2014 Instructions For Form M-1040ez - City Of Muskegon

ADVERTISEMENT

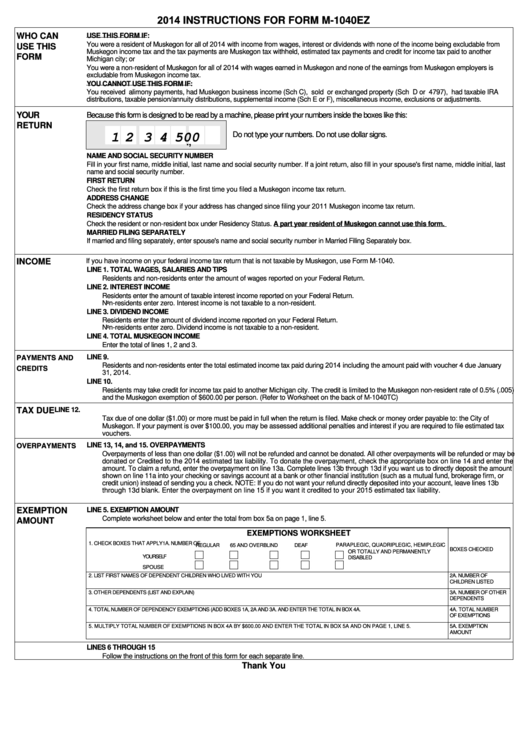

2014 INSTRUCTIONS FOR FORM M-1040EZ

WHO CAN

USE THIS FORM IF:

You were a resident of Muskegon for all of 2014 with income from wages, interest or dividends with none of the income being excludable from

USE THIS

Muskegon income tax and the tax payments are Muskegon tax withheld, estimated tax payments and credit for income tax paid to another

FORM

Michigan city; or

You were a non-resident of Muskegon for all of 2014 with wages earned in Muskegon and none of the earnings from Muskegon employers is

excludable from Muskegon income tax.

YOU CANNOT USE THIS FORM IF:

You received alimony payments, had Muskegon business income (Sch C), sold or exchanged property (Sch D or 4797), had taxable IRA

distributions, taxable pension/annuity distributions, supplemental income (Sch E or F), miscellaneous income, exclusions or adjustments.

YOUR

Because this form is designed to be read by a machine, please print your numbers inside the boxes like this:

RETURN

Do not type your numbers. Do not use dollar signs.

1 2 3 4 5 0 0

,

.

NAME AND SOCIAL SECURITY NUMBER

Fill in your first name, middle initial, last name and social security number. If a joint return, also fill in your spouse's first name, middle initial, last

name and social security number.

FIRST RETURN

Check the first return box if this is the first time you filed a Muskegon income tax return.

ADDRESS CHANGE

Check the address change box if your address has changed since filing your 2011 Muskegon income tax return.

RESIDENCY STATUS

Check the resident or non-resident box under Residency Status. A part year resident of Muskegon cannot use this form.

MARRIED FILING SEPARATELY

If married and filing separately, enter spouse's name and social security number in Married Filing Separately box.

INCOME

If you have income on your federal income tax return that is not taxable by Muskegon, use Form M-1040.

LINE 1. TOTAL WAGES, SALARIES AND TIPS

Residents and non-residents enter the amount of wages reported on your Federal Return.

LINE 2. INTEREST INCOME

Residents enter the amount of taxable interest income reported on your Federal Return.

Non-residents enter zero. Interest income is not taxable to a non-resident.

LINE 3. DIVIDEND INCOME

Residents enter the amount of dividend income reported on your Federal Return.

Non-residents enter zero. Dividend income is not taxable to a non-resident.

LINE 4. TOTAL MUSKEGON INCOME

Enter the total of lines 1, 2 and 3.

PAYMENTS AND

LINE 9.

Residents and non-residents enter the total estimated income tax paid during 2014 including the amount paid with voucher 4 due January

CREDITS

31, 2014.

LINE 10.

Residents may take credit for income tax paid to another Michigan city. The credit is limited to the Muskegon non-resident rate of 0.5% (.005)

and the Muskegon exemption of $600.00 per person. (Refer to Worksheet on the back of M-1040TC)

TAX DUE

LINE 12.

Tax due of one dollar ($1.00) or more must be paid in full when the return is filed. Make check or money order payable to: the City of

Muskegon. If your payment is over $100.00, you may be assessed additional penalties and interest if you are required to file estimated tax

vouchers.

OVERPAYMENTS

LINE 13, 14, and 15. OVERPAYMENTS

Overpayments of less than one dollar ($1.00) will not be refunded and cannot be donated. All other overpayments will be refunded or may be

donated or Credited to the 2014 estimated tax liability. To donate the overpayment, check the appropriate box on line 14 and enter the

amount. To claim a refund, enter the overpayment on line 13a. Complete lines 13b through 13d if you want us to directly deposit the amount

shown on line 11a into your checking or savings account at a bank or other financial institution (such as a mutual fund, brokerage firm, or

credit union) instead of sending you a check. NOTE: If you do not want your refund directly deposited into your account, leave lines 13b

through 13d blank. Enter the overpayment on line 15 if you want it credited to your 2015 estimated tax liability.

EXEMPTION

LINE 5. EXEMPTION AMOUNT

Complete worksheet below and enter the total from box 5a on page 1, line 5.

AMOUNT

EXEMPTIONS WORKSHEET

1. CHECK BOXES THAT APPLY

1A. NUMBER OF

REGULAR

65 AND OVER

BLIND

DEAF

PARAPLEGIC, QUADRIPLEGIC, HEMIPLEGIC

BOXES CHECKED

OR TOTALLY AND PERMANENTLY

YOURSELF

DISABLED

SPOUSE

2. LIST FIRST NAMES OF DEPENDENT CHILDREN WHO LIVED WITH YOU

2A. NUMBER OF

CHILDREN LISTED

3. OTHER DEPENDENTS (LIST AND EXPLAIN)

3A. NUMBER OF OTHER

DEPENDENTS

4. TOTAL NUMBER OF DEPENDENCY EXEMPTIONS (ADD BOXES 1A, 2A AND 3A. AND ENTER THE TOTAL IN BOX 4A.

4A. TOTAL NUMBER

OF EXEMPTIONS

5. MULTIPLY TOTAL NUMBER OF EXEMPTIONS IN BOX 4A BY $600.00 AND ENTER THE TOTAL IN BOX 5A AND ON PAGE 1, LINE 5.

5A. EXEMPTION

AMOUNT

LINES 6 THROUGH 15

Follow the instructions on the front of this form for each separate line.

Thank You

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3