Instructions

Reset Form

Print Form

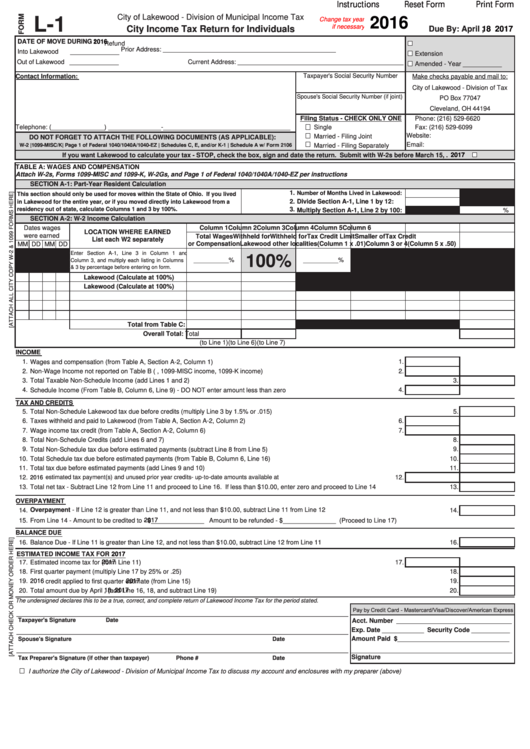

City of Lakewood - Division of Municipal Income Tax

L-1

2016

Change tax year

if necessary

City Income Tax Return for Individuals

Due By: April

18 2017

,

DATE OF MOVE DURING

2016

:

Refund

Prior Address: _________________________________________________

Into Lakewood

______________

Extension

Out of Lakewood ______________

Current Address: _______________________________________________

Amended - Year ___________

Contact Information:

Taxpayer's Social Security Number

Make checks payable and mail to:

City of Lakewood - Division of Tax

Spouse's Social Security Number (if joint)

PO Box 77047

Cleveland, OH 44194

Filing Status - CHECK ONLY ONE

Phone: (216) 529-6620

Telephone: (_______________) _______________-____________________________________

Single

Fax: (216) 529-6099

Website:

Married - Filing Joint

DO NOT FORGET TO ATTACH THE FOLLOWING DOCUMENTS (AS APPLICABLE):

Email: taxdept@lakewoodoh.net

W-2 |1099-MISC/K| Page 1 of Federal 1040/1040A/1040-EZ | Schedules C, E, and/or K-1 | Schedule A w/ Form 2106

Married - Filing Separately

If you want Lakewood to calculate your tax - STOP, check the box, sign and date the return. Submit with W-2s before March 15,

2017

.

TABLE A: WAGES AND COMPENSATION

Attach W-2s, Forms 1099-MISC and 1099-K, W-2Gs, and Page 1 of Federal 1040/1040A/1040-EZ per instructions

SECTION A-1: Part-Year Resident Calculation

1.

Number of Months Lived in Lakewood:

This section should only be used for moves within the State of Ohio. If you lived

2.

Divide Section A-1, Line 1 by 12:

in Lakewood for the entire year, or if you moved directly into Lakewood from a

residency out of state, calculate Columns 1 and 3 by 100%.

3.

Multiply Section A-1, Line 2 by 100:

%

SECTION A-2: W-2 Income Calculation

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Dates wages

LOCATION WHERE EARNED

were earned

Total Wages

Withheld for

Withheld for

Tax Credit Limit

Smaller of

Tax Credit

List each W2 separately

or Compensation

Lakewood

other localities

(Column 1 x .01)

Column 3 or 4

(Column 5 x .50)

MM DD MM DD

Enter Section A-1, Line 3 in Column 1 and

100%

__________%

__________%

Column 3, and multiply each listing in Columns 1

& 3 by percentage before entering on form.

Lakewood (Calculate at 100%)

Lakewood (Calculate at 100%)

Total from Table C:

Overall Total:

Total

(to Line 1)

(to Line 6)

(to Line 7)

INCOME

1.

Wages and compensation (from Table A, Section A-2, Column 1)

1.

2.

Non-Wage Income not reported on Table B (i.e. Gambling Winnings, 1099-MISC income, 1099-K income)

2.

3.

Total Taxable Non-Schedule Income (add Lines 1 and 2)

3.

4.

Schedule Income (From Table B, Column 6, Line 9) - DO NOT enter amount less than zero

4.

TAX AND CREDITS

5.

Total Non-Schedule Lakewood tax due before credits (multiply Line 3 by 1.5% or .015)

5.

6.

Taxes withheld and paid to Lakewood (from Table A, Section A-2, Column 2)

6.

7.

Wage income tax credit (from Table A, Section A-2, Column 6)

7.

8.

Total Non-Schedule Credits (add Lines 6 and 7)

8.

9.

Total Non-Schedule tax due before estimated payments (subtract Line 8 from Line 5)

9.

10.

Total Schedule tax due before estimated payments (from Table B, Column 6, Line 16)

10.

11.

Total tax due before estimated payments (add Lines 9 and 10)

11.

12.

estimated tax payment(s) and unused prior year credits- up-to-date amounts available at

12.

2016

13.

Total net tax - Subtract Line 12 from Line 11 and proceed to Line 16. If less than $10.00, enter zero and proceed to Line 14

13.

OVERPAYMENT

Overpayment - If Line 12 is greater than Line 11, and not less than $10.00, subtract Line 11 from Line 12

14.

14.

15.

From Line 14 - Amount to be credited to

2017

- $_______________ Amount to be refunded - $_______________ (Proceed to Line 17)

BALANCE DUE

16.

Balance Due - If Line 11 is greater than Line 12, and not less than $10.00, subtract Line 12 from Line 11

16.

ESTIMATED INCOME TAX FOR

2017

17.

Estimated income tax for

2017

(form Line 11)

17.

18.

First quarter payment (multiply Line 17 by 25% or .25)

18.

19.

2016

credit applied to first quarter

2017

estimate (from Line 15)

19.

20.

Total amount due by April

18

,

2017

(add Line 16, 18, and subtract Line 19)

20.

The undersigned declares this to be a true, correct, and complete return of Lakewood Income Tax for the period stated.

Pay by Credit Card - Mastercard/Visa/Discover/American Express

_______________________________________________________________________________________________

Taxpayer's Signature

Date

Acct. Number _________________________________

Exp. Date ____________ Security Code ___________

_______________________________________________________________________________________________

Spouse's Signature

Date

Amount Paid $________________________________

_______________________________________________________________________________________________

______________________________________________

Signature

Tax Preparer's Signature (if other than taxpayer)

Phone #

Date

I authorize the City of Lakewood - Division of Municipal Income Tax to discuss my account and enclosures with my preparer (above)

1

1 2

2 3

3 4

4