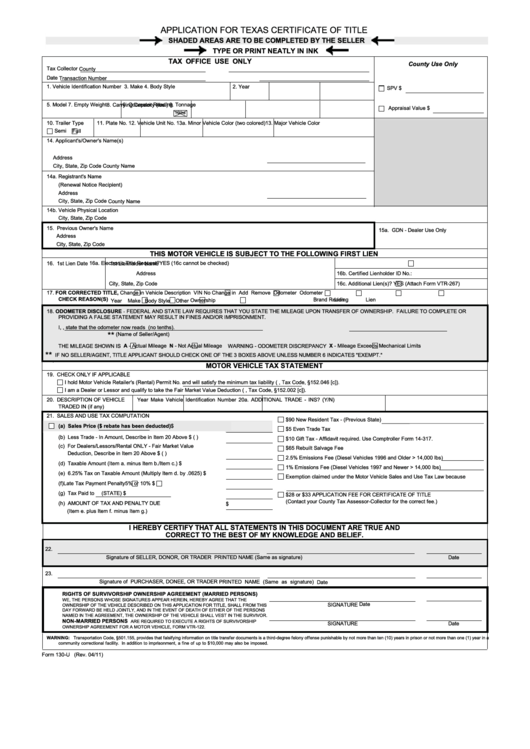

Form 130-U - Application For Texas Certificate Of Title

ADVERTISEMENT

APPLICATION FOR TEXAS CERTIFICATE OF TITLE

SHADED AREAS ARE TO BE COMPLETED BY THE SELLER

TYPE OR PRINT NEATLY IN INK

TAX OFFICE USE ONLY

County Use Only

Tax Collector

County

Date

Transaction Number

1. Vehicle Identification Number

2. Year

3. Make

4. Body Style

SPV $

5. Model

9. Tonnage

6. Odometer Reading

7. Empty Weight

8. Carrying Capacity (lbs.)

Appraisal Value $

10ths

10. Trailer Type

11. Plate No.

12. Vehicle Unit No.

13. Major Vehicle Color

13a. Minor Vehicle Color (two colored)

Semi

Full

14. Applicant's/Owner's Name(s)

Address

City, State, Zip Code

County Name

14a. Registrant's Name

(Renewal Notice Recipient)

Address

City, State, Zip Code

County Name

14b. Vehicle Physical Location

City, State, Zip Code

15. Previous Owner's Name

15a. GDN - Dealer Use Only

Address

City, State, Zip Code

THIS MOTOR VEHICLE IS SUBJECT TO THE FOLLOWING FIRST LIEN

1st Lienholder Name

16a. Electronic Title Request?

YES (16c cannot be checked)

16. 1st Lien Date

16b. Certified Lienholder ID No.:

Address

City, State, Zip Code

16c. Additional Lien(s)?

YES (Attach Form VTR-267)

Change in Vehicle Description

VIN

No Change in

Add

Remove

Odometer

Odometer

17. FOR CORRECTED TITLE,

CHECK REASON(S)

Brand

Reading

Ownership

Lien

Lien

Year

Make

Body Style

Other

18. ODOMETER DISCLOSURE - FEDERAL AND STATE LAW REQUIRES THAT YOU STATE THE MILEAGE UPON TRANSFER OF OWNERSHIP. FAILURE TO COMPLETE OR

PROVIDING A FALSE STATEMENT MAY RESULT IN FINES AND/OR IMPRISONMENT.

I,

, state that the odometer now reads

(no tenths).

**

(Name of Seller/Agent)

A - Actual Mileage

N - Not Actual Mileage

X - Mileage Exceeds Mechanical Limits

THE MILEAGE SHOWN IS

WARNING - ODOMETER DISCREPANCY

**

IF NO SELLER/AGENT, TITLE APPLICANT SHOULD CHECK ONE OF THE 3 BOXES ABOVE UNLESS NUMBER 6 INDICATES "EXEMPT."

MOTOR VEHICLE TAX STATEMENT

19. CHECK ONLY IF APPLICABLE

I hold Motor Vehicle Retailer's (Rental) Permit No.

and will satisfy the minimum tax liability (V.A.T.S., Tax Code, §152.046 [c]).

I am a Dealer or Lessor and qualify to take the Fair Market Value Deduction (V.A.T.S., Tax Code, §152.002 [c]).

20. DESCRIPTION OF VEHICLE

Year

Make

Vehicle Identification Number

20a. ADDITIONAL TRADE - INS? (Y/N)

TRADED IN (if any)

21. SALES AND USE TAX COMPUTATION

$90 New Resident Tax - (Previous State)

rebate has been deducted) $

(a) Sales Price ($

$5 Even Trade Tax

(b) Less Trade - In Amount, Describe in Item 20 Above

$ (

)

$10 Gift Tax - Affidavit required. Use Comptroller Form 14-317.

(c) For Dealers/Lessors/Rental ONLY - Fair Market Value

$65 Rebuilt Salvage Fee

Deduction, Describe in Item 20 Above

$ (

)

2.5% Emissions Fee (Diesel Vehicles 1996 and Older > 14,000 lbs)

(d) Taxable Amount (Item a. minus Item b./Item c.)

$

1% Emissions Fee (Diesel Vehicles 1997 and Newer > 14,000 lbs)

(e) 6.25% Tax on Taxable Amount (Multiply Item d. by .0625)

$

Exemption claimed under the Motor Vehicle Sales and Use Tax Law because

(f) Late Tax Payment Penalty

5% or

10%

$

(g) Tax Paid to

(STATE)

$

$28 or $33 APPLICATION FEE FOR CERTIFICATE OF TITLE

(Contact your County Tax Assessor-Collector for the correct fee.)

(h) AMOUNT OF TAX AND PENALTY DUE

$

(Item e. plus Item f. minus Item g.)

I HEREBY CERTIFY THAT ALL STATEMENTS IN THIS DOCUMENT ARE TRUE AND

CORRECT TO THE BEST OF MY KNOWLEDGE AND BELIEF.

22.

Signature of SELLER, DONOR, OR TRADER

PRINTED NAME (Same as signature)

Date

23.

Signature of PURCHASER, DONEE, OR TRADER

PRINTED NAME (Same as signature)

Date

RIGHTS OF SURVIVORSHIP OWNERSHIP AGREEMENT (MARRIED PERSONS)

WE, THE PERSONS WHOSE SIGNATURES APPEAR HEREIN, HEREBY AGREE THAT THE

Date

SIGNATURE

OWNERSHIP OF THE VEHICLE DESCRIBED ON THIS APPLICATION FOR TITLE, SHALL FROM THIS

DAY FORWARD BE HELD JOINTLY, AND IN THE EVENT OF DEATH OF EITHER OF THE PERSONS

NAMED IN THE AGREEMENT, THE OWNERSHIP OF THE VEHICLE SHALL VEST IN THE SURVIVOR.

NON-MARRIED PERSONS

ARE REQUIRED TO EXECUTE A RIGHTS OF SURVIVORSHIP

SIGNATURE

Date

OWNERSHIP AGREEMENT FOR A MOTOR VEHICLE, FORM VTR-122.

WARNING: Transportation Code, §501.155, provides that falsifying information on title transfer documents is a third-degree felony offense punishable by not more than ten (10) years in prison or not more than one (1) year in a

community correctional facility. In addition to imprisonment, a fine of up to $10,000 may also be imposed.

Form 130-U (Rev. 04/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2