Form 990 N (E-Postcard) Filing Instructions

ADVERTISEMENT

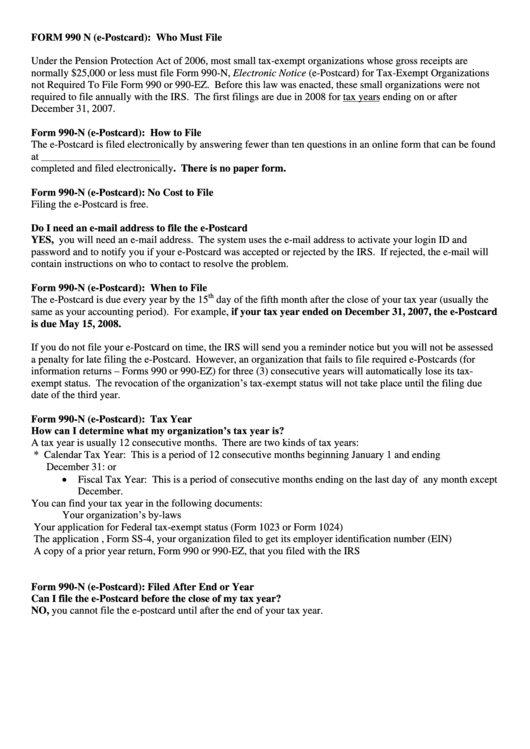

FORM 990 N (e-Postcard): Who Must File

Under the Pension Protection Act of 2006, most small tax-exempt organizations whose gross receipts are

normally $25,000 or less must file Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations

not Required To File Form 990 or 990-EZ. Before this law was enacted, these small organizations were not

required to file annually with the IRS. The first filings are due in 2008 for tax years ending on or after

December 31, 2007.

Form 990-N (e-Postcard): How to File

The e-Postcard is filed electronically by answering fewer than ten questions in an online form that can be found

at . This is a link into the IRS through Urban Institute. The form must be

completed and filed electronically. There is no paper form.

Form 990-N (e-Postcard): No Cost to File

Filing the e-Postcard is free.

Do I need an e-mail address to file the e-Postcard

YES, you will need an e-mail address. The system uses the e-mail address to activate your login ID and

password and to notify you if your e-Postcard was accepted or rejected by the IRS. If rejected, the e-mail will

contain instructions on who to contact to resolve the problem.

Form 990-N (e-Postcard): When to File

th

The e-Postcard is due every year by the 15

day of the fifth month after the close of your tax year (usually the

same as your accounting period). For example, if your tax year ended on December 31, 2007, the e-Postcard

is due May 15, 2008.

If you do not file your e-Postcard on time, the IRS will send you a reminder notice but you will not be assessed

a penalty for late filing the e-Postcard. However, an organization that fails to file required e-Postcards (for

information returns – Forms 990 or 990-EZ) for three (3) consecutive years will automatically lose its tax-

exempt status. The revocation of the organization’s tax-exempt status will not take place until the filing due

date of the third year.

Form 990-N (e-Postcard): Tax Year

How can I determine what my organization’s tax year is?

A tax year is usually 12 consecutive months. There are two kinds of tax years:

* Calendar Tax Year: This is a period of 12 consecutive months beginning January 1 and ending

December 31: or

Fiscal Tax Year: This is a period of consecutive months ending on the last day of any month except

December.

You can find your tax year in the following documents:

Your organization’s by-laws

Your application for Federal tax-exempt status (Form 1023 or Form 1024)

The application , Form SS-4, your organization filed to get its employer identification number (EIN)

A copy of a prior year return, Form 990 or 990-EZ, that you filed with the IRS

Form 990-N (e-Postcard): Filed After End or Year

Can I file the e-Postcard before the close of my tax year?

NO, you cannot file the e-postcard until after the end of your tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2