Instructions For Form 1099-Q - 2015

ADVERTISEMENT

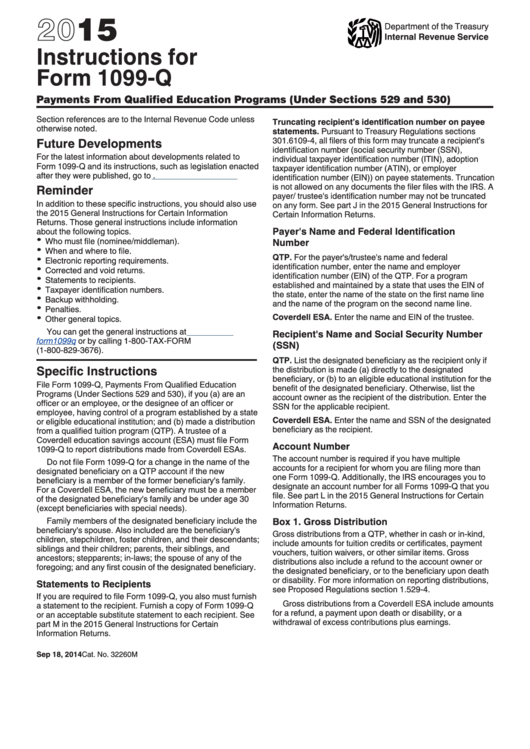

2015

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1099-Q

Payments From Qualified Education Programs (Under Sections 529 and 530)

Section references are to the Internal Revenue Code unless

Truncating recipient’s identification number on payee

otherwise noted.

statements. Pursuant to Treasury Regulations sections

Future Developments

301.6109-4, all filers of this form may truncate a recipient’s

identification number (social security number (SSN),

For the latest information about developments related to

individual taxpayer identification number (ITIN), adoption

Form 1099-Q and its instructions, such as legislation enacted

taxpayer identification number (ATIN), or employer

after they were published, go to

identification number (EIN)) on payee statements. Truncation

is not allowed on any documents the filer files with the IRS. A

Reminder

payer/ trustee's identification number may not be truncated

In addition to these specific instructions, you should also use

on any form. See part J in the 2015 General Instructions for

the 2015 General Instructions for Certain Information

Certain Information Returns.

Returns. Those general instructions include information

Payer's Name and Federal Identification

about the following topics.

Who must file (nominee/middleman).

Number

When and where to file.

QTP. For the payer's/trustee's name and federal

Electronic reporting requirements.

identification number, enter the name and employer

Corrected and void returns.

identification number (EIN) of the QTP. For a program

Statements to recipients.

established and maintained by a state that uses the EIN of

Taxpayer identification numbers.

the state, enter the name of the state on the first name line

Backup withholding.

and the name of the program on the second name line.

Penalties.

Coverdell ESA. Enter the name and EIN of the trustee.

Other general topics.

You can get the general instructions at

Recipient's Name and Social Security Number

form1099q

or by calling 1-800-TAX-FORM

(SSN)

(1-800-829-3676).

QTP. List the designated beneficiary as the recipient only if

Specific Instructions

the distribution is made (a) directly to the designated

beneficiary, or (b) to an eligible educational institution for the

File Form 1099-Q, Payments From Qualified Education

benefit of the designated beneficiary. Otherwise, list the

Programs (Under Sections 529 and 530), if you (a) are an

account owner as the recipient of the distribution. Enter the

officer or an employee, or the designee of an officer or

SSN for the applicable recipient.

employee, having control of a program established by a state

Coverdell ESA. Enter the name and SSN of the designated

or eligible educational institution; and (b) made a distribution

beneficiary as the recipient.

from a qualified tuition program (QTP). A trustee of a

Coverdell education savings account (ESA) must file Form

Account Number

1099-Q to report distributions made from Coverdell ESAs.

The account number is required if you have multiple

Do not file Form 1099-Q for a change in the name of the

accounts for a recipient for whom you are filing more than

designated beneficiary on a QTP account if the new

one Form 1099-Q. Additionally, the IRS encourages you to

beneficiary is a member of the former beneficiary's family.

designate an account number for all Forms 1099-Q that you

For a Coverdell ESA, the new beneficiary must be a member

file. See part L in the 2015 General Instructions for Certain

of the designated beneficiary's family and be under age 30

Information Returns.

(except beneficiaries with special needs).

Box 1. Gross Distribution

Family members of the designated beneficiary include the

beneficiary's spouse. Also included are the beneficiary's

Gross distributions from a QTP, whether in cash or in-kind,

children, stepchildren, foster children, and their descendants;

include amounts for tuition credits or certificates, payment

siblings and their children; parents, their siblings, and

vouchers, tuition waivers, or other similar items. Gross

ancestors; stepparents; in-laws; the spouse of any of the

distributions also include a refund to the account owner or

foregoing; and any first cousin of the designated beneficiary.

the designated beneficiary, or to the beneficiary upon death

or disability. For more information on reporting distributions,

Statements to Recipients

see Proposed Regulations section 1.529-4.

If you are required to file Form 1099-Q, you also must furnish

Gross distributions from a Coverdell ESA include amounts

a statement to the recipient. Furnish a copy of Form 1099-Q

for a refund, a payment upon death or disability, or a

or an acceptable substitute statement to each recipient. See

withdrawal of excess contributions plus earnings.

part M in the 2015 General Instructions for Certain

Information Returns.

Sep 18, 2014

Cat. No. 32260M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2