First-Year Admissions Application

ADVERTISEMENT

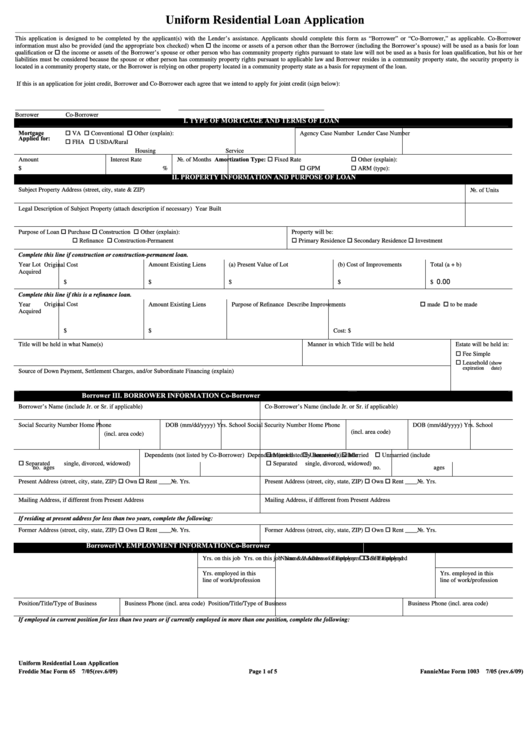

Uniform Residential Loan Application

___________________________________________________________________________________________________________________________________________________________________

This application is designed to be completed by the applicant(s) with the Lender’s assistance. Applicants should complete this form as “Borrower” or “Co-Borrower,” as applicable. Co-Borrower

information must also be provided (and the appropriate box checked) when

the income or assets of a person other than the Borrower (including the Borrower’s spouse) will be used as a basis for loan

qualification or

the income or assets of the Borrower’s spouse or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her

liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is

located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan.

If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below):

_________________________________________

_________________________________________

Borrower

Co-Borrower

I. TYPE OF MORTGAGE AND TERMS OF LOAN

Mortgage

VA

Conventional

Other (explain):

Agency Case Number

Lender Case Number

Applied for:

FHA

USDA/Rural

Housing Service

Amortization Type:

Amount

Interest Rate

No. of Months

Fixed Rate

Other (explain):

$

%

GPM

ARM (type):

II. PROPERTY INFORMATION AND PURPOSE OF LOAN

Subject Property Address (street, city, state & ZIP)

No. of Units

Legal Description of Subject Property (attach description if necessary)

Year Built

Purpose of Loan

Purchase

Construction

Other (explain):

Property will be:

Refinance

Construction-Permanent

Primary Residence

Secondary Residence

Investment

Complete this line if construction or construction-permanent loan.

Year Lot

Original Cost

Amount Existing Liens

(a) Present Value of Lot

(b) Cost of Improvements

Total (a + b)

Acquired

0.00

$

$

$

$

$

Complete this line if this is a refinance loan.

Year

Original Cost

Amount Existing Liens

Purpose of Refinance

Describe Improvements

made

to be made

Acquired

$

$

Cost: $

Title will be held in what Name(s)

Manner in which Title will be held

Estate will be held in:

Fee Simple

Leasehold

(show

expiration date)

Source of Down Payment, Settlement Charges, and/or Subordinate Financing (explain)

Borrower

III. BORROWER INFORMATION

Co-Borrower

Borrower’s Name (include Jr. or Sr. if applicable)

Co-Borrower’s Name (include Jr. or Sr. if applicable)

Social Security Number

Home Phone

DOB (mm/dd/yyyy)

Yrs. School

Social Security Number

Home Phone

DOB (mm/dd/yyyy)

Yrs. School

(incl. area code)

(incl. area code)

Married

Unmarried (include

Dependents (not listed by Co-Borrower)

Married

Unmarried (include

Dependents (not listed by Borrower)

Separated

single, divorced, widowed)

Separated

single, divorced, widowed)

no.

ages

no.

ages

Present Address (street, city, state, ZIP)

Own

Rent ____No. Yrs.

Present Address (street, city, state, ZIP)

Own

Rent ____No. Yrs.

Mailing Address, if different from Present Address

Mailing Address, if different from Present Address

If residing at present address for less than two years, complete the following:

Former Address (street, city, state, ZIP)

Own

Rent ____No. Yrs.

Former Address (street, city, state, ZIP)

Own

Rent ____No. Yrs.

Borrower

IV. EMPLOYMENT INFORMATION

Co-Borrower

Name & Address of Employer

Self Employed

Yrs. on this job

Name & Address of Employer

Self Employed

Yrs. on this job

Yrs. employed in this

Yrs. employed in this

line of work/profession

line of work/profession

Position/Title/Type of Business

Business Phone (incl. area code)

Position/Title/Type of Business

Business Phone (incl. area code)

If employed in current position for less than two years or if currently employed in more than one position, complete the following:

Uniform Residential Loan Application

Freddie Mac Form 65 7/05 (rev.6/09)

Page 1 of 5

Fannie Mae Form 1003 7/05 (rev.6/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9