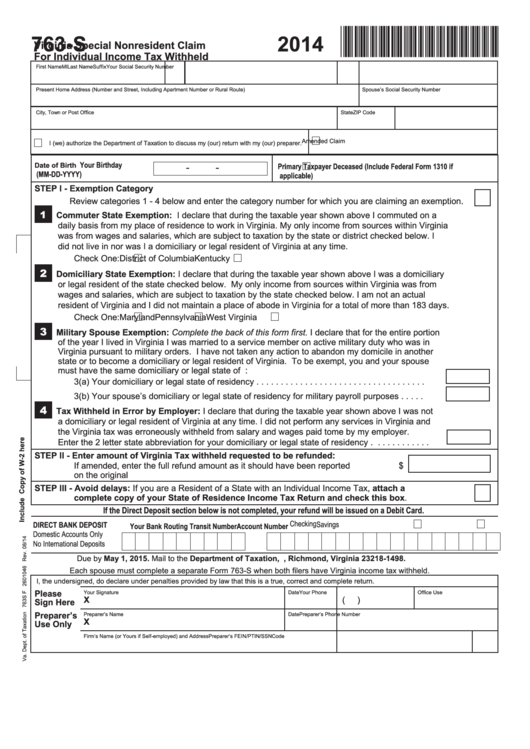

*VA763S114888*

763-S

2014

Virginia Special Nonresident Claim

For Individual Income Tax Withheld

First Name

MI

Last Name

Suffix

Your Social Security Number

Present Home Address (Number and Street, Including Apartment Number or Rural Route)

Spouse’s Social Security Number

City, Town or Post Office

State

ZIP Code

Amended Claim

I (we) authorize the Department of Taxation to discuss my (our) return with my (our) preparer.

Your Birthday

Date of Birth

-

-

Primary Taxpayer Deceased (Include Federal Form 1310 if

(MM-DD-YYYY)

applicable)

STEP I - Exemption Category

.

Review categories 1 - 4 below and enter the category number for which you are claiming an exemption

1

Commuter State Exemption: I declare that during the taxable year shown above I commuted on a

daily basis from my place of residence to work in Virginia. My only income from sources within Virginia

was from wages and salaries, which are subject to taxation by the state or district checked below. I

did not live in nor was I a domiciliary or legal resident of Virginia at any time.

Check One:

District of Columbia

Kentucky

2

Domiciliary State Exemption: I declare that during the taxable year shown above I was a domiciliary

or legal resident of the state checked below. My only income from sources within Virginia was from

wages and salaries, which are subject to taxation by the state checked below. I am not an actual

resident of Virginia and I did not maintain a place of abode in Virginia for a total of more than 183 days.

Check One:

Maryland

Pennsylvania

West Virginia

3

Military Spouse Exemption: Complete the back of this form first. I declare that for the entire portion

of the year I lived in Virginia I was married to a service member on active military duty who was in

Virginia pursuant to military orders. I have not taken any action to abandon my domicile in another

state or to become a domiciliary or legal resident of Virginia. To be exempt, you and your spouse

must have the same domiciliary or legal state of residency. Enter the 2 letter state abbreviation for:

3(a) Your domiciliary or legal state of residency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3(b) Your spouse’s domiciliary or legal state of residency for military payroll purposes . . . . .

4

Tax Withheld in Error by Employer: I declare that during the taxable year shown above I was not

a domiciliary or legal resident of Virginia at any time. I did not perform any services in Virginia and

the Virginia tax was erroneously withheld from salary and wages paid to me by my employer.

Enter the 2 letter state abbreviation for your domiciliary or legal state of residency . . . . . . . . . . . .

STEP II - Enter amount of Virginia Tax withheld requested to be refunded:

If amended, enter the full refund amount as it should have been reported

$

on the original return. You must provide copies of your withholding statements.

STEP III - Avoid delays: If you are a Resident of a State with an Individual Income Tax, attach a

complete copy of your State of Residence Income Tax Return and check this box.

If the Direct Deposit section below is not completed, your refund will be issued on a Debit Card.

Checking

Savings

DIRECT BANK DEPOSIT

Your Bank Routing Transit Number

Account Number

Domestic Accounts Only

No International Deposits

Due by May 1, 2015. Mail to the Department of Taxation, P.O. Box 1498, Richmond, Virginia 23218-1498.

Each spouse must complete a separate Form 763-S when both filers have Virginia income tax withheld.

I, the undersigned, do declare under penalties provided by law that this is a true, correct and complete return.

Please

Your Signature

Date

Your Phone

Office Use

X

(

)

Sign Here

Preparer’s

Preparer’s Name

Date

Preparer’s Phone Number

X

Use Only

Firm’s Name (or Yours if Self-employed) and Address

Preparer’s FEIN/PTIN/SSN

Code

1

1 2

2