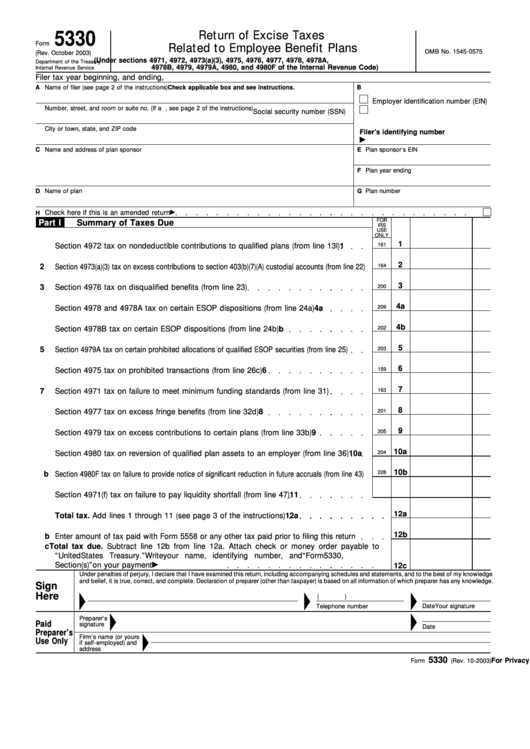

5330

Return of Excise Taxes

Form

Related to Employee Benefit Plans

OMB No. 1545-0575

(Rev. October 2003)

(Under sections 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4978A,

Department of the Treasury

4978B, 4979, 4979A, 4980, and 4980F of the Internal Revenue Code)

Internal Revenue Service

Filer tax year beginning

,

and ending

,

A

Name of filer (see page 2 of the instructions)

B

Check applicable box and see instructions.

Employer identification number (EIN)

Number, street, and room or suite no. (If a P.O. box, see page 2 of the instructions)

Social security number (SSN)

City or town, state, and ZIP code

Filer’s identifying number

C

Name and address of plan sponsor

E

Plan sponsor’s EIN

F

Plan year ending

D

Name of plan

G

Plan number

Check here if this is an amended return

H

FOR

Part I

Summary of Taxes Due

IRS

USE

ONLY

1

1

Section 4972 tax on nondeductible contributions to qualified plans (from line 13l)

161

2

2

Section 4973(a)(3) tax on excess contributions to section 403(b)(7)(A) custodial accounts (from line 22)

164

3

3

Section 4976 tax on disqualified benefits (from line 23)

200

4a

4a

Section 4978 and 4978A tax on certain ESOP dispositions (from line 24a)

209

4b

b

Section 4978B tax on certain ESOP dispositions (from line 24b)

202

5

5

Section 4979A tax on certain prohibited allocations of qualified ESOP securities (from line 25)

203

6

6

Section 4975 tax on prohibited transactions (from line 26c)

159

7

7

Section 4971 tax on failure to meet minimum funding standards (from line 31)

163

8

8

Section 4977 tax on excess fringe benefits (from line 32d)

201

9

9

Section 4979 tax on excess contributions to certain plans (from line 33b)

205

10a

10a

Section 4980 tax on reversion of qualified plan assets to an employer (from line 36)

204

10b

228

b

Section 4980F tax on failure to provide notice of significant reduction in future accruals (from line 43)

11

11

Section 4971(f) tax on failure to pay liquidity shortfall (from line 47)

226

12a

12a

Total tax. Add lines 1 through 11 (see page 3 of the instructions)

12b

b

Enter amount of tax paid with Form 5558 or any other tax paid prior to filing this return

c Total tax due. Subtract line 12b from line 12a. Attach check or money order payable to

“United States Treasury.” Write your name, identifying number, and

“Form 5330,

Section(s)

” on your payment

12c

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

(

)

Your signature

Telephone number

Date

Preparer’s

Paid

signature

Date

Preparer’s

Firm’s name (or yours

Use Only

if self-employed) and

address

5330

For Privacy Act and Paperwork Reduction Act Notice, see page 9 of the instructions.

Cat. No. 11870M

Form

(Rev. 10-2003)

1

1 2

2 3

3 4

4