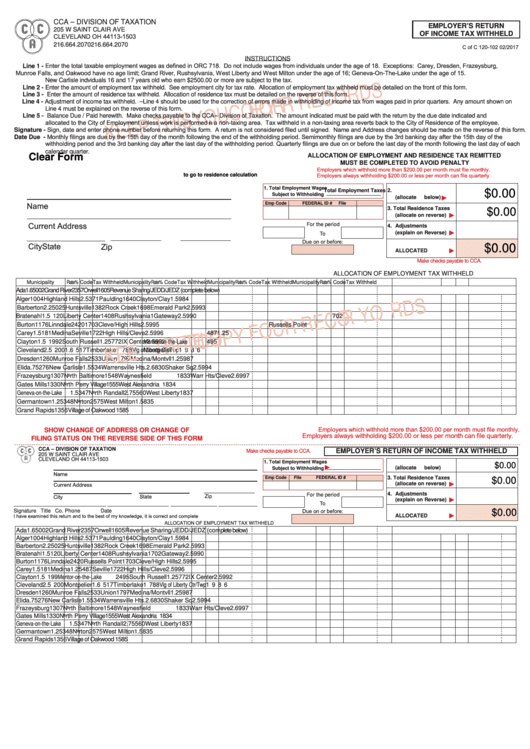

CCA – DIVISION OF TAXATION

EMPLOYER’S RETURN

205 W SAINT CLAIR AVE

OF INCOME TAX WITHHELD

CLEVELAND OH 44113-1503

216.664.2070

800.223.6317

C of C 120-102 12/2017

INSTRUCTIONS

Line 1 - Enter the total taxable employment wages as defined in ORC 718. Do not include wages from individuals under the age of 18. Exceptions: Carey, Dresden, Frazeysburg, Hamilton,

Montpelier, Munroe Falls, New Paris, Oakwood, Phillipsburg and West Alexandria have no age limit; Grand River, Rushsylvania, West Liberty and West Milton under the age of 16;

Geneva-On-The-Lake under the age of 15. New Carlisle indviduals 16 and 17 years old who earn $2500.00 or more are subject to the tax.

Line 2 - Enter the amount of employment tax withheld. See employment municipality for tax rate. Allocation of employment tax withheld must be detailed on the front of this form.

Line 3 - Enter the amount of residence tax withheld. Allocation of residence tax must be detailed on the reverse of this form.

Line 4 - Adjustment of income tax withheld. –Line 4 should be used for the correction of errors made in withholding of income tax from wages paid in prior quarters. Any amount shown on

Line 4 must be explained on the reverse of this form.

Line 5 - Balance Due / Paid herewith. Make checks payable to the CCA – Division of Taxation. The amount indicated must be paid with the return by the due date indicated and

allocated to the City of Employment unless work is performed in a non-taxing area. Tax withheld in a non-taxing area reverts back to the City of Residence of the employee.

Signature - Sign, date and enter phone number before returning this form. A return is not considered filed until signed. Name and Address changes should be made on the reverse of this form.

Date Due - Monthly filings are due by the 15th day of the month following the end of the withholding period. Semimonthly filings are due by the 3rd banking day after the 15th day of the

withholding period and the 3rd banking day after the last day of the withholding period. Quarterly filings are due on or before the last day of the month following the last day of each

calendar quarter.

ALLOCATION OF EMPLOYMENT AND RESIDENCE TAX REMITTED

MUST BE COMPLETED TO AVOID PENALTY

Clear Form

Employers which withhold more than $200.00 per month must file monthly.

Employers always withholding $200.00 or less per month can file quarterly.

Click here to go to residence calculation

1. Total Employment Wages

2. Total Employment Taxes

$0.00

Subject to Withholding

►

(allocate below)

Emp Code

FEDERAL ID #

File Code

Name

3. Total Residence Taxes

$0.00

►

(allocate on reverse)

For the period

4. Adjustments

Current Address

►

(explain on Reverse)

To

Due on or before:

5. TOTAL TAXES

$0.00

City

State

Zip

►

ALLOCATED

Make checks payable to CCA.

