Form No. 56 - Application For Grant Of Exemption Or Continuance Thereof Under Section 10(23c)(Iv) And (V) For The Year

ADVERTISEMENT

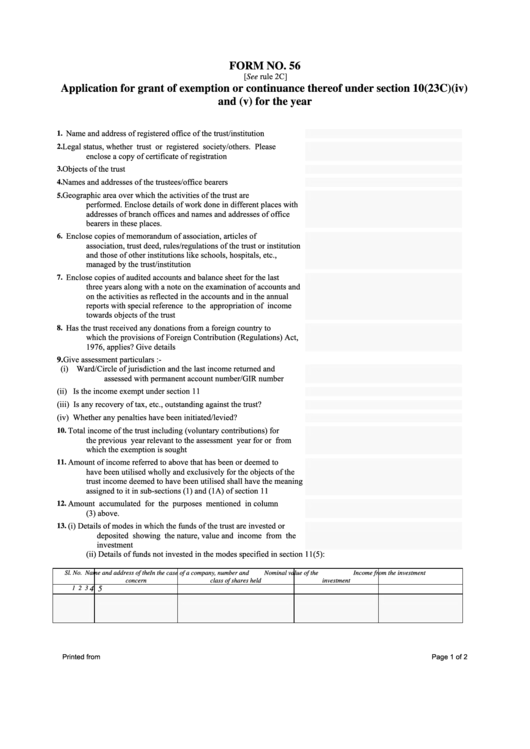

FORM NO. 56

[See rule 2C]

Application for grant of exemption or continuance thereof under section 10(23C)(iv)

and (v) for the year

Name and address of registered office of the trust/institution

1.

Legal status, whether trust or registered society/others. Please

2.

enclose a copy of certificate of registration

Objects of the trust

3.

Names and addresses of the trustees/office bearers

4.

Geographic area over which the activities of the trust are

5.

performed. Enclose details of work done in different places with

addresses of branch offices and names and addresses of office

bearers in these places.

Enclose copies of memorandum of association, articles of

6.

association, trust deed, rules/regulations of the trust or institution

and those of other institutions like schools, hospitals, etc.,

managed by the trust/institution

Enclose copies of audited accounts and balance sheet for the last

7.

three years along with a note on the examination of accounts and

on the activities as reflected in the accounts and in the annual

reports with special reference to the appropriation of income

towards objects of the trust

Has the trust received any donations from a foreign country to

8.

which the provisions of Foreign Contribution (Regulations) Act,

1976, applies? Give details

Give assessment particulars :-

9.

(i)

Ward/Circle of jurisdiction and the last income returned and

assessed with permanent account number/GIR number

(ii) Is the income exempt under section 11

(iii) Is any recovery of tax, etc., outstanding against the trust?

(iv) Whether any penalties have been initiated/levied?

Total income of the trust including (voluntary contributions) for

10.

the previous year relevant to the assessment year for or from

which the exemption is sought

Amount of income referred to above that has been or deemed to

11.

have been utilised wholly and exclusively for the objects of the

trust income deemed to have been utilised shall have the meaning

assigned to it in sub-sections (1) and (1A) of section 11

Amount accumulated for the purposes mentioned in column

12.

(3) above.

(i) Details of modes in which the funds of the trust are invested or

13.

deposited showing the nature, value and income from the

investment

(ii) Details of funds not invested in the modes specified in section 11(5):

Sl. No.

Name and address of the

In the case of a company, number and

Nominal value of the

Income from the investment

concern

class of shares held

investment

1

2

3

4

5

Printed from

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2