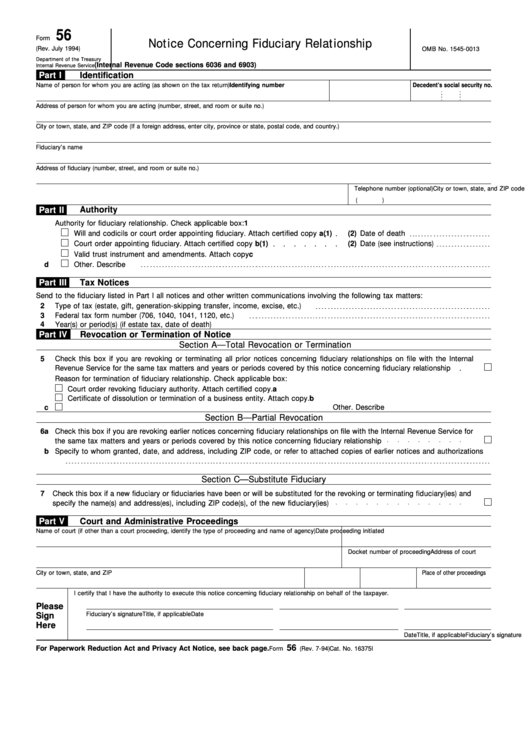

Form 56 - Notice Concerning Fiduciary Relationship

ADVERTISEMENT

56

Form

Notice Concerning Fiduciary Relationship

(Rev. July 1994)

OMB No. 1545-0013

Department of the Treasury

(Internal Revenue Code sections 6036 and 6903)

Internal Revenue Service

Part I

Identification

Name of person for whom you are acting (as shown on the tax return)

Identifying number

Decedent’s social security no.

Address of person for whom you are acting (number, street, and room or suite no.)

City or town, state, and ZIP code (If a foreign address, enter city, province or state, postal code, and country.)

Fiduciary’s name

Address of fiduciary (number, street, and room or suite no.)

City or town, state, and ZIP code

Telephone number (optional)

(

)

Authority

Part II

1

Authority for fiduciary relationship. Check applicable box:

a(1)

Will and codicils or court order appointing fiduciary. Attach certified copy

(2) Date of death

b(1)

Court order appointing fiduciary. Attach certified copy

(2) Date (see instructions)

c

Valid trust instrument and amendments. Attach copy

d

Other. Describe

Part III

Tax Notices

Send to the fiduciary listed in Part I all notices and other written communications involving the following tax matters:

2

Type of tax (estate, gift, generation-skipping transfer, income, excise, etc.)

3

Federal tax form number (706, 1040, 1041, 1120, etc.)

4

Year(s) or period(s) (if estate tax, date of death)

Part IV

Revocation or Termination of Notice

Section A—Total Revocation or Termination

5

Check this box if you are revoking or terminating all prior notices concerning fiduciary relationships on file with the Internal

Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship

Reason for termination of fiduciary relationship. Check applicable box:

a

Court order revoking fiduciary authority. Attach certified copy.

b

Certificate of dissolution or termination of a business entity. Attach copy.

c

Other. Describe

Section B—Partial Revocation

6a

Check this box if you are revoking earlier notices concerning fiduciary relationships on file with the Internal Revenue Service for

the same tax matters and years or periods covered by this notice concerning fiduciary relationship

b

Specify to whom granted, date, and address, including ZIP code, or refer to attached copies of earlier notices and authorizations

Section C—Substitute Fiduciary

7

Check this box if a new fiduciary or fiduciaries have been or will be substituted for the revoking or terminating fiduciary(ies) and

specify the name(s) and address(es), including ZIP code(s), of the new fiduciary(ies)

Part V

Court and Administrative Proceedings

Name of court (if other than a court proceeding, identify the type of proceeding and name of agency)

Date proceeding initiated

Address of court

Docket number of proceeding

City or town, state, and ZIP code

Date

Time

a.m.

Place of other proceedings

p.m.

I certify that I have the authority to execute this notice concerning fiduciary relationship on behalf of the taxpayer.

Please

Fiduciary’s signature

Title, if applicable

Date

Sign

Here

Fiduciary’s signature

Title, if applicable

Date

56

For Paperwork Reduction Act and Privacy Act Notice, see back page.

Cat. No. 16375I

Form

(Rev. 7-94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2