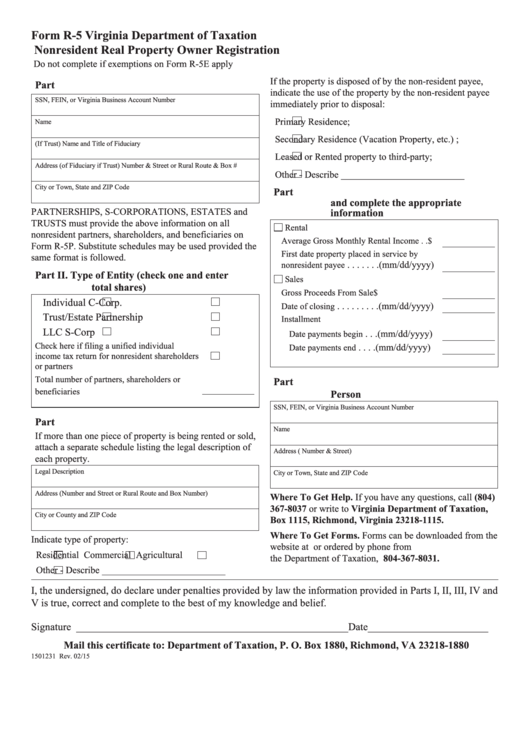

Form R-5

Virginia Department of Taxation

Nonresident Real Property Owner Registration

Do not complete if exemptions on Form R-5E apply

If the property is disposed of by the non-resident payee,

Part I.

Nonresident Payee

indicate the use of the property by the non-resident payee

SSN, FEIN, or Virginia Business Account Number

immediately prior to disposal:

Primary Residence;

Name

Secondary Residence (Vacation Property, etc.) ;

(If Trust) Name and Title of Fiduciary

Leased or Rented property to third-party;

Address (of Fiduciary if Trust) Number & Street or Rural Route & Box #

Other - Describe __________________________

City or Town, State and ZIP Code

Part IV.

Check either Rentals and/or Sales

and complete the appropriate

PARTNERSHIPS, S-CORPORATIONS, ESTATES and

information

TRUSTS must provide the above information on all

Rental

nonresident partners, shareholders, and beneficiaries on

Average Gross Monthly Rental Income . . $

Form R-5P. Substitute schedules may be used provided the

First date property placed in service by

same format is followed.

. . . . . . . (mm/dd/yyyy)

nonresident payee

Part II.

Type of Entity (check one and enter

Sales

total shares)

. . . . . . . . . . . .

Gross Proceeds From Sale

$

Individual

C-Corp.

. . . . . . . . . (mm/dd/yyyy)

Date of closing

Trust/Estate

Partnership

Installment

LLC

S-Corp

. . . (mm/dd/yyyy)

Date payments begin

Check here if filing a unified individual

. . . . (mm/dd/yyyy)

Date payments end

income tax return for nonresident shareholders

or partners

Total number of partners, shareholders or

Part V.

Broker or Real Estate Reporting

. . . . . . . . . . . . . . . . . . . . . .

beneficiaries

Person

SSN, FEIN, or Virginia Business Account Number

Part III.

Property Information

Name

If more than one piece of property is being rented or sold,

attach a separate schedule listing the legal description of

Address ( Number & Street)

each property.

Legal Description

City or Town, State and ZIP Code

Address (Number and Street or Rural Route and Box Number)

Where To Get Help. If you have any questions, call (804)

367-8037 or write to Virginia Department of Taxation, P.O.

City or County and ZIP Code

Box 1115, Richmond, Virginia 23218-1115.

Where To Get Forms. Forms can be downloaded from the

Indicate type of property:

website at or ordered by phone from

Residential

Commercial

Agricultural

the Department of Taxation, 804-367-8031.

Other - Describe __________________________

I, the undersigned, do declare under penalties provided by law the information provided in Parts I, II, III, IV and

V is true, correct and complete to the best of my knowledge and belief.

Signature

____________________________________________________ Date_______________________

Mail this certificate to: Department of Taxation, P. O. Box 1880, Richmond, VA 23218-1880

1501231 Rev. 02/15

1

1 2

2