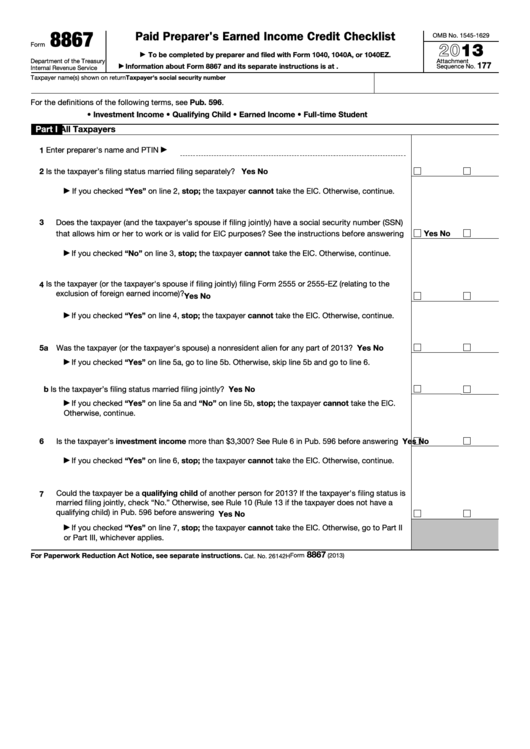

8867

Paid Preparer's Earned Income Credit Checklist

OMB No. 1545-1629

2013

Form

To be completed by preparer and filed with Form 1040, 1040A, or 1040EZ.

▶

Department of the Treasury

Attachment

177

Information about Form 8867 and its separate instructions is at

Sequence No.

▶

Internal Revenue Service

Taxpayer's social security number

Taxpayer name(s) shown on return

For the definitions of the following terms, see Pub. 596.

• Investment Income

• Qualifying Child

• Earned Income

• Full-time Student

Part I

All Taxpayers

Enter preparer's name and PTIN

1

▶

2

Is the taxpayer’s filing status married filing separately? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 2, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

3

Does the taxpayer (and the taxpayer’s spouse if filing jointly) have a social security number (SSN)

that allows him or her to work or is valid for EIC purposes? See the instructions before answering

Yes

No

If you checked “No” on line 3, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

Is the taxpayer (or the taxpayer's spouse if filing jointly) filing Form 2555 or 2555-EZ (relating to the

4

exclusion of foreign earned income)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 4, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

5a Was the taxpayer (or the taxpayer's spouse) a nonresident alien for any part of 2013?

.

.

.

.

Yes

No

If you checked “Yes” on line 5a, go to line 5b. Otherwise, skip line 5b and go to line 6.

▶

b Is the taxpayer’s filing status married filing jointly?

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If you checked “Yes” on line 5a and “No” on line 5b, stop; the taxpayer cannot take the EIC.

▶

Otherwise, continue.

6

Is the taxpayer’s investment income more than $3,300? See Rule 6 in Pub. 596 before answering

Yes

No

If you checked “Yes” on line 6, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

Could the taxpayer be a qualifying child of another person for 2013? If the taxpayer's filing status is

7

married filing jointly, check “No.” Otherwise, see Rule 10 (Rule 13 if the taxpayer does not have a

qualifying child) in Pub. 596 before answering .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 7, stop; the taxpayer cannot take the EIC. Otherwise, go to Part II

▶

or Part III, whichever applies.

8867

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2013)

Cat. No. 26142H

1

1 2

2 3

3 4

4