Instructions For Form Nc-5px Amended Withholding Payment Voucher

ADVERTISEMENT

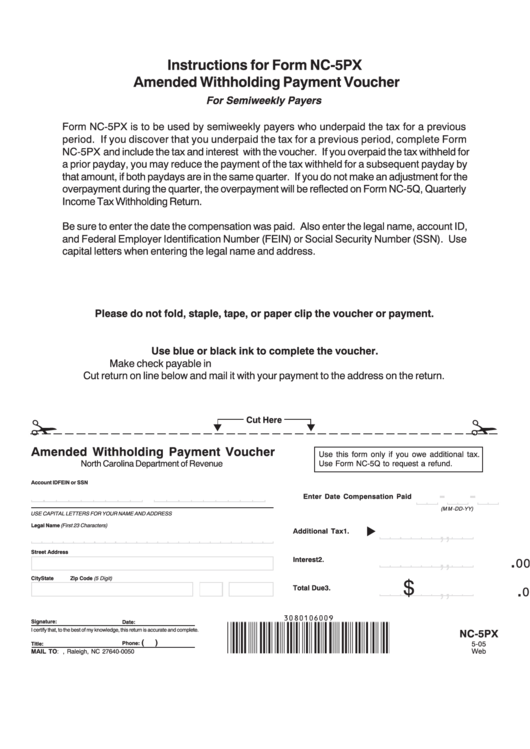

Instructions for Form NC-5PX

Amended Withholding Payment Voucher

For Semiweekly Payers

Form NC-5PX is to be used by semiweekly payers who underpaid the tax for a previous

period. If you discover that you underpaid the tax for a previous period, complete Form

NC-5PX and include the tax and interest with the voucher. If you overpaid the tax withheld for

a prior payday, you may reduce the payment of the tax withheld for a subsequent payday by

that amount, if both paydays are in the same quarter. If you do not make an adjustment for the

overpayment during the quarter, the overpayment will be reflected on Form NC-5Q, Quarterly

Income Tax Withholding Return.

Be sure to enter the date the compensation was paid. Also enter the legal name, account ID,

and Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Use

capital letters when entering the legal name and address.

Please do not fold, staple, tape, or paper clip the voucher or payment.

Use blue or black ink to complete the voucher.

Make check payable in U.S. currency to N.C. Department of Revenue.

Cut return on line below and mail it with your payment to the address on the return.

!

!

Cut Here

Amended Withholding Payment Voucher

Use this form only if you owe additional tax.

North Carolina Department of Revenue

Use Form NC-5Q to request a refund.

Account ID

FEIN or SSN

Enter Date Compensation Paid

(M M -DD-YY)

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

,

,

.

Legal Name (First 23 Characters)

1.

Additional Tax

00

,

,

.

Street Address

2.

Interest

00

$

City

State

Zip Code (5 Digit)

,

,

.

3.

Total Due

00

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

NC-5PX

(

)

Phone:

5-05

Title:

Web

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1