Flight Expenses Worksheet

Download a blank fillable Flight Expenses Worksheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Flight Expenses Worksheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Colmark & Associates, LLC

2015 Flight Expenses Worksheet

In order to meet the "adequate records" requirement of IRC section 274(d), all flight crew

members are required to maintain a daily log or calendar to serve as documentary evidence of

their overnight travel expenses, if amount exceeds $75 you will also need to keep a receipt.

This calendar and the attached worksheet are designed to meet the requirements set forth by

the IRS. It is imperative that you fill out accurately and complete all worksheets. We cannot

claim a deduction for you if we do not know about the expense. Write down all expenses you

incurred as a flight crewmember and we will determine if the expense is deductible based on

IRS guidelines. You may fill out the online version of this worksheet found in the secured client

portal on our website

Start by logging in using your username and

.

password. If not registered, select the Resources tab and click on the link Client Portal. At the

bottom of the page is a register here link, click on that and fill out the information. It may take

up to 24 hours to grant you access. Within the portal you can select the online 2015 tax

organizers and

2015 Itemized Deductions / Calendar / Unreimbursed Business Expenses. We will also

have a 2016 version available so you may input your data for next year. Use the date associated with

the current filing tax year which is 2015.

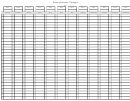

Indicate on the calendar where your overnights occurred. It does not matter whether you fly

AM's or PM's, the last day of your trip will always be where you are based. The only exception

to this rule is if you pick up a trip out of base.

Example: A crew member based in MDW on a four day pairing with overnights in

Denver, Las Vegas, Kansas City should be entered on the calendar DEN; LAS; MCI;

MDW next to the corresponding dates of your layover.

If you fly a one day trip (turn or a local), mark the city you returned to on your calendar.

Example: A crew member flew from MDW to LAS to MCI to MDW; MDW should be

marked next to the corresponding date of the one day trip.

Do not forget to indicate when you had company required training events such as PC's, PT's,

EPT and Recurrent Training. The same holds true for any union, FFDO training and company

business overnight travel (non-reimbursed as long as it was outside your base).

Do not mark the days you were on reserve or vacation since the IRS will not let us count this

towards unreimbursed per diem. New Hires: Mark on your calendar the city your training took

place for the entire time that you were in training.

210 East Third Street

Ph: (815) 626-8600

Sterling, IL. 61081

Mobile: (815) 799-4404

Fax: (815) 626-9268

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4