Application For Homestead Property Tax Exemption Template

ADVERTISEMENT

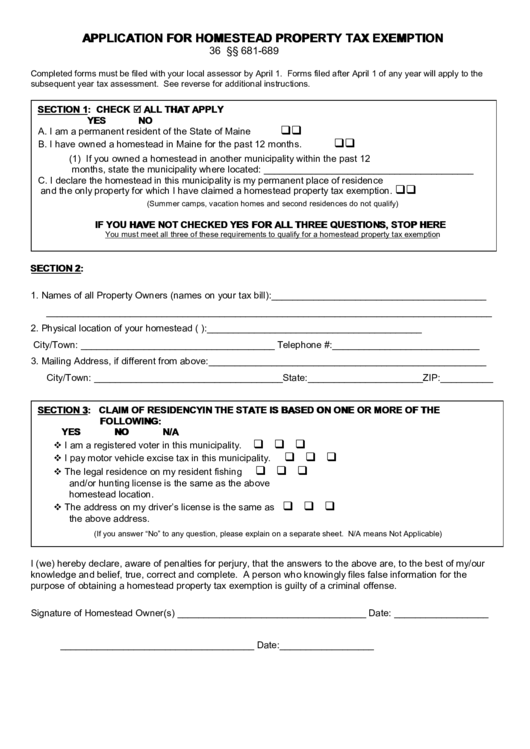

APPLICATION FOR HOMESTEAD PROPERTY TAX EXEMPTION

36 M.R.S.A. §§ 681-689

Completed forms must be filed with your local assessor by April 1. Forms filed after April 1 of any year will apply to the

subsequent year tax assessment. See reverse for additional instructions.

SECTION 1: CHECK ALL THAT APPLY

YES

NO

A. I am a permanent resident of the State of Maine

B. I have owned a homestead in Maine for the past 12 months.

(1) If you owned a homestead in another municipality within the past 12

months, state the municipality where located: ________________________________________

C. I declare the homestead in this municipality is my permanent place of residence

and the only property for which I have claimed a homestead property tax exemption.

(Summer camps, vacation homes and second residences do not qualify)

IF YOU HAVE NOT CHECKED YES FOR ALL THREE QUESTIONS, STOP HERE

You must meet all three of these requirements to qualify for a homestead property tax exemption

SECTION 2:

1. Names of all Property Owners (names on your tax bill):_________________________________________

_____________________________________________________________________________________

2. Physical location of your homestead (i.e. 14 Maple St.):_________________________________________

City/Town: _____________________________________ Telephone #:____________________________

3. Mailing Address, if different from above:_____________________________________________________

City/Town: ____________________________________State:______________________ZIP:__________

SECTION 3: CLAIM OF RESIDENCY IN THE STATE IS BASED ON ONE OR MORE OF THE

FOLLOWING:

YES

NO

N/A

I am a registered voter in this municipality.

I pay motor vehicle excise tax in this municipality.

The legal residence on my resident fishing

and/or hunting license is the same as the above

homestead location.

The address on my driver’s license is the same as

the above address.

(If you answer “No” to any question, please explain on a separate sheet. N/A means Not Applicable)

I (we) hereby declare, aware of penalties for perjury, that the answers to the above are, to the best of my/our

knowledge and belief, true, correct and complete. A person who knowingly files false information for the

purpose of obtaining a homestead property tax exemption is guilty of a criminal offense.

Signature of Homestead Owner(s) ____________________________________ Date: __________________

_____________________________________ Date:__________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2