Life Insurance Product Comparison Chart - Hpso

ADVERTISEMENT

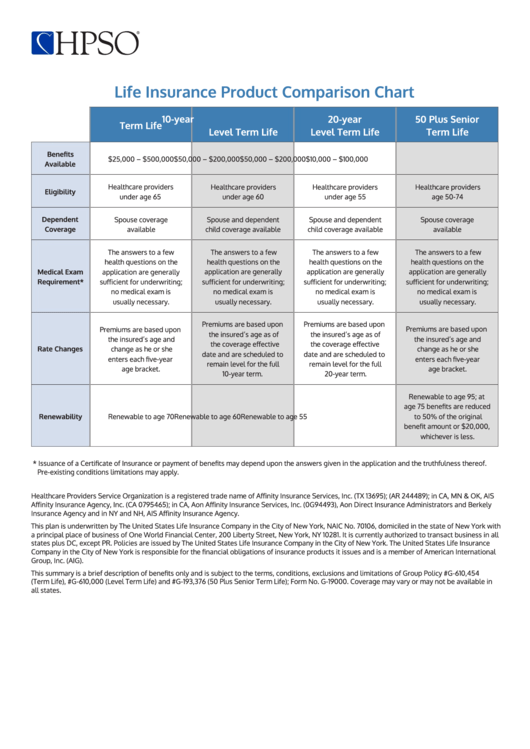

Life Insurance Product Comparison Chart

10-year

20-year

50 Plus Senior

Term Life

Level Term Life

Level Term Life

Term Life

Benefits

$25,000 – $500,000

$50,000 – $200,000

$50,000 – $200,000

$10,000 – $100,000

Available

Healthcare providers

Healthcare providers

Healthcare providers

Healthcare providers

Eligibility

under age 65

under age 60

under age 55

age 50-74

Spouse coverage

Spouse and dependent

Spouse and dependent

Spouse coverage

Dependent

available

child coverage available

child coverage available

available

Coverage

The answers to a few

The answers to a few

The answers to a few

The answers to a few

health questions on the

health questions on the

health questions on the

health questions on the

application are generally

application are generally

application are generally

application are generally

Medical Exam

Requirement*

sufficient for underwriting;

sufficient for underwriting;

sufficient for underwriting;

sufficient for underwriting;

no medical exam is

no medical exam is

no medical exam is

no medical exam is

usually necessary.

usually necessary.

usually necessary.

usually necessary.

Premiums are based upon

Premiums are based upon

Premiums are based upon

Premiums are based upon

the insured’s age as of

the insured’s age as of

the insured’s age and

the insured’s age and

the coverage effective

the coverage effective

change as he or she

change as he or she

Rate Changes

date and are scheduled to

date and are scheduled to

enters each five-year

enters each five-year

remain level for the full

remain level for the full

age bracket.

age bracket.

20-year term.

10-year term.

Renewable to age 95; at

age 75 benefits are reduced

Renewable to age 70

Renewable to age 60

Renewable to age 55

to 50% of the original

Renewability

benefit amount or $20,000,

whichever is less.

* Issuance of a Certificate of Insurance or payment of benefits may depend upon the answers given in the application and the truthfulness thereof.

Pre-existing conditions limitations may apply.

Healthcare Providers Service Organization is a registered trade name of Affinity Insurance Services, Inc. (TX 13695); (AR 244489); in CA, MN & OK, AIS

Affinity Insurance Agency, Inc. (CA 0795465); in CA, Aon Affinity Insurance Services, Inc. (0G94493), Aon Direct Insurance Administrators and Berkely

Insurance Agency and in NY and NH, AIS Affinity Insurance Agency.

This plan is underwritten by The United States Life Insurance Company in the City of New York, NAIC No. 70106, domiciled in the state of New York with

a principal place of business of One World Financial Center, 200 Liberty Street, New York, NY 10281. It is currently authorized to transact business in all

states plus DC, except PR. Policies are issued by The United States Life Insurance Company in the City of New York. The United States Life Insurance

Company in the City of New York is responsible for the financial obligations of insurance products it issues and is a member of American International

Group, Inc. (AIG).

This summary is a brief description of benefits only and is subject to the terms, conditions, exclusions and limitations of Group Policy #G-610,454

(Term Life), #G-610,000 (Level Term Life) and #G-193,376 (50 Plus Senior Term Life); Form No. G-19000. Coverage may vary or may not be available in

all states.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1