Illinois Charitable Organization Annual Report - I Support Community

ADVERTISEMENT

~For~Offic~eUs~eOn~I

- - - - - ,

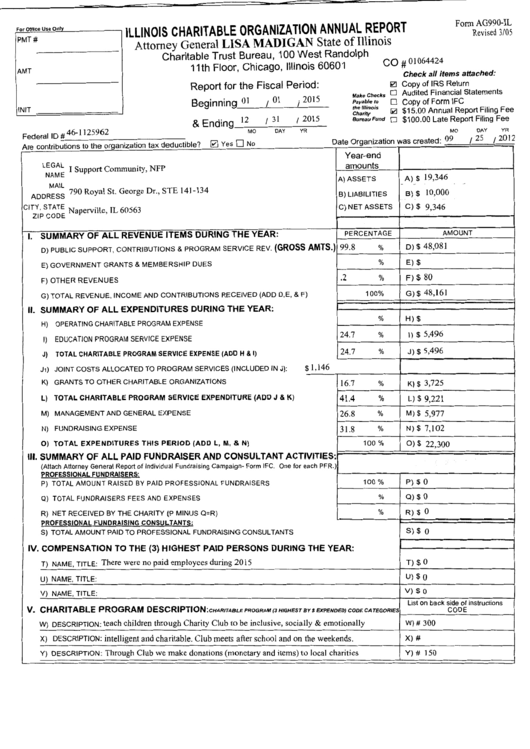

ILLINOIS CHARITABLE ORGANIZATION ANNUAL REPORT

PMT

#

Attorney General LISA MADIGAN State of Illinois

Form AG990-IL

Revised 3/05

Charitable Trust Bureau, 100 West Randolph

11th Floor, Chicago, Illinois 60601

co

#

01064424

AMT

!NIT

Federal ID

#

46-1125962

Report for the Fiscal Period:

Beginni ng_o_1 _

__,_/ _0_1 _

_,_ 1 _2_0_15_

&

Ending_12 _ _ 1 _3_1 _ _ 1_2_01_5_

MO

DAY

YR

Are contributions to th e organiza ion ax e uc

1

e.

. f

d d

fbl

?

0

Yes

D

No

LEGAL

.

I

Support Commumty, NFP

NAME

MAIL

ADDRESS 790

Royal St. George Dr., STE

14

I- I

34

Make Checks

Payable to

the Illinois

Charity

Bureau Fund

Check all items attached:

0 Copy of IRS Return

D

Audited Financial Statements

D Copy of Form IFC

~

$15.00 Annual Report Filing Fee

D $100.00 Late Report Filing Fee

MO

Date Organization was created·

09

DAY

I

25

YR

I

2012

Year-end

amounts

A) ASSETS

A) $ 19,346

-

-

-

B) LIABILITIES

8)$ 10,000

CITY, STATE

Naperville TL

60563

C) NET ASSETS

C)$ 9,346

ZIP CODE

'

I. SUMMARY OF ALL REVENUE ITEMS DURING THE YEAR:

PERCENTAGE

AMOUNT

D) PUBLIC SUPPORT, CONTRIBUTIONS & PROGRAM SERVICE REV.

(GROSS AMTS.)

99.8

%

D)

$ 48,081

E) GOVERNMENT GRANTS & MEMBERSHIP DUES

%

E) $

F) OTHER REVENUES

.2

%

F) $ 80

G) TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D,E, & F)

100%

G) $ 48,161

11. SUMMARY OF ALL EXPENDITURES DURING THE YEAR:

H)

OPERATING CHARITABLE PROGRAM EXPENSE

%

H)$

I)

EDUCATION PROGRAM SERVICE EXPENSE

24.7

%

I) $ 5,496

J)

TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADD H

&

I)

24.7

%

J) $ 5,496

J1) JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J):

$1,146

K) GRANTS TO OTHER CHARITABLE ORGANIZATIONS

16.7

%

K)

$

3,725

L) TOTAL CHARITABLE PROGRAM SERVICE EXPENDITURE (ADD

J

& K)

41.4

%

L)

$

9,221

M) MANAGEMENT AND GENERAL EXPENSE

26.8

%

M) $ 5,977

N) FUNDRAISING EXPENSE

31.8

%

N) $ 7,102

0) TOTAL EXPENDITURES THIS PERIOD (ADD L, M, & N)

100 %

0) $ 22,300

Ill. SUMMARY OF ALL PAID FUNDRAISER AND CONSULTANT ACTIVITIES:

(Attach Attorney General Report of Individual Fundraising Campaign- Form IFC. One for each PFR.)

PROFESSIONAL FUNDRAISERS:

P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS

100 %

P) $ 0

Q)

TOTAL FUNDRAISERS FEES AND EXPENSES

%

Q) $ 0

R) NET RECEIVED BY THE CHARITY (P MINUS Q=R)

%

R) $ 0

PROFESSIONAL FUNDRAISING CONSULTANTS:

S) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS

S) $ 0

IV. COMPENSATION TO THE (3) HIGHEST PAID PERSONS DURING THE YEAR:

T) NAME, TITLE:

There were no paid employees during

2015

T) $ 0

U) NAME, TITLE:

U) $ 0

V) NAME, TITLE:

V)

$

0

List on back side of instructions

v.

CHARITABLE PROGRAM DESCRIPTION:

CHARITABLE PROGRAM (3 HIGHEST BY$ EXPENDED) CODE CATEGORIES

CODE

W) DESCRIPTION:

teach children through Charity Club to be inclusive, socially & emotionally

W)# 300

X) DESCRIPTION:

intelligent and charitable. Club meets after school and on the weekends.

X)#

Y) DESCRIPTION:

Through Club we make donations (monetary and items) to local charities

Y) # 150

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3