South Africa Customs And Excise Form

ADVERTISEMENT

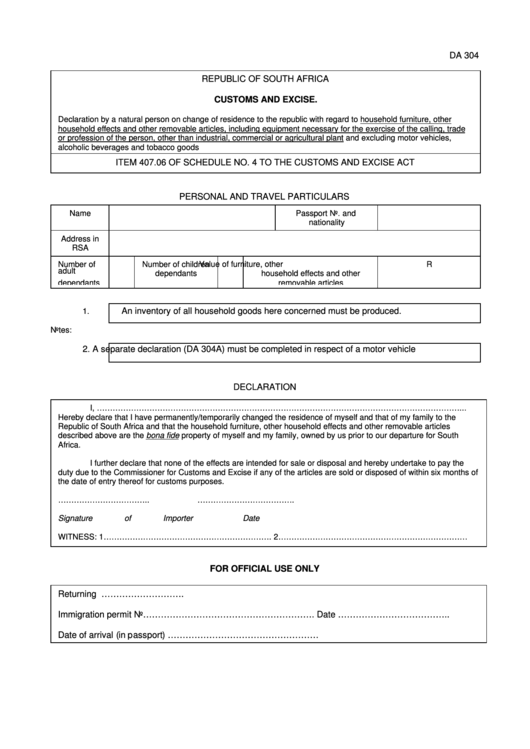

DA 304

REPUBLIC OF SOUTH AFRICA

CUSTOMS AND EXCISE.

Declaration by a natural person on change of residence to the republic with regard to household furniture, other

household effects and other removable articles, including equipment necessary for the exercise of the calling, trade

or profession of the person, other than industrial, commercial or agricultural plant and excluding motor vehicles,

alcoholic beverages and tobacco goods

ITEM 407.06 OF SCHEDULE NO. 4 TO THE CUSTOMS AND EXCISE ACT

PERSONAL AND TRAVEL PARTICULARS

Name

Passport No. and

nationality

Address in

RSA

Number of

Number of children

Value of furniture, other

R

adult

dependants

household effects and other

dependants

removable articles

An inventory of all household goods here concerned must be produced.

1.

Notes:

2.

A separate declaration (DA 304A) must be completed in respect of a motor vehicle

DECLARATION

I, …………………………………………………………………………………………………………………………...

Hereby declare that I have permanently/temporarily changed the residence of myself and that of my family to the

Republic of South Africa and that the household furniture, other household effects and other removable articles

described above are the bona fide property of myself and my family, owned by us prior to our departure for South

Africa.

I further declare that none of the effects are intended for sale or disposal and hereby undertake to pay the

duty due to the Commissioner for Customs and Excise if any of the articles are sold or disposed of within six months of

the date of entry thereof for customs purposes.

……………………………..

……………………………….

Signature of Importer

Date

WITNESS: 1……………………………………………………….

2………………………………………………………………

FOR OFFICIAL USE ONLY

Returning S.A. resident after an absence of ……………………….

Immigration permit No………………………………………………….

Date ………………………………..

Date of arrival (in passport) ……………………………………………

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3