Form 1099-R - Record 3 - 2016

Download a blank fillable Form 1099-R - Record 3 - 2016 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 1099-R - Record 3 - 2016 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

PRINT

RESET

LINKS

PLEASE USE THE GREEN PRINT BUTTON TO PRINT THIS FORM. THANK YOU.

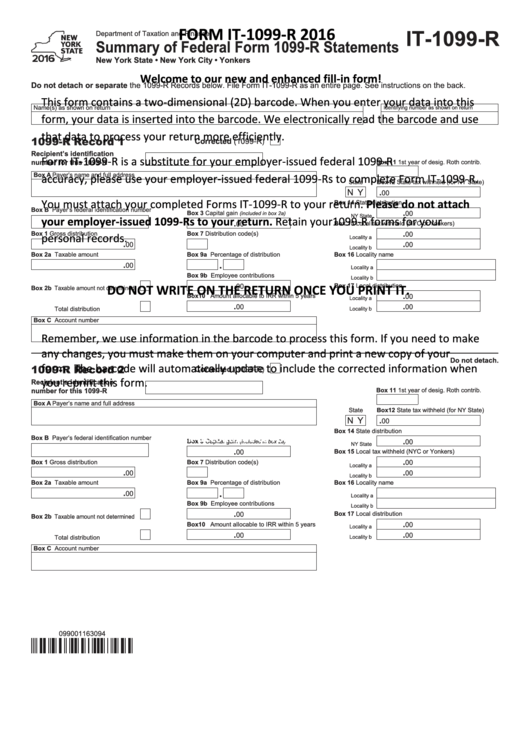

IT-1099-R

Department of Taxation and Finance

Summary of Federal Form 1099-R Statements

New York State • New York City • Yonkers

Do not detach or separate the 1099-R Records below. File Form IT-1099-R as an entire page. See instructions on the back.

WARNING: PLEASE USE A DIFFERENT PDF VIEWER

Name(s) as shown on return

Identifying number as shown on return

You tried to open this form in an application that is not compatible with some of the features enabled in this form.

To solve this problem, please use Adobe® Reader. Please follow the instructions below:

1099-R Record 1

Corrected (1099-R

)

Recipient’s identification

1. Save the form (PDF file) in your hard drive and from now on, work on that document. If you need to fill more than one

number for this 1099-R ..................

Box 11 1st year of desig. Roth contrib.

form, make copies and assign a different file name to each form.

Box A Payer’s name and full address

State

Box 12 State tax withheld (for NY State)

N Y

.

2. If you do not have Adobe® Reader on your computer, you can download it at:

00

Box 14 State distribution

Box B Payer’s federal identification number

.

Box 3 Capital gain

00

(included in box 2a)

3. Open the form you just saved with:

NY State

.

00

Box 15 Local tax withheld (NYC or Yonkers)

.

Box 1 Gross distribution

Box 7 Distribution code(s)

00

- Adobe® Reader (version 5 or higher), or

Locality a

.

.

00

00

Locality b

Box 2a Taxable amount

Box 9a Percentage of distribution

Box 16 Locality name

- Adobe® Acrobat (Standard or Professional).

.

00

Locality a

Box 9b Employee contributions

Locality b

Adobe® Reader v11 (2012) or higher will allow you to save the form data and complete the form in different sessions.

.

00

Box 17 Local distribution

Box 2b Taxable amount not determined

.

Box 10 Amount allocable to IRR within 5 years

00

Locality a

.

.

00

00

Total distribution . ......................

Locality b

Box C Account number

Thank you.

Do not detach.

1099-R Record 2

Corrected (1099-R

)

Recipient’s identification

number for this 1099-R ..................

Box 11 1st year of desig. Roth contrib.

Box A Payer’s name and full address

State

Box 12 State tax withheld (for NY State)

.

N Y

00

Box 14 State distribution

Box B Payer’s federal identification number

.

Box 3 Capital gain

00

(included in box 2a)

NY State

.

Box 15 Local tax withheld (NYC or Yonkers)

00

.

Box 1 Gross distribution

Box 7 Distribution code(s)

00

Locality a

.

.

00

00

Locality b

Box 2a Taxable amount

Box 9a Percentage of distribution

Box 16 Locality name

.

00

Locality a

Box 9b Employee contributions

Locality b

.

00

Box 17 Local distribution

Box 2b Taxable amount not determined

.

Box 10 Amount allocable to IRR within 5 years

00

Locality a

.

.

00

00

Total distribution . ......................

Locality b

Box C Account number

099001173094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2