Form 990-N - Farmshare Austin

ADVERTISEMENT

f 01111 Y7UIN

k

4

’

UL4..cUU) ‘.J111111

V 1V.VV aLIU I lulL I%J.LULl1

I

I

Jj

I

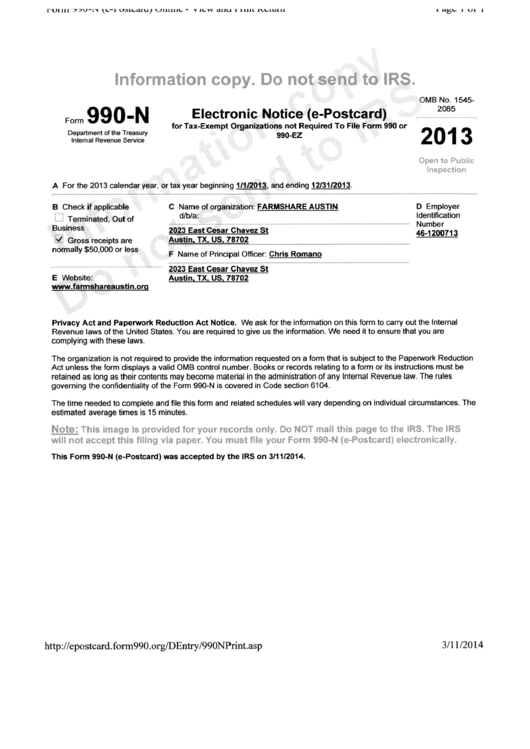

0MB No.

1545-

Form

990—N

Electronic Notice (e-Postcard)

2085

for Tax-Exempt Organizations not Required To

File

Form 990 or

Department of the Treasury

990-EZ

Internal Revenue Service

A For the 2013 calendar year, or

tax

year beginning 11112013, and ending 1213112013.

8 Check if applicable

C Name of organization: FARMSHARE AUSTIN

D Employer

Terminated, Out of

dlbla.

Identification

Business

2023 East Cesar Chavez St

4j20’371

3

4 Gross receipts are

Austin, TX, US. 78702

normally $50 000 or less

F Name of Pnncipal Officer: Chns Romano

2023 East Cesar Chavez St

E Website:

Austin, TX, US, 78702

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal

Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are

complying with these laws.

The organization is not required to provide the information requested on a form that is subject to the Paperwork Reduction

Act unless the form displays a valid 0MB control number. Books or records relating to a form or its instructions must be

retained as long as their contents may become material in the administration of any Internal Revenue law. The rules

governing the confidentiality of the Form 990-N is covered in Code section 6104.

The time needed to complete and file this form and related schedules will vary depending on individual circumstances. The

estimated average times is 15 minutes.

This Form 990-N (e-Postcard) was accepted by the IRS on 311112014.

3/11/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1