Hud-1 - Alt Title

ADVERTISEMENT

Previous editions are obsolete

form HUD-1 (3/86) ref Handbook 4305.2

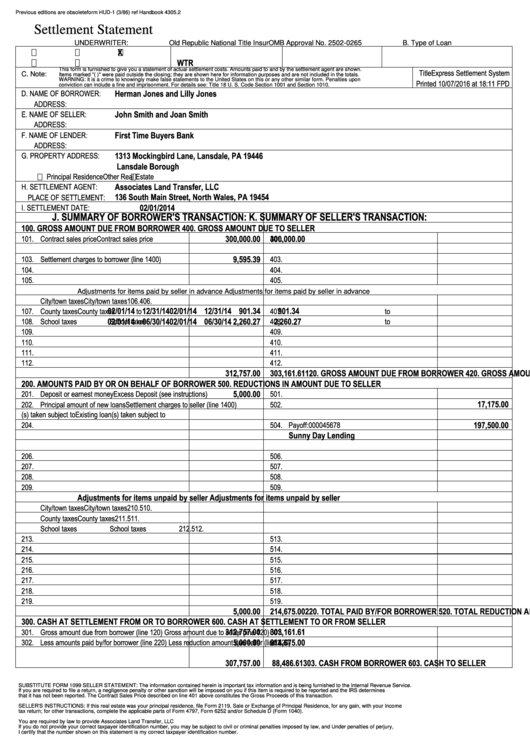

Settlement Statement

A.

U.S. Department of Housing and Urban Development

B. Type of Loan

UNDERWRITER: Old Republic National Title Insur

OMB Approval No. 2502-0265

1.

FHA

2.

FmHA

3.

X

Conv. Unins.

6. File Number

7. Loan Number

8. Mortgage Insurance Case Number

4.

VA

5.

Conv. Ins.

WTR

This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown.

TitleExpress Settlement System

C. Note:

Items marked "(p.o.c.)" were paid outside the closing; they are shown here for information purposes and are not included in the totals.

WARNING: It is a crime to knowingly make false statements to the United States on this or any other similar form. Penalties upon

Printed 10/07/2016 at 18:11 FPD

conviction can include a fine and imprisonment. For details see: Title 18 U. S. Code Section 1001 and Section 1010.

D. NAME OF BORROWER:

Herman Jones and Lilly Jones

ADDRESS:

E. NAME OF SELLER:

John Smith and Joan Smith

ADDRESS:

F. NAME OF LENDER:

First Time Buyers Bank

ADDRESS:

G. PROPERTY ADDRESS:

1313 Mockingbird Lane, Lansdale, PA 19446

Lansdale Borough

Principal Residence

Other Real Estate

H. SETTLEMENT AGENT:

Associates Land Transfer, LLC

PLACE OF SETTLEMENT:

136 South Main Street, North Wales, PA 19454

I. SETTLEMENT DATE:

02/01/2014

J. SUMMARY OF BORROWER'S TRANSACTION:

K. SUMMARY OF SELLER'S TRANSACTION:

100. GROSS AMOUNT DUE FROM BORROWER

400. GROSS AMOUNT DUE TO SELLER

101.

Contract sales price

300,000.00

401.

Contract sales price

300,000.00

102.

Personal property

402.

Personal property

103.

Settlement charges to borrower (line 1400)

9,595.39

403.

104.

404.

105.

405.

Adjustments for items paid by seller in advance

Adjustments for items paid by seller in advance

106.

City/town taxes

406.

City/town taxes

107.

County taxes

02/01/14 12/31/14

to

901.34

407.

County taxes

02/01/14 12/31/14

to

901.34

108.

School taxes

02/01/14 06/30/14

to

2,260.27

408.

School taxes

02/01/14 06/30/14

to

2,260.27

109.

409.

110.

410.

111.

411.

112.

412.

120. GROSS AMOUNT DUE FROM BORROWER

312,757.00

420. GROSS AMOUNT DUE TO SELLER

303,161.61

200. AMOUNTS PAID BY OR ON BEHALF OF BORROWER

500. REDUCTIONS IN AMOUNT DUE TO SELLER

201.

Deposit or earnest money

5,000.00

501.

Excess Deposit (see instructions)

202.

Principal amount of new loans

502.

Settlement charges to seller (line 1400)

17,175.00

203.

Existing loan(s) taken subject to

503.

Existing loan(s) taken subject to

204.

504.

Payoff:000045678

197,500.00

Sunny Day Lending

205.

505. Payoff of second mortgage loan

206.

506.

207.

507.

208.

508.

209.

509.

Adjustments for items unpaid by seller

Adjustments for items unpaid by seller

210.

City/town taxes

510.

City/town taxes

211.

County taxes

511.

County taxes

212.

School taxes

512.

School taxes

213.

513.

214.

514.

215.

515.

216.

516.

217.

517.

218.

518.

219.

519.

220. TOTAL PAID BY/FOR BORROWER

5,000.00

520. TOTAL REDUCTION AMOUNT DUE SELLER

214,675.00

300. CASH AT SETTLEMENT FROM OR TO BORROWER

600. CASH AT SETTLEMENT TO OR FROM SELLER

301.

Gross amount due from borrower (line 120)

312,757.00

601.

Gross amount due to seller (line 420)

303,161.61

302.

Less amounts paid by/for borrower (line 220)

5,000.00

602.

Less reduction amount due seller (line 520)

214,675.00

303. CASH FROM BORROWER

307,757.00

603. CASH TO SELLER

88,486.61

SUBSTITUTE FORM 1099 SELLER STATEMENT: The information contained herein is important tax information and is being furnished to the Internal Revenue Service.

If you are required to file a return, a negligence penalty or other sanction will be imposed on you if this item is required to be reported and the IRS determines

that it has not been reported. The Contract Sales Price described on line 401 above constitutes the Gross Proceeds of this transaction.

SELLER'S INSTRUCTIONS: If this real estate was your principal residence, file Form 2119, Sale or Exchange of Principal Residence, for any gain, with your Income

tax return; for other transactions, complete the applicable parts of Form 4797, Form 6252 and/or Schedule D (Form 1040).

You are required by law to provide Associates Land Transfer, LLC

If you do not provide your correct taxpayer identification number, you may be subject to civil or criminal penalties imposed by law, and Under penalties of perjury,

I certify that the number shown on this statement is my correct taxpayer identification number.

TIN:

/

SELLER(S) SIGNATURE(S):

/

SELLER 1

SELLER 2

SELLER 1

SELLER 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2