Sample Profit & Loss Statement Of Taxi Business

ADVERTISEMENT

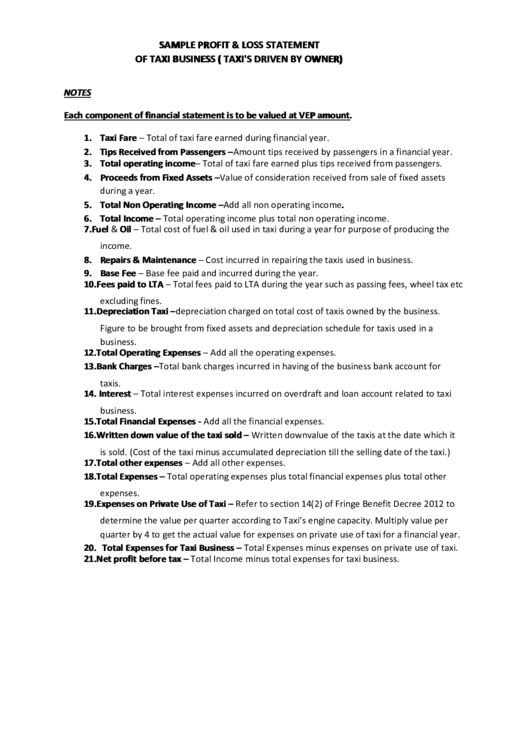

SAMPLE PROFIT & LOSS STATEMENT

OF TAXI BUSINESS ( TAXI'S DRIVEN BY OWNER)

NOTES

Each component of financial statement is to be valued at VEP amount.

1. Taxi Fare – Total of taxi fare earned during financial year.

2. Tips Received from Passengers –Amount tips received by passengers in a financial year.

3. Total operating income – Total of taxi fare earned plus tips received from passengers.

4. Proceeds from Fixed Assets – Value of consideration received from sale of fixed assets

during a year.

5. Total Non Operating Income – Add all non operating income.

6. Total Income – Total operating income plus total non operating income.

7. Fuel & Oil – Total cost of fuel & oil used in taxi during a year for purpose of producing the

income.

8. Repairs & Maintenance – Cost incurred in repairing the taxis used in business.

9. Base Fee – Base fee paid and incurred during the year.

10. Fees paid to LTA – Total fees paid to LTA during the year such as passing fees, wheel tax etc

excluding fines.

11. Depreciation Taxi – depreciation charged on total cost of taxis owned by the business.

Figure to be brought from fixed assets and depreciation schedule for taxis used in a

business.

12. Total Operating Expenses – Add all the operating expenses.

13. Bank Charges – Total bank charges incurred in having of the business bank account for

taxis.

14. Interest – Total interest expenses incurred on overdraft and loan account related to taxi

business.

15. Total Financial Expenses - Add all the financial expenses.

16. Written down value of the taxi sold – Written down value of the taxis at the date which it

is sold. (Cost of the taxi minus accumulated depreciation till the selling date of the taxi.)

17. Total other expenses – Add all other expenses.

18. Total Expenses – Total operating expenses plus total financial expenses plus total other

expenses.

19. Expenses on Private Use of Taxi – Refer to section 14(2) of Fringe Benefit Decree 2012 to

determine the value per quarter according to Taxi’s engine capacity. Multiply value per

quarter by 4 to get the actual value for expenses on private use of taxi for a financial year.

20. Total Expenses for Taxi Business – Total Expenses minus expenses on private use of taxi.

21. Net profit before tax – Total Income minus total expenses for taxi business.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4