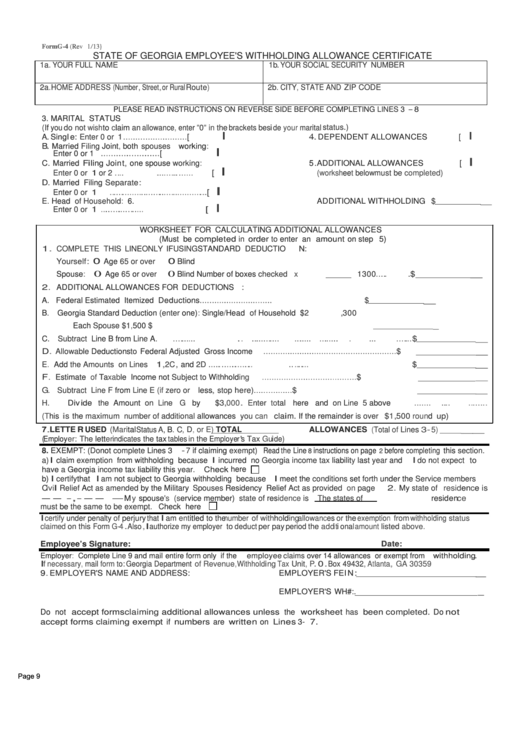

Form G-4 - State Of Georgia Employee'S Withholding Allowance Certificate

ADVERTISEMENT

Form G-4

(Rev 1/13}

STATE OF GEORGIA EMPLOYEE'S WITHHOLDING ALLOWANCE CERTIFICATE

1a.

YOUR FULL NAME

1b. YOUR SOCIAL SECURITY NUMBER

2a.

HOME ADDRESS

(Number,

Street,

or Rural

Route)

2b. CITY,

STATE AND ZIP CODE

PLEASE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING

LINES

3

-

8

3. MARITAL STATUS

(If

you do not

wish

to claim

an

allowance,

enter

"0"

in

the brackets beside

your

marital status.)

I

I

A.

Single:

Enter 0 or

1.......................................[

4.

DEPENDENT ALLOWANCES

[

B.

Married

Filing

Joint,

both

spouses

working:

I

Enter 0 or 1 ...............................................[

I

C.

Married Filing

Joint,

one spouse

working:

5. ADDITIONAL ALLOWANCES

[

I

Enter 0 or

1

or 2 ...........................................[

(worksheet

below must be

completed)

D.

Married Filing

Separate:

I

Enter

0 or 1 ...............................................[

E.

Head

of

Household:

6. ADDITIONAL WITHHOLDING

$

_

I

Enter

0 or 1 ...............................................[

WORKSHEET FOR CALCULATING ADDITIONAL ALLOWANCES

(Must be completed

in

order

to

enter an amount on step 5)

1

.

COMPLETE THIS

LINE

ONLY

IF

USING

STANDARD

DEDUCTION:

0

0

Yourself:

Age

65 or over

Blind

Spouse:

0

Age

65

or

over

0

Blind

Number of boxes

checked

x

1300...............$.

_

2.

ADDITIONAL ALLOWANCES FOR

DEDUCTIONS:

A. Federal Estimated Itemized

Deductions.........................................................................

$

_

B.

Georgia Standard Deduction

(enter

one):

Single/Head

of

Household

$2,300

Each

Spouse

$1,500

$

_

C.

Subtract

Line B from

Line A................................................................................................................$

_

D.

Allowable

Deductions

to

Federal Adjusted Gross Income

.................................................................$

_

E.

Add

the Amounts on Lines

1, 2C,

and

2D ..........................................................................................$

_

F.

Estimate

of

Taxable Income not

Subject to

Withholding

...................................................................$

_

G.

Subtract Line F

from

Line E

(if

zero or

less,

stop here)......................................................................$

_

H.

Divide

the

Amount

on Line G

by

$3,000.

Enter

total here and

on Line 5

above

................................

(This

is

the

maximum number of additional

allowances

you

can

claim. If the remainder

is over $1,500

round

up)

7.LETTER USED (Marital

Status A,

B.

C, D,

or E)

TOTAL ALLOWANCES

(Total

of

Lines

3-

5)

__

(Employer:

The

letter

indicates the

tax

tables

in

the Employer's Tax Guide)

8. EXEMPT:

(Do

not

complete

Lines 3

-

7

if claiming

exempt)

Read

the

Line

instructions on page

before

completing

this

section.

8

2

a)

I claim

exemption

from withholding because I incurred no

Georgia income tax

liability

last

year

and

I do

not

expect to

have

a

Georgia

income

tax

liability this

year.

Check here

b) I

certify

that I

am

not subject to Georgia withholding because I meet the

conditions

set

forth

under the

Service members

Civil

Relief

Act

as amended

by the Military

Spouses

Residency Relief

Act as provided

on

page

2.

My

state of

residence

is

-- -,---

-My spouse's

(service member)

state of

residence

is

The states of

residence

must

be

the same to be exempt.

Check here

I

certify

under penalty

of

perjury that

I

am

entitled

to the

number of withholding

allowances

or

the

exemption

from withholding status

claimed

on this Form

G-4.

Also,

I

authorize my employer to deduct per pay period the additional

amount

listed

above.

Employee’s Signature:

Date:

Employer:

Complete

Line

9 and mail entire form only if the

employee claims

over 14 allowances or exempt from

withholding.

If

necessary,

mail

form

to:

Georgia Department

of

Revenue,

Withholding Tax

Unit, P. 0.

Box

49432, Atlanta,

GA

30359.

9.EMPLOYER'S NAME AND ADDRESS:

EMPLOYER'S

FEIN:

_

EMPLOYER'S WH#:.

_

Do not accept forms

claiming

additional allowances unless the worksheet

has

been

completed.

Do not

accept forms

claiming

exempt if numbers are written on Lines 3- 7.

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2