- g u s d - G U -

- U

OMB No. 1545-1620

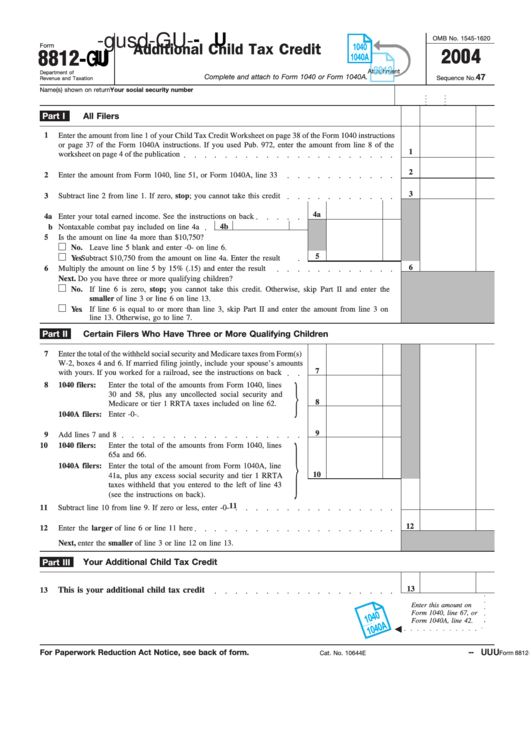

Form

1040

Additional Child Tax Credit

. . . . . . . . . .

2004

8812

U -GU

1040A

8812

Attachment

Department of

47

Complete and attach to Form 1040 or Form 1040A.

Sequence No.

Revenue and Taxation

Name(s) shown on return

Your social security number

Part I

All Filers

1

Enter the amount from line 1 of your Child Tax Credit Worksheet on page 38 of the Form 1040 instructions

or page 37 of the Form 1040A instructions. If you used Pub. 972, enter the amount from line 8 of the

1

worksheet on page 4 of the publication

2

2

Enter the amount from Form 1040, line 51, or Form 1040A, line 33

3

3

Subtract line 2 from line 1. If zero, stop; you cannot take this credit

4a

4a

Enter your total earned income. See the instructions on back

4b

b

Nontaxable combat pay included on line 4a

5

Is the amount on line 4a more than $10,750?

No.

Leave line 5 blank and enter -0- on line 6.

5

Yes. Subtract $10,750 from the amount on line 4a. Enter the result

6

6

Multiply the amount on line 5 by 15% (.15) and enter the result

Next. Do you have three or more qualifying children?

No. If line 6 is zero, stop; you cannot take this credit. Otherwise, skip Part II and enter the

smaller of line 3 or line 6 on line 13.

Yes.

If line 6 is equal to or more than line 3, skip Part II and enter the amount from line 3 on

line 13. Otherwise, go to line 7.

Part II

Certain Filers Who Have Three or More Qualifying Children

7

Enter the total of the withheld social security and Medicare taxes from Form(s)

W-2, boxes 4 and 6. If married filing jointly, include your spouse’s amounts

7

with yours. If you worked for a railroad, see the instructions on back

8

1040 filers:

Enter the total of the amounts from Form 1040, lines

30 and 58, plus any uncollected social security and

8

Medicare or tier 1 RRTA taxes included on line 62.

1040A filers:

Enter -0-.

9

9

Add lines 7 and 8

10

1040 filers:

Enter the total of the amounts from Form 1040, lines

65a and 66.

1040A filers:

Enter the total of the amount from Form 1040A, line

10

41a, plus any excess social security and tier 1 RRTA

taxes withheld that you entered to the left of line 43

(see the instructions on back).

11

11

Subtract line 10 from line 9. If zero or less, enter -0-

12

12

Enter the larger of line 6 or line 11 here

Next, enter the smaller of line 3 or line 12 on line 13.

Your Additional Child Tax Credit

Part III

13

This is your additional child tax credit

13

Enter this amount on

Form 1040, line 67, or

Form 1040A, line 42.

- - U U U

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 10644E

Form 8812-GU (2004)

1

1 2

2