Identification Form

ADVERTISEMENT

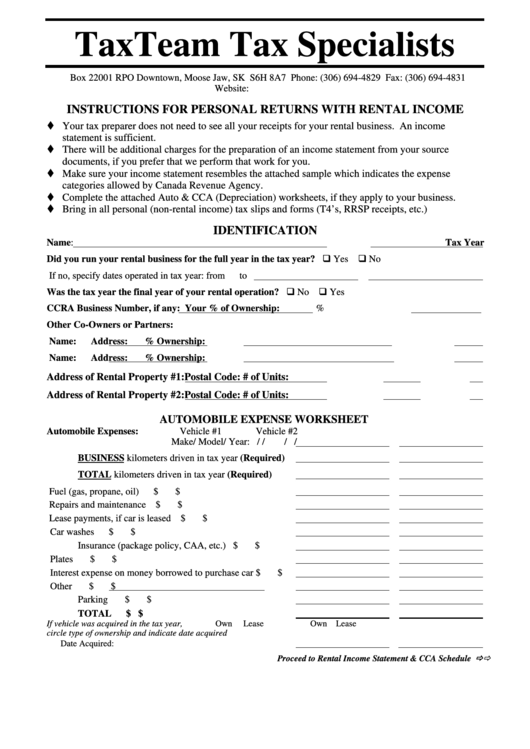

TaxTeam Tax Specialists

Box 22001 RPO Downtown, Moose Jaw, SK S6H 8A7 Phone: (306) 694-4829 Fax: (306) 694-4831

Website:

INSTRUCTIONS FOR PERSONAL RETURNS WITH RENTAL INCOME

Your tax preparer does not need to see all your receipts for your rental business. An income

statement is sufficient.

There will be additional charges for the preparation of an income statement from your source

documents, if you prefer that we perform that work for you.

Make sure your income statement resembles the attached sample which indicates the expense

categories allowed by Canada Revenue Agency.

Complete the attached Auto & CCA (Depreciation) worksheets, if they apply to your business.

Bring in all personal (non-rental income) tax slips and forms (T4’s, RRSP receipts, etc.)

IDENTIFICATION

Name:

Tax Year

Did you run your rental business for the full year in the tax year?

Yes

No

If no, specify dates operated in tax year: from

to

Was the tax year the final year of your rental operation?

No

Yes

CCRA Business Number, if any:

Your % of Ownership:

%

Other Co-Owners or Partners:

Name:

Address:

% Ownership:

Name:

Address:

% Ownership:

Address of Rental Property #1:

Postal Code:

# of Units:

Address of Rental Property #2:

Postal Code:

# of Units:

AUTOMOBILE EXPENSE WORKSHEET

Automobile Expenses:

Vehicle #1

Vehicle #2

Make/ Model/ Year:

/

/

/

/

BUSINESS kilometers driven in tax year (Required)

TOTAL kilometers driven in tax year

(Required)

Fuel (gas, propane, oil)

$

$

Repairs and maintenance

$

$

Lease payments, if car is leased

$

$

Car washes

$

$

Insurance (package policy, CAA, etc.)

$

$

Plates

$

$

Interest expense on money borrowed to purchase car

$

$

Other

$

$

Parking

$

$

TOTAL

$

$

Own

Lease

Own Lease

If vehicle was acquired in the tax year,

circle type of ownership and indicate date acquired

Date Acquired:

Proceed to Rental Income Statement & CCA Schedule

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3