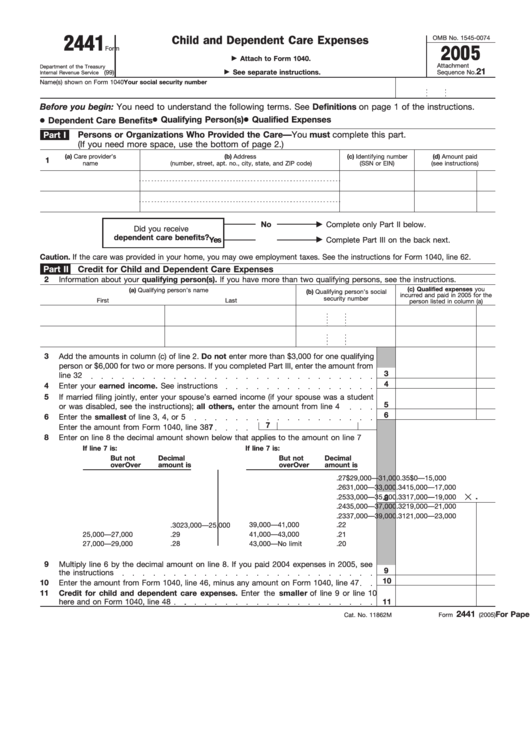

2441

OMB No. 1545-0074

Child and Dependent Care Expenses

Form

2005

Attach to Form 1040.

Attachment

Department of the Treasury

21

See separate instructions.

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on Form 1040

Your social security number

Before you begin: You need to understand the following terms. See Definitions on page 1 of the instructions.

● Qualifying Person(s)

● Qualified Expenses

● Dependent Care Benefits

Part I

Persons or Organizations Who Provided the Care—You must complete this part.

(If you need more space, use the bottom of page 2.)

(a) Care provider’s

(b) Address

(c) Identifying number

(d) Amount paid

1

name

(number, street, apt. no., city, state, and ZIP code)

(SSN or EIN)

(see instructions)

No

Complete only Part II below.

Did you receive

dependent care benefits?

Yes

Complete Part III on the back next.

Caution. If the care was provided in your home, you may owe employment taxes. See the instructions for Form 1040, line 62.

Part II

Credit for Child and Dependent Care Expenses

2

Information about your qualifying person(s). If you have more than two qualifying persons, see the instructions.

(c) Qualified expenses you

(a) Qualifying person’s name

(b) Qualifying person’s social

incurred and paid in 2005 for the

security number

First

Last

person listed in column (a)

3

Add the amounts in column (c) of line 2. Do not enter more than $3,000 for one qualifying

person or $6,000 for two or more persons. If you completed Part III, enter the amount from

3

line 32

4

4

Enter your earned income. See instructions

5

If married filing jointly, enter your spouse’s earned income (if your spouse was a student

5

or was disabled, see the instructions); all others, enter the amount from line 4

6

6

Enter the smallest of line 3, 4, or 5

7

7

Enter the amount from Form 1040, line 38

8

Enter on line 8 the decimal amount shown below that applies to the amount on line 7

If line 7 is:

If line 7 is:

But not

Decimal

But not

Decimal

Over

over

amount is

Over

over

amount is

$0—15,000

.35

$29,000—31,000

.27

15,000—17,000

.34

31,000—33,000

.26

.

17,000—19,000

.33

33,000—35,000

.25

8

19,000—21,000

.32

35,000—37,000

.24

21,000—23,000

.31

37,000—39,000

.23

39,000—41,000

.22

23,000—25,000

.30

41,000—43,000

25,000—27,000

.29

.21

.28

27,000—29,000

43,000—No limit

.20

9

Multiply line 6 by the decimal amount on line 8. If you paid 2004 expenses in 2005, see

9

the instructions

10

10

Enter the amount from Form 1040, line 46, minus any amount on Form 1040, line 47

11

Credit for child and dependent care expenses. Enter the smaller of line 9 or line 10

here and on Form 1040, line 48

11

2441

For Paperwork Reduction Act Notice, see page 4 of the instructions.

Cat. No. 11862M

Form

(2005)

1

1 2

2