2

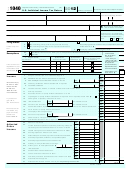

Form 1040 (2010)

Page

38

Amount from line 37 (adjusted gross income)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

38

Tax and

{

}

39a

You were born before January 2, 1946,

Blind.

Check

Total boxes

Credits

Spouse was born before January 2, 1946,

checked

39a

if:

Blind.

▶

If your spouse itemizes on a separate return or you were a dual-status alien, check here

b

39b

▶

40

Itemized deductions (from Schedule A) or your standard deduction (see instructions) .

.

40

41

Subtract line 40 from line 38

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

41

42

Exemptions. Multiply $3,650 by the number on line 6d .

42

.

.

.

.

.

.

.

.

.

.

.

43

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- .

43

.

44

Tax (see instructions). Check if any tax is from: a

Form(s) 8814

b

Form 4972 .

44

45

Alternative minimum tax (see instructions). Attach Form 6251 .

.

.

.

.

.

.

.

.

45

46

Add lines 44 and 45 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

46

▶

47

47

Foreign tax credit. Attach Form 1116 if required .

.

.

.

48

48

Credit for child and dependent care expenses. Attach Form 2441

49

Education credits from Form 8863, line 23

.

.

.

.

.

49

50

Retirement savings contributions credit. Attach Form 8880

50

51

51

Child tax credit (see instructions) .

.

.

.

.

.

.

.

52

Residential energy credits. Attach Form 5695

.

.

.

.

52

53

Other credits from Form: a

3800 b

8801

c

53

54

Add lines 47 through 53. These are your total credits .

.

.

.

.

.

.

.

.

.

.

.

54

55

Subtract line 54 from line 46. If line 54 is more than line 46, enter -0-

.

.

.

.

.

.

55

▶

Other

56

Self-employment tax. Attach Schedule SE

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

56

57

Unreported social security and Medicare tax from Form:

a

4137

b

8919

.

.

57

Taxes

58

58

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

.

.

59

a

b

c

59

Form(s) W-2, box 9

Schedule H

Form 5405, line 16

.

.

.

.

60

Add lines 55 through 59. This is your total tax

.

.

.

.

.

.

.

.

.

.

.

.

.

60

▶

Payments

61

Federal income tax withheld from Forms W-2 and 1099

.

.

61

62

2010 estimated tax payments and amount applied from 2009 return

62

63

63

Making work pay credit. Attach Schedule M .

.

.

.

.

.

.

If you have a

64a

Earned income credit (EIC)

.

.

.

.

.

.

.

.

.

.

64a

qualifying

b

Nontaxable combat pay election

64b

child, attach

Schedule EIC.

65

65

Additional child tax credit. Attach Form 8812

.

.

.

.

.

.

66

66

American opportunity credit from Form 8863, line 14

.

.

.

67

First-time homebuyer credit from Form 5405, line 10 .

.

.

67

68

Amount paid with request for extension to file

.

.

.

.

.

68

69

69

Excess social security and tier 1 RRTA tax withheld

.

.

.

.

70

70

Credit for federal tax on fuels. Attach Form 4136

.

.

.

.

71

Credits from Form: a

2439 b

8839 c

8801 d

8885

71

72

Add lines 61, 62, 63, 64a, and 65 through 71. These are your total payments .

.

.

.

72

▶

Refund

73

If line 72 is more than line 60, subtract line 60 from line 72. This is the amount you overpaid

73

74a

Amount of line 73 you want refunded to you. If Form 8888 is attached, check here

74a

.

▶

b

Routing number

c Type:

Checking

Savings

▶

▶

Direct deposit?

See

d

Account number

▶

instructions.

75

Amount of line 73 you want applied to your 2011 estimated tax

75

▶

▶

Amount

76

Amount you owe. Subtract line 72 from line 60. For details on how to pay, see instructions

76

▶

You Owe

77

Estimated tax penalty (see instructions)

.

.

.

.

.

.

.

77

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete below.

No

Third Party

Designee

Designee’s

Phone

Personal identification

name

no.

number (PIN)

▶

▶

▶

Sign

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

Here

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

Joint return?

See page 12.

Keep a copy

Spouse’s signature. If a joint return, both must sign.

Date

Spouse’s occupation

for your

records.

Print/Type preparer’s name

PTIN

Preparer’s signature

Date

Paid

Check

if

self-employed

Preparer

Firm's EIN ▶

Firm’s name

▶

Use Only

Phone no.

Firm’s address ▶

1040

Form

(2010)

1

1 2

2