Form 13614-C - Intake/interview & Quality Review Sheet, Form W-2 - Wage And Tax Statement Etc.

ADVERTISEMENT

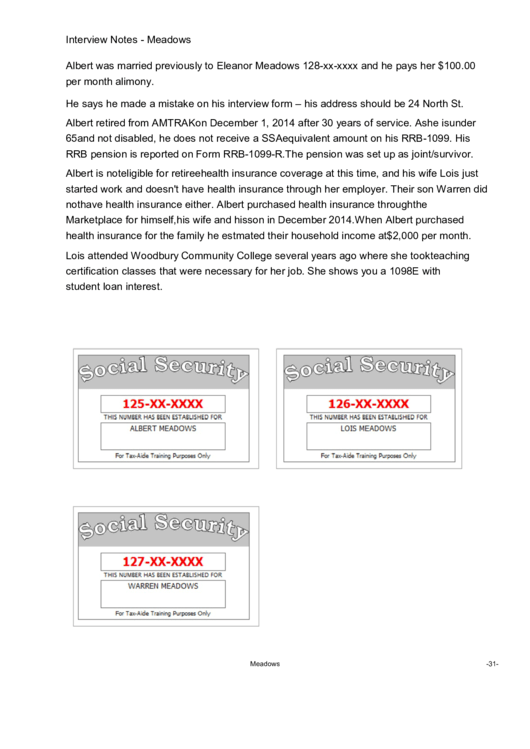

Interview Notes - Meadows

Albert was married previously to Eleanor Meadows 128-xx-xxxx and he pays her $100.00

per month alimony.

He says he made a mistake on his interview form – his address should be 24 North St.

Albert retired from AMTRAK on December 1, 2014 after 30 years of service. As he is under

65 and not disabled, he does not receive a SSA equivalent amount on his RRB-1099. His

RRB pension is reported on Form RRB-1099-R. The pension was set up as joint/survivor.

Albert is not eligible for retiree health insurance coverage at this time, and his wife Lois just

started work and doesn't have health insurance through her employer. Their son Warren did

not have health insurance either. Albert purchased health insurance through the

Marketplace for himself, his wife and his son in December 2014. When Albert purchased

health insurance for the family he estmated their household income at $2,000 per month.

Lois attended Woodbury Community College several years ago where she took teaching

certification classes that were necessary for her job. She shows you a 1098E with

student loan interest.

Meadows

-31-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7