Oiss Instructions For Filling Out And Mailing The 8843 - Boston College

ADVERTISEMENT

8843 Instructions 2017 (for 2016 tax year)

Scroll down to find the form 8843 (can be filled in by hand or online:

pdf/f8843.pdf). If you have a pre-printed 8843 from Human Resources (usually sent at the end of February),

you can use the preprinted form.

All students and dependents considered non-residents for Federal Tax purposes must file the 8843

even if you did not earn any money in the U.S. (See the OISS website to determine if you are a resident or

non-resident for Federal tax purposes). Those who earned income and have to file a 1040NR or 1040NR-

EZ should attach the 8843 with their tax return which can be completed using the Windstar System. See the

OISS tax website for details.

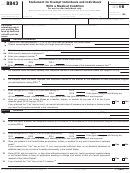

Name and Address:

•

Fill in "First name", "Last name", and "Social Security number". If you do not have a Social

Security Number leave this blank.

•

Fill in the "Address in county of residence" box with your home country address

•

Fill in the "Address in the United States" box with your local address

Part I: All students and scholars including dependents:

1a. Enter visa status and date when you last entered the U.S. This information can be found on your I-94

card, the white card that was given to you when you entered the U.S.

1b. Enter your current immigration status. It will be the same as above unless you changed your status in

the U.S. since your last entry.

2. 3. and 3a. Enter citizenship and relevant information.

4a and 4b. 4b will be the number of days you were in the U.S in 2016

Part II: J Visiting Professor, Scholar or Researcher

5. Enter: Boston College, 140 Commonwealth Ave. Chestnut Hill MA. If you were a researcher or

professor at more than one university, enter the most recent university in 2016

6. Enter the name, address (use the BC address above) and the phone number for the department chair or

your faculty sponsor.

7. Complete if you held a J or Q status in the listed years.

8. Only list the years that you were that you were considered a non-resident in A, G, F, J, M, or Q status.

Part III: Students

9. Enter the most recent academic institution you attended in 2016. For Boston College enter: Boston

College, 140 Commonwealth Ave. Chestnut Hill, MA 02467

10. Enter: Adrienne Nussbaum, Office of International Students and Scholars, 72 College Rd. Chestnut Hill

MA 02467

Part IV and Part V: Skip

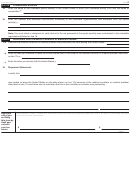

Sign and Mail:

•

Sign and date the form at the bottom

•

Make a photocopy of your completed Form 8843 to keep for your records.

Mail to:

Internal Revenue Service Austin, TX 73301-0215 (Note: There is NO street address)

Filing deadlines:

•

If you had no U.S. earned income and are filing only Form 8843, the deadline for filing this form is

June 15. YOU DO NOT NEED A WINDSTAR PASSWORD TO COMPLETE THIS FORM.

•

If you must file Form 1040NR-EZ or 1040NR, then you must complete Form 8843 and mail with

your tax return before the filing deadline, which is April 15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3