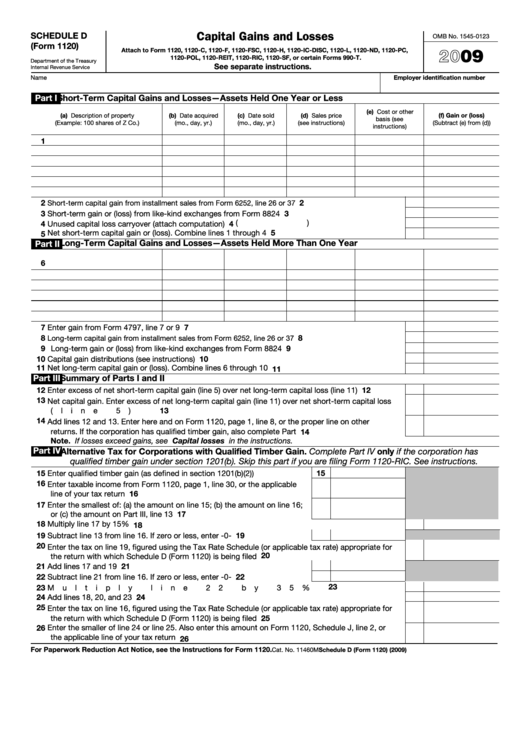

Capital Gains and Losses

SCHEDULE D

OMB No. 1545-0123

(Form 1120)

2009

Attach to Form 1120, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC,

1120-POL, 1120-REIT, 1120-RIC, 1120-SF, or certain Forms 990-T.

Department of the Treasury

See separate instructions.

Internal Revenue Service

Name

Employer identification number

Part I

Short-Term Capital Gains and Losses—Assets Held One Year or Less

(e) Cost or other

(a) Description of property

(b) Date acquired

(c) Date sold

(d) Sales price

(f) Gain or (loss)

basis (see

(Example: 100 shares of Z Co.)

(mo., day, yr.)

(mo., day, yr.)

(see instructions)

(Subtract (e) from (d))

instructions)

1

2

2

Short-term capital gain from installment sales from Form 6252, line 26 or 37 .

.

.

.

.

.

.

.

.

.

3 Short-term gain or (loss) from like-kind exchanges from Form 8824

.

.

.

.

.

.

.

.

.

.

.

3

4 (

)

4 Unused capital loss carryover (attach computation)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

5 Net short-term capital gain or (loss). Combine lines 1 through 4

.

.

.

.

.

.

.

.

.

.

.

.

Long-Term Capital Gains and Losses—Assets Held More Than One Year

Part II

6

7 Enter gain from Form 4797, line 7 or 9 .

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

8

Long-term capital gain from installment sales from Form 6252, line 26 or 37 .

.

.

.

.

.

.

.

.

.

9 Long-term gain or (loss) from like-kind exchanges from Form 8824

9

.

.

.

.

.

.

.

.

.

.

.

10 Capital gain distributions (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11 Net long-term capital gain or (loss). Combine lines 6 through 10

.

.

.

.

.

.

.

.

.

.

.

.

11

Part III

Summary of Parts I and II

12 Enter excess of net short-term capital gain (line 5) over net long-term capital loss (line 11) .

.

.

.

12

13 Net capital gain. Enter excess of net long-term capital gain (line 11) over net short-term capital loss

13

(line 5)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14 Add lines 12 and 13. Enter here and on Form 1120, page 1, line 8, or the proper line on other

returns. If the corporation has qualified timber gain, also complete Part IV .

.

.

.

.

.

.

.

.

14

Note. If losses exceed gains, see Capital losses in the instructions.

Part IV

Alternative Tax for Corporations with Qualified Timber Gain. Complete Part IV only if the corporation has

qualified timber gain under section 1201(b). Skip this part if you are filing Form 1120-RIC. See instructions.

15 Enter qualified timber gain (as defined in section 1201(b)(2)) .

.

.

.

15

16 Enter taxable income from Form 1120, page 1, line 30, or the applicable

line of your tax return

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17 Enter the smallest of: (a) the amount on line 15; (b) the amount on line 16;

or (c) the amount on Part III, line 13 .

.

.

.

.

.

.

.

.

.

.

.

17

18 Multiply line 17 by 15% .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

19 Subtract line 13 from line 16. If zero or less, enter -0- .

19

.

.

.

.

.

20 Enter the tax on line 19, figured using the Tax Rate Schedule (or applicable tax rate) appropriate for

20

the return with which Schedule D (Form 1120) is being filed .

.

.

.

.

.

.

.

.

.

.

.

.

.

21 Add lines 17 and 19 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

22 Subtract line 21 from line 16. If zero or less, enter -0- .

22

.

.

.

.

.

23

23 Multiply line 22 by 35% .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

24

24 Add lines 18, 20, and 23

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25 Enter the tax on line 16, figured using the Tax Rate Schedule (or applicable tax rate) appropriate for

the return with which Schedule D (Form 1120) is being filed .

.

.

.

.

.

.

.

.

.

.

.

.

.

25

26 Enter the smaller of line 24 or line 25. Also enter this amount on Form 1120, Schedule J, line 2, or

the applicable line of your tax return

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

26

For Paperwork Reduction Act Notice, see the Instructions for Form 1120.

Cat. No. 11460M

Schedule D (Form 1120) (2009)

1

1