Irs Tax Exempt Statuses For Farmers Markets Chart

ADVERTISEMENT

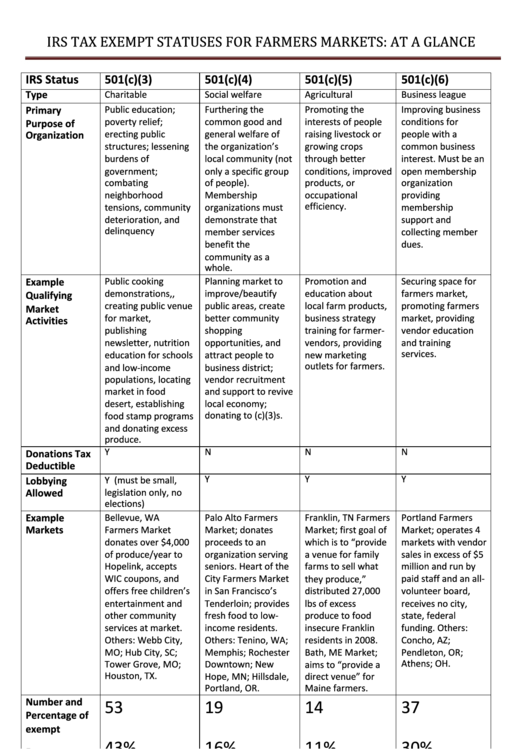

IRS TAX EXEMPT STATUSES FOR FARMERS MARKETS: AT A GLANCE

IRS Status

501(c)(3)

501(c)(4)

501(c)(5)

501(c)(6)

Type

Charitable

Social welfare

Agricultural

Business league

Public education;

Furthering the

Promoting the

Improving business

Primary

poverty relief;

common good and

interests of people

conditions for

Purpose of

erecting public

general welfare of

raising livestock or

people with a

Organization

structures; lessening

the organization’s

growing crops

common business

burdens of

local community (not

through better

interest. Must be an

government;

only a specific group

conditions, improved

open membership

combating

of people).

products, or

organization

neighborhood

Membership

occupational

providing

tensions, community

organizations must

efficiency.

membership

deterioration, and

demonstrate that

support and

delinquency

member services

collecting member

benefit the

dues.

community as a

whole.

Example

Public cooking

Planning market to

Promotion and

Securing space for

demonstrations,,

improve/beautify

education about

farmers market,

Qualifying

creating public venue

public areas, create

local farm products,

promoting farmers

Market

for market,

better community

business strategy

market, providing

Activities

publishing

shopping

training for farmer-

vendor education

newsletter, nutrition

opportunities, and

vendors, providing

and training

education for schools

attract people to

new marketing

services.

and low-income

business district;

outlets for farmers.

populations, locating

vendor recruitment

market in food

and support to revive

desert, establishing

local economy;

food stamp programs

donating to (c)(3)s.

and donating excess

produce.

Donations Tax

Y

N

N

N

Deductible

Y (must be small,

Y

Y

Y

Lobbying

legislation only, no

Allowed

elections)

Bellevue, WA

Palo Alto Farmers

Franklin, TN Farmers

Portland Farmers

Example

Farmers Market

Market; donates

Market; first goal of

Market; operates 4

Markets

donates over $4,000

proceeds to an

which is to “provide

markets with vendor

of produce/year to

organization serving

a venue for family

sales in excess of $5

Hopelink, accepts

seniors. Heart of the

farms to sell what

million and run by

WIC coupons, and

City Farmers Market

they produce,”

paid staff and an all-

offers free children’s

in San Francisco’s

distributed 27,000

volunteer board,

entertainment and

Tenderloin; provides

lbs of excess

receives no city,

other community

fresh food to low-

produce to food

state, federal

services at market.

income residents.

insecure Franklin

funding. Others:

Others: Webb City,

Others: Tenino, WA;

residents in 2008.

Concho, AZ;

MO; Hub City, SC;

Memphis; Rochester

Bath, ME Market;

Pendleton, OR;

Tower Grove, MO;

Downtown; New

aims to “provide a

Athens; OH.

Houston, TX.

Hope, MN; Hillsdale,

direct venue” for

Portland, OR.

Maine farmers.

Number and

53

19

14

37

Percentage of

43%

16%

11%

30%

exempt

Farmers

Market

Organizations

with each

designation as

of July 29,

1

2010

*This document was compiled for the Farmers Market Coalition by Sarah Johnson and Katie Stewart

1

Data obtained from IRS.gov, Tax Stats-Exempt Organizations, IRS Master File Data

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1