Form S-3 - Purchases For Resale And By Exempt Organizations - 2013

ADVERTISEMENT

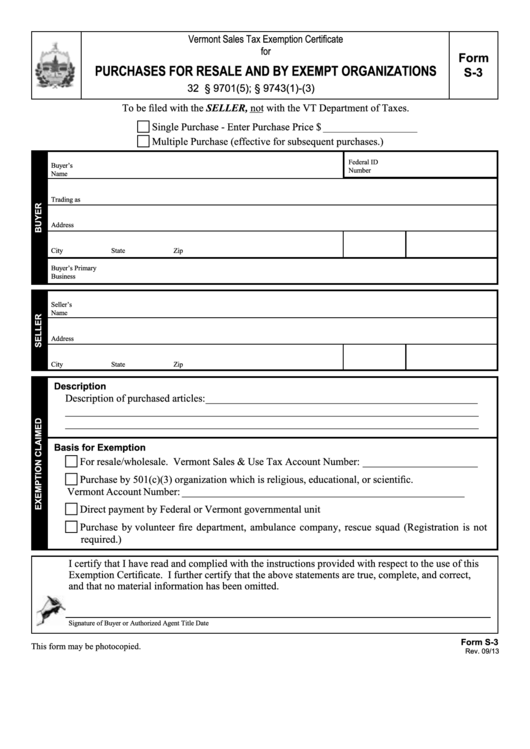

Vermont Sales Tax Exemption Certificate

for

Form

PURCHASES FOR RESALE AND BY EXEMPT ORGANIZATIONS

S-3

32 V.S.A. § 9701(5); § 9743(1)-(3)

To be filed with the SELLER, not with the VT Department of Taxes.

Single Purchase - Enter Purchase Price $ __________________

Multiple Purchase (effective for subsequent purchases.)

Federal ID

Buyer’s

Number

Name

Trading as

Address

City

State

Zip

Buyer’s Primary

Business

Seller’s

Name

Address

City

State

Zip

Description

Description of purchased articles: ____________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

Basis for Exemption

For resale/wholesale. Vermont Sales & Use Tax Account Number: ______________________

Purchase by 501(c)(3) organization which is religious, educational, or scientific.

Vermont Account Number: ______________________________________________________

Direct payment by Federal or Vermont governmental unit

Purchase by volunteer fire department, ambulance company, rescue squad (Registration is not

required.)

I certify that I have read and complied with the instructions provided with respect to the use of this

Exemption Certificate. I further certify that the above statements are true, complete, and correct,

and that no material information has been omitted.

Signature of Buyer or Authorized Agent

Title

Date

Form S-3

This form may be photocopied.

Rev. 09/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2