44-016 - Employee'S Statement Of Nonresidence In Iowa - Iowa Department Of Revenue

ADVERTISEMENT

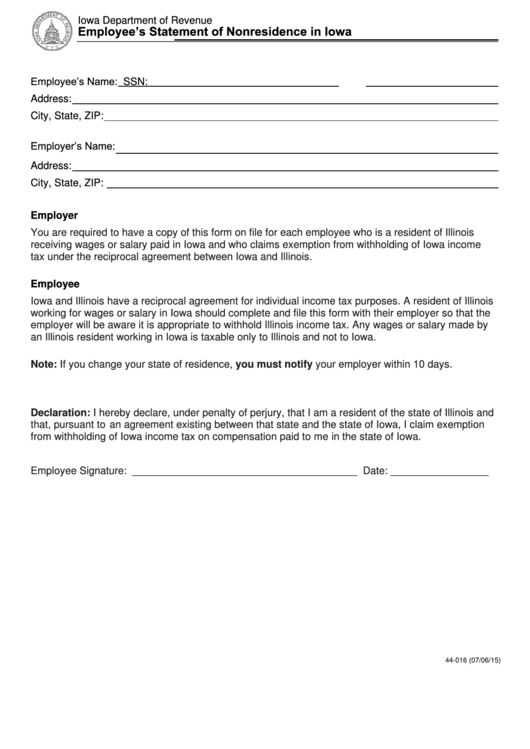

Iowa Department of Revenue

Employee’s Statement of Nonresidence in Iowa

https://tax.iowa.gov

Employee’s Name:

SSN:

Address:

City, State, ZIP:

Employer’s Name:

Address:

City, State, ZIP:

Employer

You are required to have a copy of this form on file for each employee who is a resident of Illinois

receiving wages or salary paid in Iowa and who claims exemption from withholding of Iowa income

tax under the reciprocal agreement between Iowa and Illinois.

Employee

Iowa and Illinois have a reciprocal agreement for individual income tax purposes. A resident of Illinois

working for wages or salary in Iowa should complete and file this form with their employer so that the

employer will be aware it is appropriate to withhold Illinois income tax. Any wages or salary made by

an Illinois resident working in Iowa is taxable only to Illinois and not to Iowa.

Note: If you change your state of residence, you must notify your employer within 10 days.

Declaration: I hereby declare, under penalty of perjury, that I am a resident of the state of Illinois and

that, pursuant to an agreement existing between that state and the state of Iowa, I claim exemption

from withholding of Iowa income tax on compensation paid to me in the state of Iowa.

Employee Signature: _______________________________________ Date: _________________

44-016 (07/06/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1