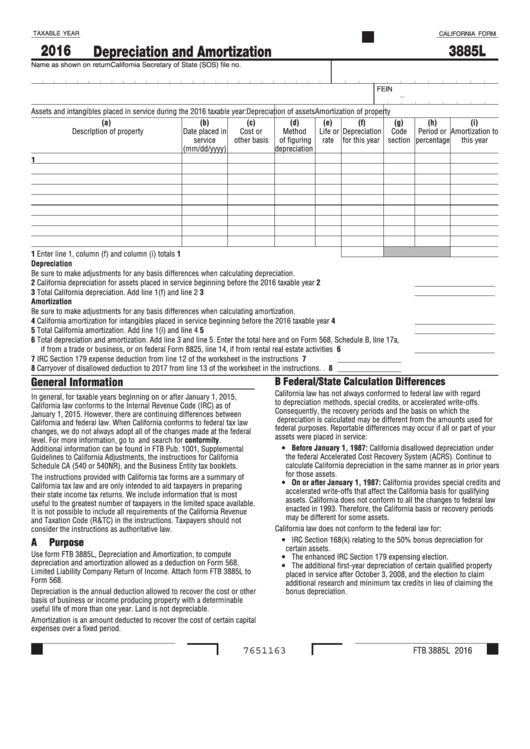

TAXABLE YEAR

CALIFORNIA FORM

2016

3885L

Depreciation and Amortization

Name as shown on return

California Secretary of State (SOS) file no.

v

FEIN

-

Assets and intangibles placed in service during the 2016 taxable year:

Depreciation of assets

Amortization of property

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

Description of property

Date placed in

Cost or

Method

Life or

Depreciation

Code

Period or

Amortization to

service

other basis

of figuring

rate

for this year

section

percentage

this year

(mm/dd/yyyy)

depreciation

1

1 Enter line 1, column (f) and column (i) totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Depreciation

Be sure to make adjustments for any basis differences when calculating depreciation.

2 California depreciation for assets placed in service beginning before the 2016 taxable year . . . . . . . . . . . . . . . . . . . . . . 2

3 Total California depreciation. Add line 1(f) and line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Amortization

Be sure to make adjustments for any basis differences when calculating amortization.

4 California amortization for intangibles placed in service beginning before the 2016 taxable year . . . . . . . . . . . . . . . . . . 4

5 Total California amortization. Add line 1(i) and line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total depreciation and amortization. Add line 3 and line 5. Enter the total here and on Form 568, Schedule B, line 17a,

if from a trade or business, or on federal Form 8825, line 14, if from rental real estate activities . . . . . . . . . . . . . . . . . . 6

7 IRC Section 179 expense deduction from line 12 of the worksheet in the instructions . . . . . . . 7

8 Carryover of disallowed deduction to 2017 from line 13 of the worksheet in the instructions. . 8

General Information

B

Federal/State Calculation Differences

California law has not always conformed to federal law with regard

In general, for taxable years beginning on or after January 1, 2015,

to depreciation methods, special credits, or accelerated write-offs.

California law conforms to the Internal Revenue Code (IRC) as of

Consequently, the recovery periods and the basis on which the

January 1, 2015. However, there are continuing differences between

depreciation is calculated may be different from the amounts used for

California and federal law. When California conforms to federal tax law

federal purposes. Reportable differences may occur if all or part of your

changes, we do not always adopt all of the changes made at the federal

assets were placed in service:

level. For more information, go to ftb.ca.gov and search for conformity.

y Before January 1, 1987: California disallowed depreciation under

Additional information can be found in FTB Pub. 1001, Supplemental

the federal Accelerated Cost Recovery System (ACRS). Continue to

Guidelines to California Adjustments, the instructions for California

calculate California depreciation in the same manner as in prior years

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

for those assets.

The instructions provided with California tax forms are a summary of

y On or after January 1, 1987: California provides special credits and

California tax law and are only intended to aid taxpayers in preparing

accelerated write-offs that affect the California basis for qualifying

their state income tax returns. We include information that is most

assets. California does not conform to all the changes to federal law

useful to the greatest number of taxpayers in the limited space available.

enacted in 1993. Therefore, the California basis or recovery periods

It is not possible to include all requirements of the California Revenue

may be different for some assets.

and Taxation Code (R&TC) in the instructions. Taxpayers should not

California law does not conform to the federal law for:

consider the instructions as authoritative law.

y IRC Section 168(k) relating to the 50% bonus depreciation for

A

Purpose

certain assets.

Use form FTB 3885L, Depreciation and Amortization, to compute

y The enhanced IRC Section 179 expensing election.

depreciation and amortization allowed as a deduction on Form 568,

y The additional first-year depreciation of certain qualified property

Limited Liability Company Return of Income. Attach form FTB 3885L to

placed in service after October 3, 2008, and the election to claim

Form 568.

additional research and minimum tax credits in lieu of claiming the

Depreciation is the annual deduction allowed to recover the cost or other

bonus depreciation.

basis of business or income producing property with a determinable

useful life of more than one year. Land is not depreciable.

Amortization is an amount deducted to recover the cost of certain capital

expenses over a fixed period.

FTB 3885L 2016

7651163

1

1 2

2