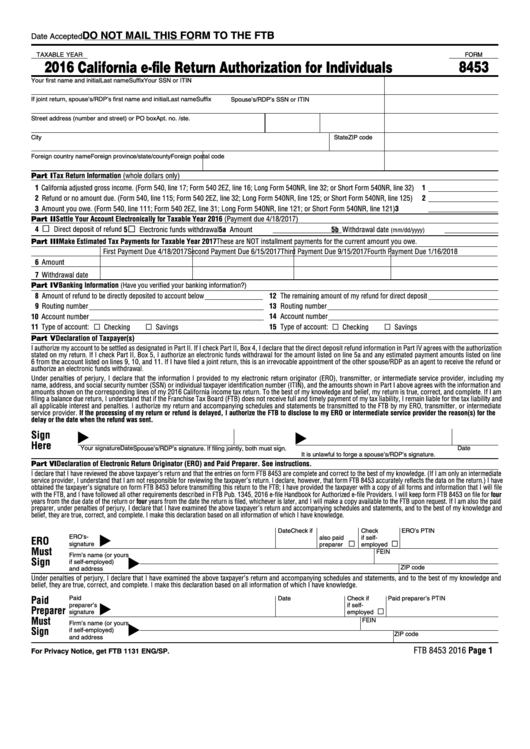

DO NOT MAIL THIS FORM TO THE FTB

Date Accepted

TAXABLE YEAR

FORM

2016

8453

California e-file Return Authorization for Individuals

Your first name and initial

Last name

Suffix

Your SSN or ITIN

If joint return, spouse’s/RDP’s first name and initial

Last name

Suffix

Spouse’s/RDP’s SSN or ITIN

Street address (number and street) or PO box

Apt. no. /ste. no.

PMB/private mailbox

Daytime telephone number

City

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

Part I Tax Return Information (whole dollars only)

1 California adjusted gross income. (Form 540, line 17; Form 540 2EZ, line 16; Long Form 540NR, line 32; or Short Form 540NR, line 32) 1

2 Refund or no amount due. (Form 540, line 115; Form 540 2EZ, line 32; Long Form 540NR, line 125; or Short Form 540NR, line 125) 2

3 Amount you owe. (Form 540, line 111; Form 540 2EZ, line 31; Long Form 540NR, line 121; or Short Form 540NR, line 121) . . . . . . 3

Part II Settle Your Account Electronically for Taxable Year 2016 (Payment due 4/18/2017)

□

□

4

Direct deposit of refund 5

Electronic funds withdrawal 5a Amount

5b Withdrawal date

(mm/dd/yyyy)

Part III Make Estimated Tax Payments for Taxable Year 2017 These are NOT installment payments for the current amount you owe.

First Payment Due 4/18/2017

Second Payment Due 6/15/2017

Third Payment Due 9/15/2017

Fourth Payment Due 1/16/2018

6 Amount

7 Withdrawal date

Part IV

Banking Information

(Have you verified your banking information?)

8 Amount of refund to be directly deposited to account below

12 The remaining amount of my refund for direct deposit

9 Routing number

13 Routing number

10 Account number

14 Account number

□

□

□

□

15 Type of account:

11 Type of account:

Checking

Savings

Checking

Savings

Part V Declaration of Taxpayer(s)

I authorize my account to be settled as designated in Part II. If I check Part II, Box 4, I declare that the direct deposit refund information in Part IV agrees with the authorization

stated on my return. If I check Part II, Box 5, I authorize an electronic funds withdrawal for the amount listed on line 5a and any estimated payment amounts listed on line

6 from the account listed on lines 9, 10, and 11. If I have filed a joint return, this is an irrevocable appointment of the other spouse/RDP as an agent to receive the refund or

authorize an electronic funds withdrawal.

Under penalties of perjury, I declare that the information I provided to my electronic return originator (ERO), transmitter, or intermediate service provider, including my

name, address, and social security number (SSN) or individual taxpayer identification number (ITIN), and the amounts shown in Part I above agrees with the information and

amounts shown on the corresponding lines of my 2016 California income tax return. To the best of my knowledge and belief, my return is true, correct, and complete. If I am

filing a balance due return, I understand that if the Franchise Tax Board (FTB) does not receive full and timely payment of my tax liability, I remain liable for the tax liability and

all applicable interest and penalties. I authorize my return and accompanying schedules and statements be transmitted to the FTB by my ERO, transmitter, or intermediate

service provider. If the processing of my return or refund is delayed, I authorize the FTB to disclose to my ERO or intermediate service provider the reason(s) for the

delay or the date when the refund was sent.

Sign

Here

Your signature

Date

Spouse’s/RDP’s signature. If filing jointly, both must sign.

Date

It is unlawful to forge a spouse’s/RDP’s signature.

Part VI Declaration of Electronic Return Originator (ERO) and Paid Preparer. See instructions.

I declare that I have reviewed the above taxpayer’s return and that the entries on form FTB 8453 are complete and correct to the best of my knowledge. (If I am only an intermediate

service provider, I understand that I am not responsible for reviewing the taxpayer’s return. I declare, however, that form FTB 8453 accurately reflects the data on the return.) I have

obtained the taxpayer’s signature on form FTB 8453 before transmitting this return to the FTB; I have provided the taxpayer with a copy of all forms and information that I will file

with the FTB, and I have followed all other requirements described in FTB Pub. 1345, 2016 e-file Handbook for Authorized e-file Providers. I will keep form FTB 8453 on file for four

years from the due date of the return or four years from the date the return is filed, whichever is later, and I will make a copy available to the FTB upon request. If I am also the paid

preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. I make this declaration based on all information of which I have knowledge.

Date

Check if

Check

ERO’s PTIN

ERO's-

□

□

also paid

if self-

ERO

signature

preparer

employed

Must

FEIN

Firm’s name (or yours

Sign

if self-employed)

ZIP code

and address

Under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. I make this declaration based on all information of which I have knowledge.

Paid

Paid

Date

Check if

Paid preparer’s PTIN

□

preparer’s

if self-

Preparer

signature

employed

Must

FEIN

Firm’s name (or yours

Sign

if self-employed)

ZIP code

and address

FTB 8453 2016 Page 1

For Privacy Notice, get FTB 1131 ENG/SP.

1

1