Verification Of Income Unusual Circumstances

ADVERTISEMENT

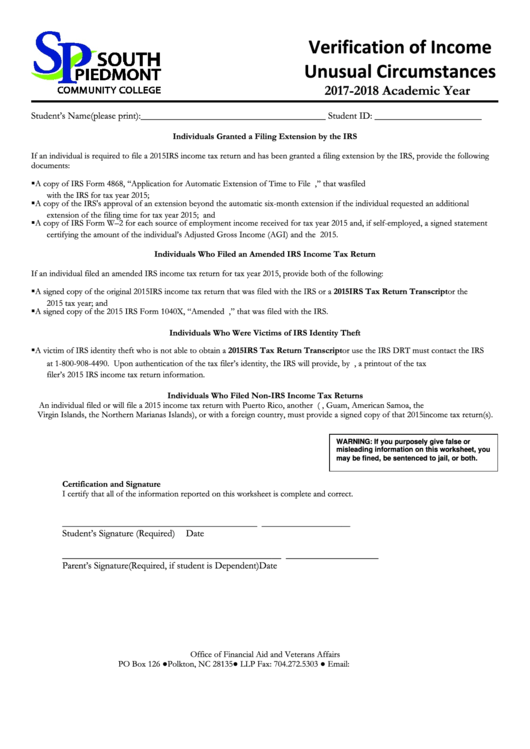

Verification of Income

Unusual Circumstances

2017-2018 Academic Year

Student’s Name (please print):______________________________________ Student ID: ______________________

Individuals Granted a Filing Extension by the IRS

If an individual is required to file a 2015 IRS income tax return and has been granted a filing extension by the IRS, provide the following

documents:

A copy of IRS Form 4868, ‘‘Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,’’ that was filed

with the IRS for tax year 2015;

A copy of the IRS's approval of an extension beyond the automatic six-month extension if the individual requested an additional

extension of the filing time for tax year 2015; and

A copy of IRS Form W–2 for each source of employment income received for tax year 2015 and, if self-employed, a signed statement

certifying the amount of the individual’s Adjusted Gross Income (AGI) and the U.S. income tax paid for tax year 2015.

Individuals Who Filed an Amended IRS Income Tax Return

If an individual filed an amended IRS income tax return for tax year 2015, provide both of the following:

A signed copy of the original 2015 IRS income tax return that was filed with the IRS or a 2015 IRS Tax Return Transcript or the

2015 tax year; and

A signed copy of the 2015 IRS Form 1040X, “Amended U.S. Individual Income Tax Return,” that was filed with the IRS.

Individuals Who Were Victims of IRS Identity Theft

A victim of IRS identity theft who is not able to obtain a 2015 IRS Tax Return Transcript or use the IRS DRT must contact the IRS

at 1-800-908-4490. Upon authentication of the tax filer’s identity, the IRS will provide, by U.S. Postal Service, a printout of the tax

filer’s 2015 IRS income tax return information.

Individuals Who Filed Non-IRS Income Tax Returns

An individual filed or will file a 2015 income tax return with Puerto Rico, another U.S. territory (e.g., Guam, American Samoa, the U.S.

Virgin Islands, the Northern Marianas Islands), or with a foreign country, must provide a signed copy of that 2015 income tax return(s).

WARNING: If you purposely give false or

misleading information on this worksheet, you

may be fined, be sentenced to jail, or both.

Certification and Signature

I certify that all of the information reported on this worksheet is complete and correct.

____________________________________________

____________________

Student’s Signature (Required)

Date

_____________________________________________

___________________

Parent’s Signature (Required, if student is Dependent)

Date

Office of Financial Aid and Veterans Affairs

PO Box 126 ● Polkton, NC 28135 ● LLP Fax: 704.272.5303 ● Email: finaid@spcc.edu

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1