ALLOCATION OF EMPLOYMENT TAX WITHHELD

Rate% Code

Rate% Code

Rate% Code

Rate% Code

Municipality

Tax Withheld

Municipality

Tax Withheld

Municipality

Tax Withheld

Municipality

Tax Withheld

Ada

1.65 002

Hamilton

2 365

Orwell

1 605

Revenue Sharing/JEDD/JEDZ (complete below)

Alger

1 004

Highland Hills

2.5 371

Paulding

1 640

Butler Co Annex

2 951

Barberton

2.25 025

Huntsville

1 382

Phillipsburg

1.5 659

Clayton/Clay

1.5 984

Bratenahl

1.5 120

Liberty Center

1 408

Rock Creek

1

698

Emerald Park

2.5 993

Burton

1 176

Linndale

2 420

Rushsylvania

1 702

Gateway

2.5 990

Mentor-on-the-Lake

Carey

1.5 181

2 495

Russells Point

1 703

Cleve/High Hills

2.5 995

Clayton

1.5 199

Montpelier

1.6

517

Seville

1 722

Hamilton - Fairfield I

2 952

Cleveland

2.5 200

Munroe Falls

2 533

Shreve

1 755

Hamilton - Fairfield II

2 953

Dresden

1 260

New Carlisle

1.5 534

South Russell

1.25 772

Hamilton - Fairfield III

2 954

Elida

.75 276

New Miami

1.75 539

Timberlake

1 788

High Hills/Cleve

2.5 996

Frazeysburg

1 307

New Paris

1 541

Union

1 797

IX Center

2.5 992

Vlg of Liberty Ctr/Twp

Gates Mills

1 330

North Baltimore

1 548

Warrensville Hts.

2.6 830

1 986

Geneva-on-the-Lake

1.5 347

North Perry Village

1 555

Waynesfield

1 833

Shaker Sq

2.5 994

Germantown

1.25 348

North Randall

2.75 560

West Alexandria

1 834

Warr Hts/Cleve

2.6 997

Grand Rapids

1 356

Norton

2 575

West Liberty

1 837

Grand River

2 357

Village of Oakwood

1 585

West Milton

1.5 835

SHOW CHANGE OF ADDRESS OR CHANGE OF

Employers which withhold more than $200.00 per month must file monthly.

Employers always withholding $200.00 or less per month can file quarterly.

FILING STATUS ON THE REVERSE SIDE OF THIS FORM

CCA – DIVISION OF TAXATION

EMPLOYER’S RETURN OF INCOME TAX WITHHELD

Make checks payable to CCA.

205 W SAINT CLAIR AVE

CLEVELAND OH 44113-1503

2. Total Employment Taxes

1. Total Employment Wages

$0.00

►

(allocate below)

Subject to Withholding

Emp Code

FEDERAL ID #

File Code

3. Total Residence Taxes

Name

$0.00

►

(allocate on reverse)

Current Address

4. Adjustments

For the period

►

(explain on Reverse)

Zip

To

5. TOTAL TAXES

Signature

Title

Co. Phone

Date

Due on or before:

$0.00

►

ALLOCATED

I have examined this return and to the best of my knowledge, it is correct and complete

ALLOCATION OF EMPLOYMENT TAX WITHHELD

Ada

1.65 002

Hamilton

2 365

Orwell

1 605

Revenue Sharing/JEDD/JEDZ (complete below)

Alger

1 004

Highland Hills

2.5 371

Paulding

1 640

Butler Co Annex

2 951

Barberton

2.25 025

Huntsville

1 382

Phillipsburg

1.5 659

Clayton/Clay

1.5 984

Bratenahl

1.5 120

Liberty Center

1 408

Rock Creek

1 698

Emerald Park

2.5 993

Burton

1 176

Linndale

2 420

Rushsylvania

1 702

Gateway

2.5 990

Mentor-on-the-Lake

Carey

1.5 181

2 495

Russells Point

1 703

Cleve/High Hills

2.5 995

Clayton

1.5 199

Montpelier

1.6 517

Seville

1 722

Hamilton - Fairfield I

2 952

Cleveland

2.5 200

Munroe Falls

2 533

Shreve

1 755

Hamilton - Fairfield II

2 953

Dresden

1 260

New Carlisle

1.5 534

South Russell

1.25 772

Hamilton - Fairfield III

2 954

Elida

.75 276

New Miami

1.75 539

Timberlake

1 788

High Hills/Cleve

2.5 996

Frazeysburg

1 307

New Paris

1 541

Union

1 797

IX Center

2.5 992

Vlg of Liberty Ctr/Twp

Gates Mills

1 330

North Baltimore

1 548

Warrensville Hts.

2.6 830

1 986

Geneva-on-the-Lake

1.5 347

North Perry Village

1 555

Waynesfield

1 833

Shaker Sq

2.5 994

Germantown

1.25 348

North Randall

2.75 560

West Alexandria

1 834

Warr Hts/Cleve

2.6 997

Grand Rapids

1 356

Norton

2 575

West Liberty

1 837

Grand River

2 357

Village of Oakwood

1 585

West Milton

1.5 835

1

1 2

2